The post Ethereum Reclaims $2,000, But Weak MVRV Ratio Signals Bearish Turn: Will Bears Dominate ETH Price? appeared first on Coinpedia Fintech News

The Federal Reserve decided not to change interest rates on May 7, keeping them at 4.25% to 4.50%. This made crypto assets more appealing to investors. As a result, the market is rising today, with Bitcoin hitting $100,000. Ethereum is also going up, but experts believe STHs might soon sell to take profits. This is backed by a decline in key on-chain activity, which could lead to a price reversal soon.

ETH’s MVRV Ratio to Trigger Reversal

In the past 24 hours, the crypto market has seen a strong surge. Bitcoin has climbed back to the $100,000 level, which it last reached in February. Ethereum also rose above $2,000, recovering from losses linked to earlier tensions between the U.S. and China.

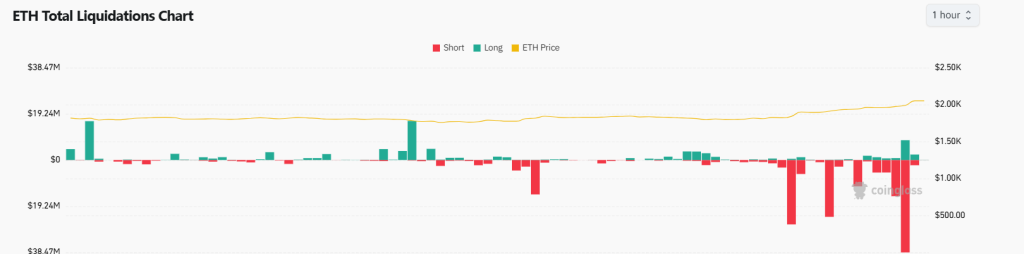

According to Coinglass, more than $175 million worth of Ethereum positions were liquidated during this period. Of that, buyers closed $27 million in positions, while sellers saw $148 million in forced liquidations. The rise in Ethereum’s price also led to an 18% jump in open interest, now totaling $24.8 billion.

Also read: Altcoin Season is Here: XRP, ADA, SUI, ETH Rally

Ethereum’s recent gains are partly due to increased interest from large investors since April. CoinShares reported two straight weeks of money flowing into Ether-based ETFs. Some also believe the Pectra upgrade, launched on May 7, helped boost the price.

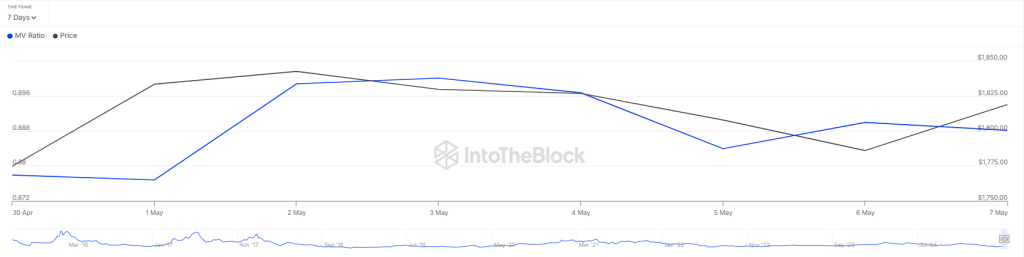

The current buying demand in the crypto market might not last long. Data from IntoTheBlock shows the MVRV ratio has dropped to 0.888, meaning many investors are selling at a loss even though prices are rising. This kind of panic selling could encourage more selling and lead to a downturn.

Still, some major players (“smart money”) are buying. Wintermute made large purchases in the last 24 hours, possibly to benefit from the surge and earn market-making fees. Similarly, Lookonchain reported that Abraxas Capital withdrew over 41,000 ETH (worth $75M) from Binance and Kraken. Despite the price rise, nearly half of all Ethereum wallets, about 65.5 million, are still holding at a loss.

What’s Next for ETH Price?

Sellers are having a hard time pushing Ether below its moving averages, which suggests there’s not much pressure to sell during the upward rally. Buyers are holding the price around immediate resistance line. As of writing, ETH price trades at $2,048, surging over 13% in the last 24 hours.

Buyers may use this as a chance to break through the resistance at $2,109. If they succeed, the ETH/USDT pair could gain momentum and head above the $2,500 level. There’s a smaller hurdle at the immediate 23.6% Fib level, but it’s expected to be overcome.

On the flip side, sellers will likely try to drag the price below the moving averages. If that happens, ETH could drop to $1,734. Buyers will probably step in there, but if they can’t hold that level, the price might fall further to key support at $1,542.

As the RSI trades within the overbought region at level 78, ETH price is poised for a short-term downward correction.

2 months ago

44

2 months ago

44

English (US) ·

English (US) ·