The post Ethereum Price Analysis: Is ETH Ready to Moon Akin to Bitcoin and Gold Soon? appeared first on Coinpedia Fintech News

Ethereum (ETH) price has gained bullish momentum in the past two days akin to Bitcoin (BTC) and Gold. The top-tier altcoin, with a fully diluted valuation of about $541 billion, surged over 4% during the past 24 hours to reach a range high of about $4,517 before retracing to trade around $4,485 at press time.

The Ethereum price pump in the last two days has almost mirrored that of Bitcoin, which has closely followed the footsteps of gold. With the wider crypto market signaling a bullish outlook, more than $470 million was liquidated from the leveraged traders during the last 24 hours.

Top Reasons Why Ethereum Price Surged Today

‘Uptober’ Crypto Bullish Narrative

Historically, the Ethereum price has recorded positive returns in October since its inception. Moreover, Ether price is expected to record a parabolic rally in the fourth quarter, akin to the 2017 crypto summer.

Short Squeeze Impact

Heavy liquidation of short traders in the past two days, amid ‘Uptober’ sentiment, has influenced the rising odds of a short squeeze. During the past 24 hours, a total of $129 million was liquidated from Ether’s leveraged market, with over $106 million involving short traders.

High Demand from Whale Investors

The demand for Ethereum by whale investors has remained high in the recent past. For instance, aggregate market data from CoinGecko shows that a total of 13 entities, led by BitMine, have accumulated over 4 million ETH, valued at nearly $18 billion.

Market data analysis from SoSoValue shows that the U.S. spot Ether ETFs purchased Ether valued at around $80 million on Wednesday.

What’s Next for Ether Price?

From a technical analysis standpoint, the ETH price has rallied above a crucial support/resistance level around $4.2k in the last two days.

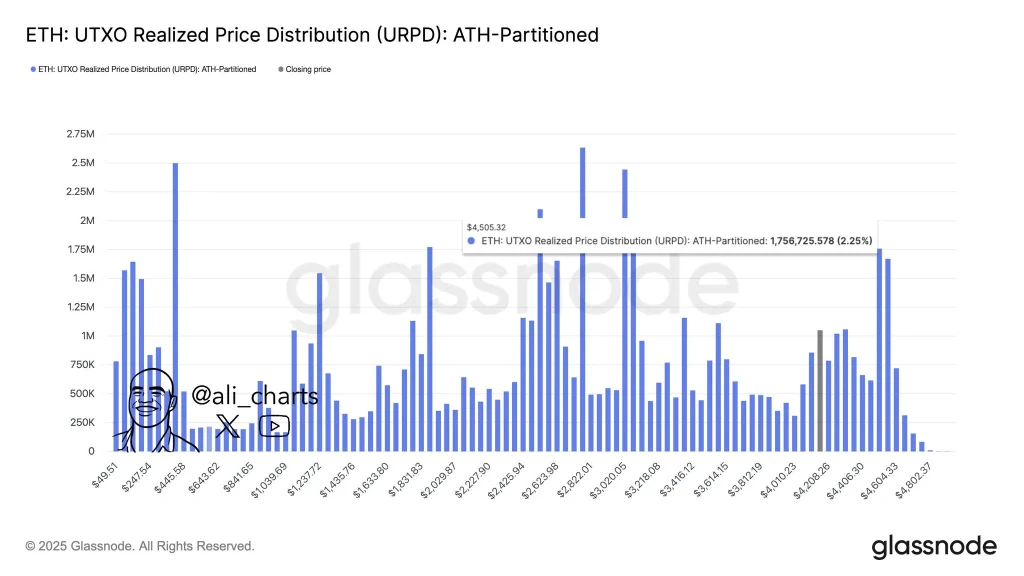

However, crypto analyst Ali Martinez recently noted that the ETH price faces a strong resistance level around $4,505.

2 hours ago

16

2 hours ago

16

English (US) ·

English (US) ·