Virtual currency investment report

Crypto asset (virtual currency) exchange Bybit announced on the 27th that it has released the latest version of its report on the investment behavior of its users.

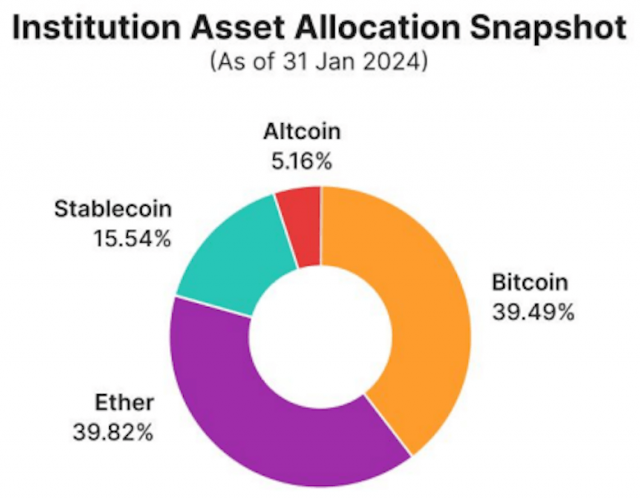

This report mainly reports on the investor's fund allocation status. The research period covered by the report released this time is from July 2013 to January 2024. Bybit reported that as of the 31st of last month, Ethereum (ETH) slightly exceeded Bitcoin (BTC) in terms of institutional investors' allocation of funds.

Below is a graph of institutional investors' capital allocation, with Ethereum and Bitcoin alone accounting for about 80% of the total. In a report published by Bybit in December last year, Bitcoin accounted for 35% and Ethereum accounted for 15%, for a total of 50%. The report released in December covers the period of investigation from December 2022 to September 2023.

Source: report

connection: “Investigating the allocation of funds by institutional investors in Bitcoin, Ethereum, and Altcoins” Bybit report

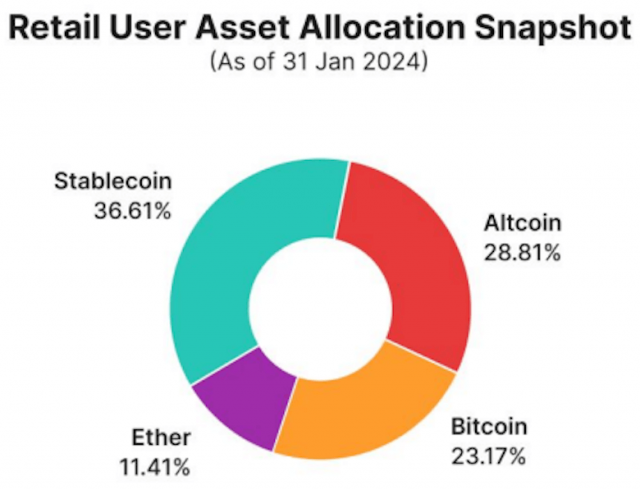

On the other hand, the capital allocation for individual investors as of the end of last month is as follows. Compared to institutional investors, their allocation to Bitcoin and Ethereum is small, with stablecoins being the largest. In this report, only USDT and USDC are considered stablecoins.

Source: report

What is a stablecoin?

A virtual currency whose price is always stable. Various stable coins have been developed whose value is backed by legal currency or virtual currency, and whose prices are stabilized using algorithms.

Virtual currency glossary

Virtual currency glossary

Bybit said institutional investors started increasing their investment in Ethereum last September, and this trend accelerated last month. This trend is driven by the approach of Ethereum's next upgrade, “Dencun,'' and the expectation that Ethereum spot ETFs (exchange traded funds) will be approved in the United States by the end of 2024. ing.

connection: What are the importance and benefits of Ethereum's next upgrade “Dencun”?

Recently, the performance of Ethereum and Bitcoin has been increasingly compared. Bloomberg reported last week that “Ethereum has outperformed Bitcoin this year, with speculation that the next wave of U.S. crypto spot ETFs will focus on this second-largest digital asset (by market capitalization).'' Posted on X.

connection: Ethereum outperforms Bitcoin's year-to-date rate of increase Expectations for approval of spot ETF and concerns about concentration risk

About other brands

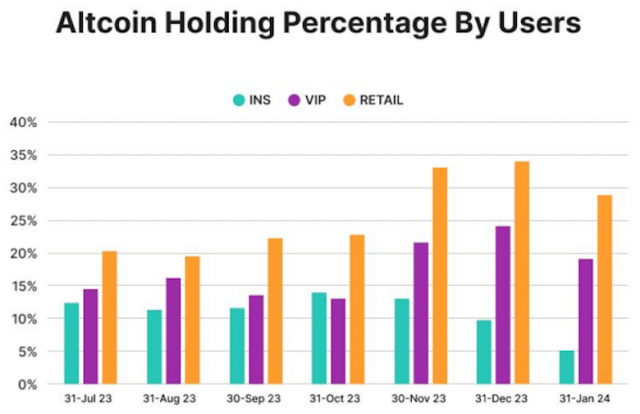

This report defines altcoins as anything other than Bitcoin, Ethereum, and stablecoins. Bybit reported that both institutional and individual investors reduced their investments in altcoins by January 2024.

Below is a graph of the holding percentage of altcoins. “INS” represents institutional investors, “VIP” represents individual traders with more than $50,000, and “RETAIL” represents other users.

Source: report

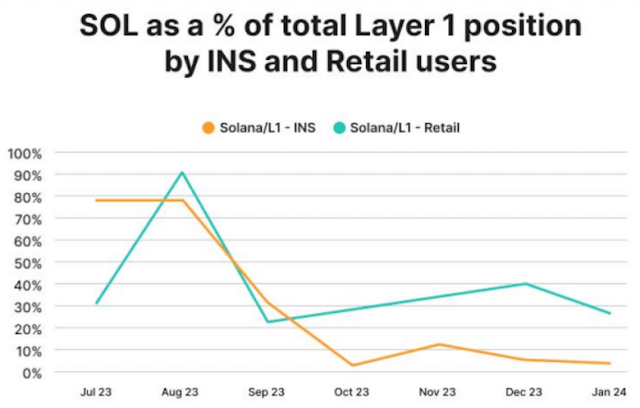

He also mentioned Solana (SOL) separately. Both institutional investors and individual investors held a large amount of Solana in the third quarter of 2023 (July to September), but they have taken profits from the subsequent price rise and are currently reducing their holdings. The following is Solana's share of investment in major layer 1 stocks.

Source: report

Solana (SOL) special feature

The post “Ethereum is the most-held virtual currency by institutional investors,” while individual investors still mainly hold cash – Bybit latest report appeared first on Our Bitcoin News.

1 year ago

91

1 year ago

91

![Will Stellar [XLM] drop to $0.378 after bearish breakdown?](https://ambcrypto.com/wp-content/uploads/2025/08/Evans-2025-08-18T135547.070-min.png)

English (US) ·

English (US) ·