Ahead of the Merge, validators staked 32 Ethereum on the PoS Beacon Chain to meet the requirements to participate in the block approval process. ── From the columns and interviews released this week, carefully select 10 books you want to read on Sunday.

Ethereum in 2023: Prospects and Challenges

The looming staked Ether withdrawal – this will be the most pressing issue facing Ethereum developers.

Since the “Merge” in September last year, the consensus mechanism of the Ethereum blockchain has moved to Proof of Stake (PoS), the Ethereum blockchain has been working to approve blocks and add them to the blockchain. now use validators instead of miners. …read more

Declining Demand for Binance USD Brings Stablecoin Competition to a New Phase – Could It Be a Killer Use Case for Crypto Assets?

(Danny Nelson/CoinDesk)

(Danny Nelson/CoinDesk)Binance, the world’s largest cryptocurrency exchange, made a big push to its own stablecoin Binance USD (BUSD) last year.

However, recent speculation over the health of Binance has seen growth slow as $5.5 billion worth of BUSD was liquidated in a single month. Coinciding with the drop in demand for BUSD, data also surfaced in December showing the outflow of crypto assets deposited on Binance. …read more.

Why am I a skeptic, convinced that the cryptocurrency industry will survive?

Known as a cryptocurrency skeptic, it may seem strange that I am contributing to the Digital Assets Conference at Duke University on January 20th and 21st. I once wrote a column for the Wall Street Journal calling for a crypto ban.

I still believe that unbacked crypto assets such as Bitcoin have no economic utility and the cost to society far outweighs the benefits. But we also understand that the broader digital asset industry will not disappear. …read more

Don’t be fooled by the price predictions at the beginning of the year

Crypto asset price volatility is a problem that has plagued investors for the past 14 months. But the problem won’t go away anytime soon. If you’re an active crypto investor, or just curious, you’ve already seen the annual price predictions.

There may be no better expression of the difficulty of predicting cryptocurrency prices than the following title, reported by US TV station CNBC. …read more

By 2023, ReFi will go mainstream

DeFi (decentralized finance) made a big splash in the summer of 2020, becoming synonymous with the most recent bull market and much of the speculative activity that followed. One reason DeFi was born was to address the failure of banks to provide a transparent and inclusive financial system.

ReFi (regenerative finance) uses cryptocurrency technology and thinking to rebuild the economy in a more inclusive and sustainable way. I believe ReFi will be hotter than DeFi in 2023, especially at the intersection of crypto and climate change. …read more

Will smart TVs pave the way for the spread of the Metaverse in the mass market?[CES 2023]

(Pete Pachal/CoinDesk)

(Pete Pachal/CoinDesk)Is Web3 ready for prime time?

Using some of the TVs announced at CES, the world’s largest technology trade fair held in Las Vegas, you can easily access the Metaverse and NFT Wallet with just a remote control. Competition among manufacturers to produce TVs with various added functions is accelerating. …read more

Why Blockchain Is As Important As ERP To The Future Of Enterprises

A great disconnect is underway.

If there’s a silver lining to the woes of the past few months, it might be the potential to steer the blockchain world away from financial engineering and toward more compelling business uses that create real value. …read more

