Blast usage increases

The crypto asset (virtual currency) Ethereum (ETH) L2 “Blast” has increased the amount of deposits to the equivalent of $1.1 billion (155 billion yen) even before its official launch.

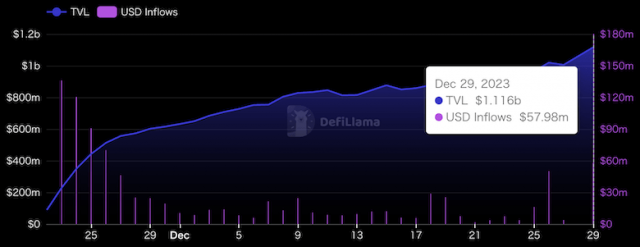

The following is a graph from the data site “DeFiLlama”, which represents the total value “TVL (Total Value Locked)” of virtual currencies locked for operation between November 22nd and December 29th (blue line ). TVL on November 22nd was worth $89.5 million (12.6 billion yen).

Source: DeFiLlama

What is L2?

Abbreviation for “Layer 2”, which refers to the “second layer” network. Processing all transactions on the main chain would place a heavy load on the main chain, leading to slower processing speeds and higher network fees. By performing some transactions on L2, it is expected that the load on the main chain will be reduced and processing speed will be improved.

Virtual currency glossary

Virtual currency glossary

connection:What is blockchain layer 2? Explaining types, points of interest, and typical networks

Blast is an L2 chain that automatically provides yield on Ethereum and stablecoins. It is currently not yet launched, but early access applications began on the 21st of last month.

connection: New Ethereum layer 2 “Blast” raised 3 billion yen, starts early access

An invitation code is required to use Blast in early access. Once you get the invitation code and gain access to Blast, you will be able to bridge and transfer Ethereum and stablecoins.

Currently, it offers a yield of 4% per year on Ethereum and 5% per year on stablecoins. In addition, “Blast Points” are awarded according to the amount of assets bridged and the number of people invited, and Blast Points will be available for use in May 2024 to receive airdrops.

The mainnet is planned to launch in February of the same year.

Concerns about Blast

It appears that many users are currently raising funds to Blast in search of yield and airdrops. On the 28th, it was reported that there were over 85,000 users in early access. On the other hand, concerns have been raised about Blast.

Blast has reached $1.1 Billion in TVL!

85,836 community members are now earning yield (~4% for ETH and 5% for stables) + Blast Points.

Excited to share all that we’ve been working on behind the scenes in the new year! pic.twitter.com/0jkIPGStJw

— Blast (@Blast_L2) December 27, 2023

First, since the mainnet launch is in February next year, you will not be able to withdraw the funds you have deposited until then. The company plans to launch the testnet in January next year, but it drew criticism for starting one-way deposits before that.

“We disagree with the decision to launch the bridge before L2 and make withdrawals impossible for three months,” said Dan Robinson of Paradigm, the investment firm that led Blast’s funding.

In this regard, Blast founder Pacman emphasized that Paradigm is not involved in the market entry strategy. And he argues that the invite reward system is critical to community contributions and the platform’s success.

Security concerns have also been raised as Blast funds are managed using a multisig contract (Gnosis Safe) shared by five new anonymous accounts. Some have pointed out that the contract is at risk of being misused because the identity of the operator is unclear.

connection: Blur founder’s L2 “Blast” collects 60 billion yen, community concerns about transparency increase rapidly

The post Ethereum L2 “Blast” TVL increases to the equivalent of 155 billion yen before going live appeared first on Our Bitcoin News.

1 year ago

110

1 year ago

110

English (US) ·

English (US) ·