Macroeconomics and financial markets

In the US NY stock market on the 30th, the Dow closed at $141 (0.43%) higher than the previous day and the Nasdaq at $87 (0.73%) higher.

The swift response by European and US financial authorities has eased the financial turmoil surrounding the bank failures that had rocked markets and improved investor sentiment.

connection:U.S. stocks continue to rise, U.S. quarterly GDP finalized downward | 31st Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 2.72% from the previous day to $28,180.

BTC/USD Weekly

Since the beginning of the year, it has been trending in the latest high range while increasing its upper price, and the 200MA (moving average line), which had been on a downward slope since February last year, has begun to reverse.

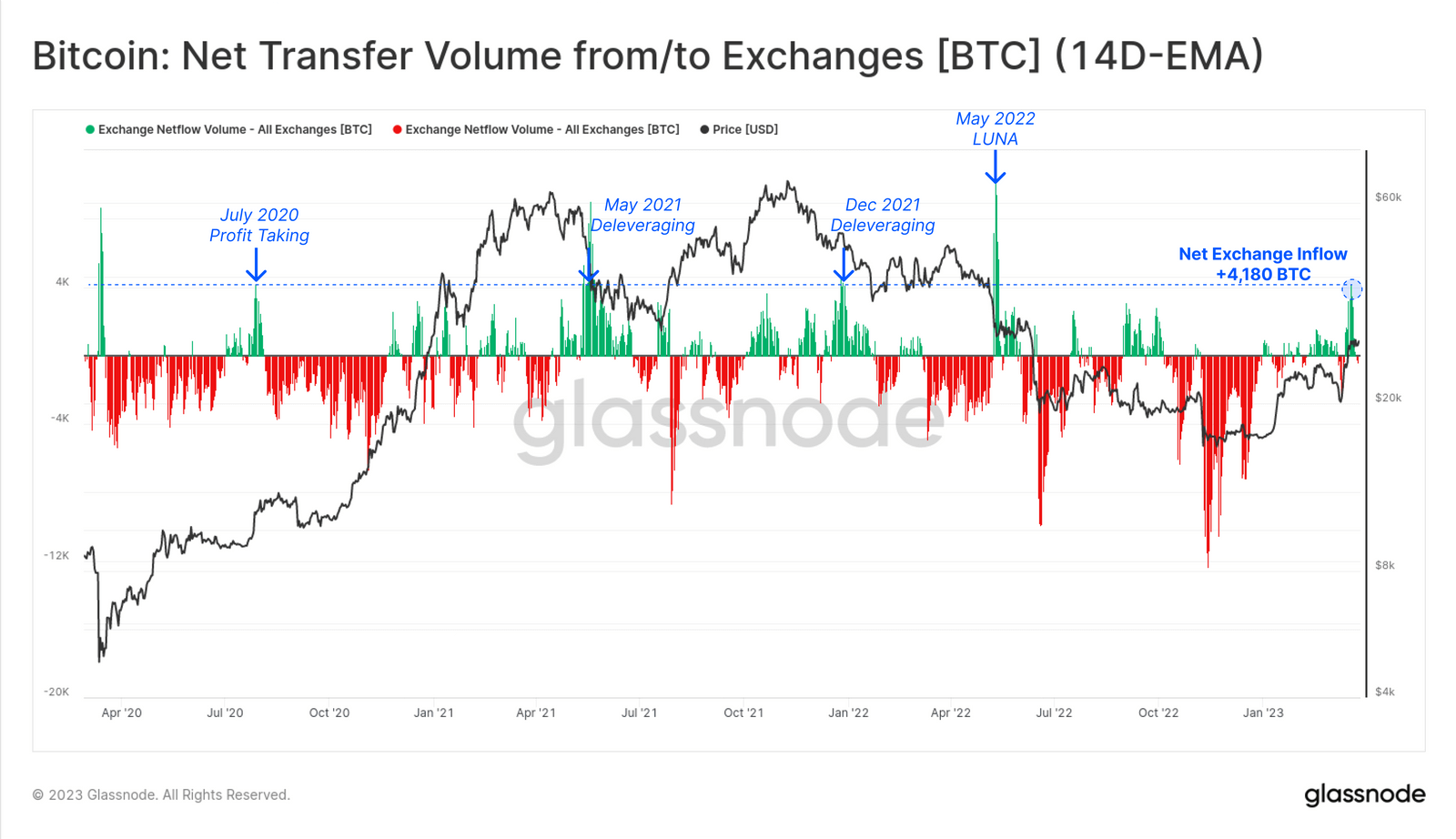

According to Glassnode analysis, net inflows to exchanges (14-day average) were +4,180 BTC, the highest level since May 2022 when the Terra (LUNA) shock occurred.