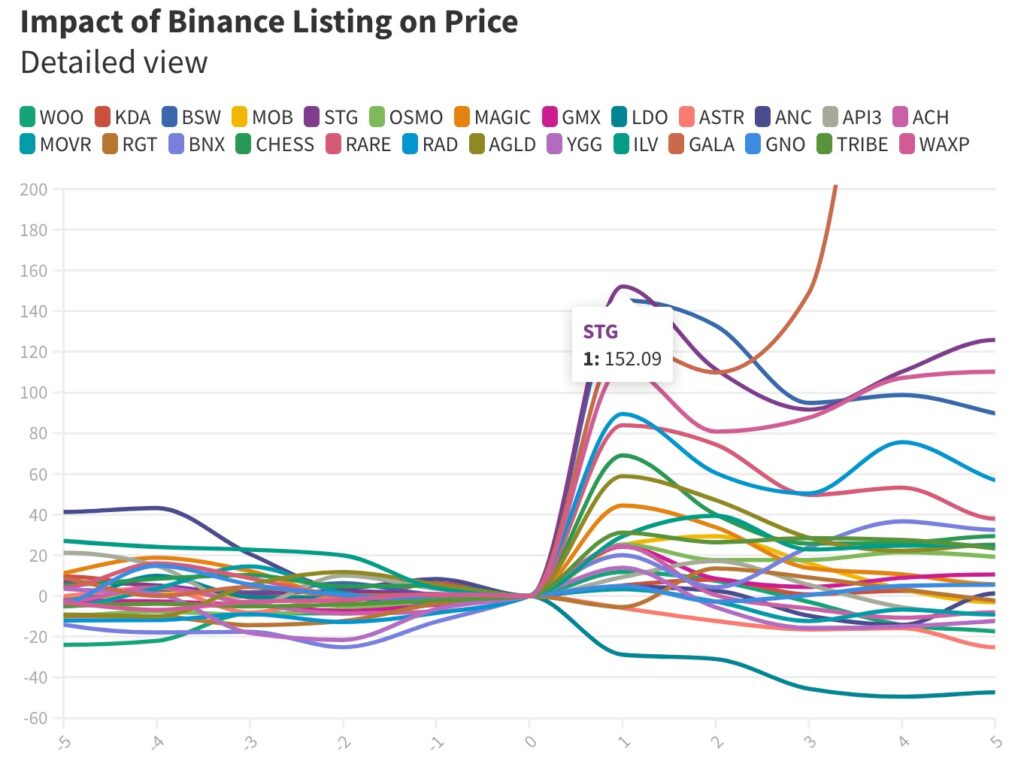

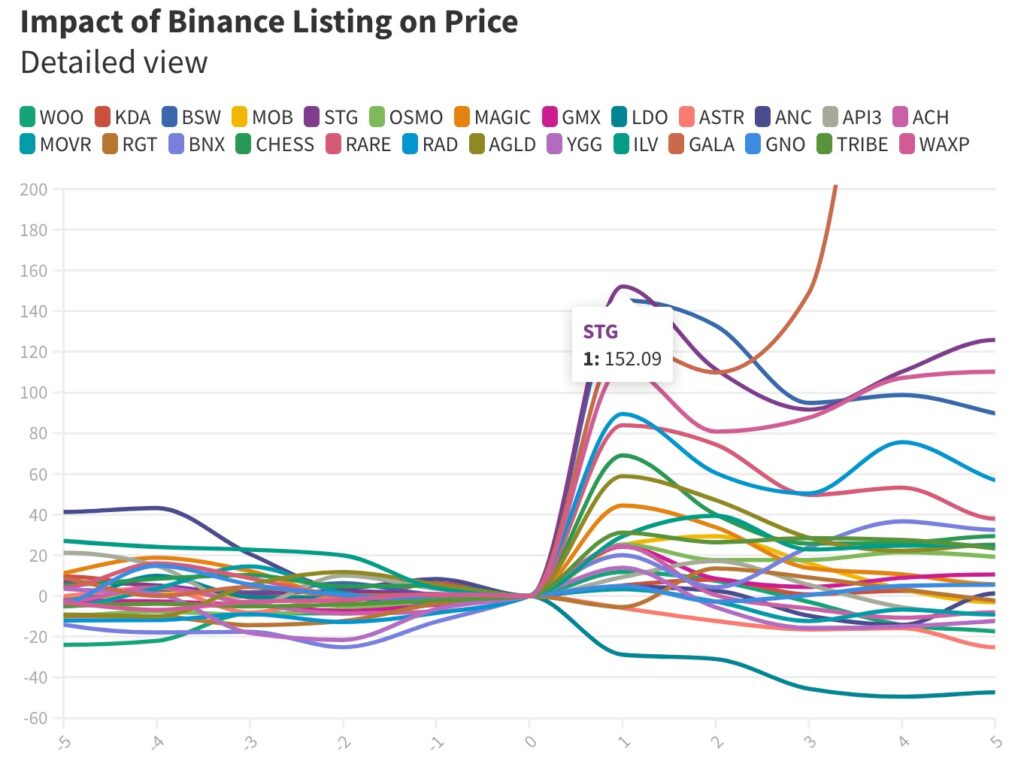

Price rises 41% on the first day of listing What is the “Binance effect”?

(Ren & Heinrich)

(Ren & Heinrich)Binance-listed cryptocurrencies have risen 73% in price in the first 30 days, according to an analysis by crypto investor Ren & Heinrich.

Len & Heinrich tracked 26 crypto assets for 18 months. Binance-listed cryptocurrencies reportedly increased in price by 41% on the first day of listing and by 24% on the third day. The findings prove the existence of a “Binance Effect” that benefits crypto assets, at least in the short term. …read more

Investment survey of 18-19 year olds ── Investment is possible without parental consent by lowering the adult age: Bitbank

Bitbank, which operates a crypto-asset (virtual currency) exchange, will allow 18- to 19-year-olds to start investing without parental consent as the age of adulthood is lowered in April 2022. Conducted a web questionnaire survey on management and investment. On January 12th, we announced the aggregate results of 496 responses. …read more

Market momentum has improved since the new year, speculators are buying in the futures market[bitbank chart analysis]

In 2022, the price of Bitcoin fell from 5.32 million yen to 2.17 million yen in one year, and the bearish trend became clear.

In the foreign exchange market, the dollar-yen exchange rate temporarily rose to 150 yen to 1 dollar, which was a historical change. The rapid rise in interest rates by central banks around the world has slowed the inflow of funds into Bitcoin, which has led to a significant drop in the price of Bitcoin. Many central banks are expected to raise interest rates in the first half of this year, which is expected to be a headwind for the Bitcoin market. …read more

|Text and editing: coindesk JAPAN editorial department

|Image: Shutterstock

The post Ethereum in 2023 Reasons to be convinced of the survival of the crypto asset industry[10 carefully selected books you want to read on Sunday]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

178

2 years ago

178

English (US) ·

English (US) ·