Glassnode

At 17:00 today, major derivatives exchange Deribit will cut off options at the end of the fiscal year, followed by CME (Chicago Mercantile Exchange) futures SQ. With 141,000 BTC (approximately $4 billion) worth of options expiring on Deribit, it is pointed out that volatility (price volatility) may increase.

Large #options expiry coming this Friday 8 AM UTC

141K #Bitcoin options are set to expire on Deribit with a notional value of $3.8 billion.

Max pain $24,000, put/call ratio: 0.73#Ethereum max pain $1600, $3 B. notional value, put/call ratio 0.33  #Cryptooptions #ETH pic.twitter.com/JTWSaamY5p

#Cryptooptions #ETH pic.twitter.com/JTWSaamY5p

— Deribit (@DeribitExchange) March 28, 2023

connection:Professional analysis of Bitcoin derivatives market before major SQ | Contribution: Virtual NISHI

altcoin market

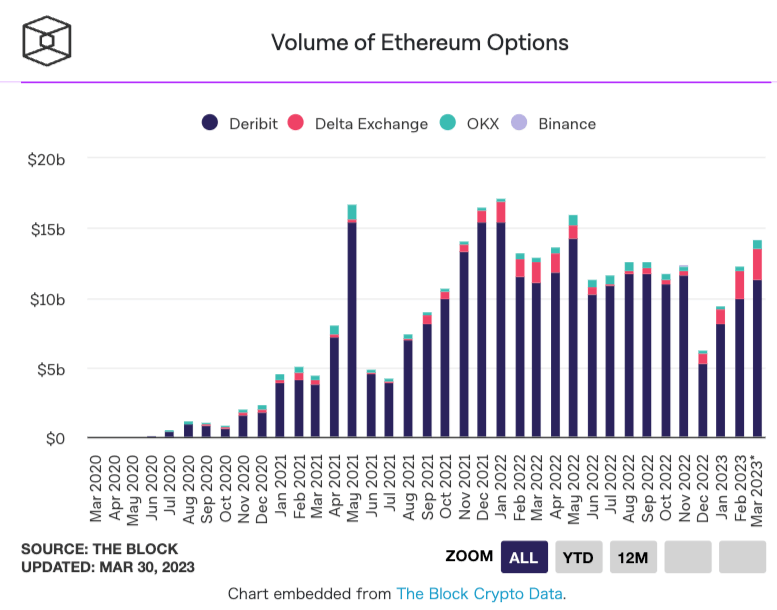

Data from The Block shows Ethereum (ETH) futures monthly trading volume rose in March. It reached its highest level since May 2022.

The block

On the Chicago Mercantile Exchange (CME), Ethereum (ETH) options open interest also increased, reaching a record high. It seems to have anticipated the Shanghai (Shapella) upgrade scheduled around April 12 (epoch number 194,048).

It’s happening

Shapella is scheduled on mainnet for epoch 194048, scheduled for 22:27:35 UTC on Apr. 12, 2023

Client releases compatible with the upgrade are listed in the announcement below  https://t.co/I0hSv9lnjz

https://t.co/I0hSv9lnjz

— timbeiko.eth  (@TimBeiko) March 28, 2023

(@TimBeiko) March 28, 2023

The implementation of the ETH withdrawal (unlocking) function from the Ethereum 2.0 staking contract is attracting attention, and a certain amount of selling pressure is expected.

According to the official website, there are currently 558,606 validators and a stake of 17.84 million ETH. Staking means activating the validator software by depositing 32 ETH. A mechanism that allows income gain rewards to be obtained in exchange for maintaining the robustness of the network.

Waiting times and withdrawal limits are set to prevent network instability, and cumulative rewards are expected to be reinvested after unstaking, so the view is that the impact on the market will be limited. There is also Also, the assets associated with decentralized liquid staking platforms like Lido, which account for about 30% of total deposits, are already liquid.

Coinbase estimates that daily Ethereum trading volume far exceeds the estimated unstake volume.

connection:What is the ETH “Shanghai” upgrade?Summary of each company’s view on staking cancellation and ETH selling pressure

On the other hand, crypto asset exchange Kraken, which was recently sued by the U.S. SEC (Securities and Exchange Commission), was forced to suspend its staking service, and if Coinbase follows suit, selling pressure will increase accordingly. is also assumed.

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Ethereum Futures Monthly Trading Volume Reaches Highest Level Since May Last Year as Bitcoin Tangles at Recent Highs appeared first on Our Bitcoin News.

2 years ago

138

2 years ago

138

English (US) ·

English (US) ·