Trading crypto assets (virtual currencies) is now very difficult. The market is caught between conflicting forces, including the Silvergate problem for crypto-focused banks, operational bottlenecks at major exchanges and optimism that Ethereum’s “Shanghai” upgrade is imminent. because it is

According to cryptocurrency financial services provider Matrixport, the best way to weather this predicament is to adopt a relative value strategy (a strategy that trades one or more securities in relation to another).

“Now is the time for relative value trading,” Matrixport’s head of research and strategy Markus Thielen said in a March 7 note to clients. “Traders can raise money by buying call options on Ethereum (ETH) and selling calls on Bitcoin (BTC). can purchase the

An option is a derivative transaction that gives the holder the right (but not the obligation) to buy or sell the underlying asset at a specified price on or before a specified date. A call option gives the right to buy and a put option gives the right to sell.

Buying a call/put option is like buying insurance against a bullish/bearish move. The buyer pays the seller for the protection by paying a premium when conducting the transaction.

Matrixport’s proposal is to sell bitcoin (BTC) call options to collect a premium that will be used to fund the purchase of ethereum (ETH) call options.

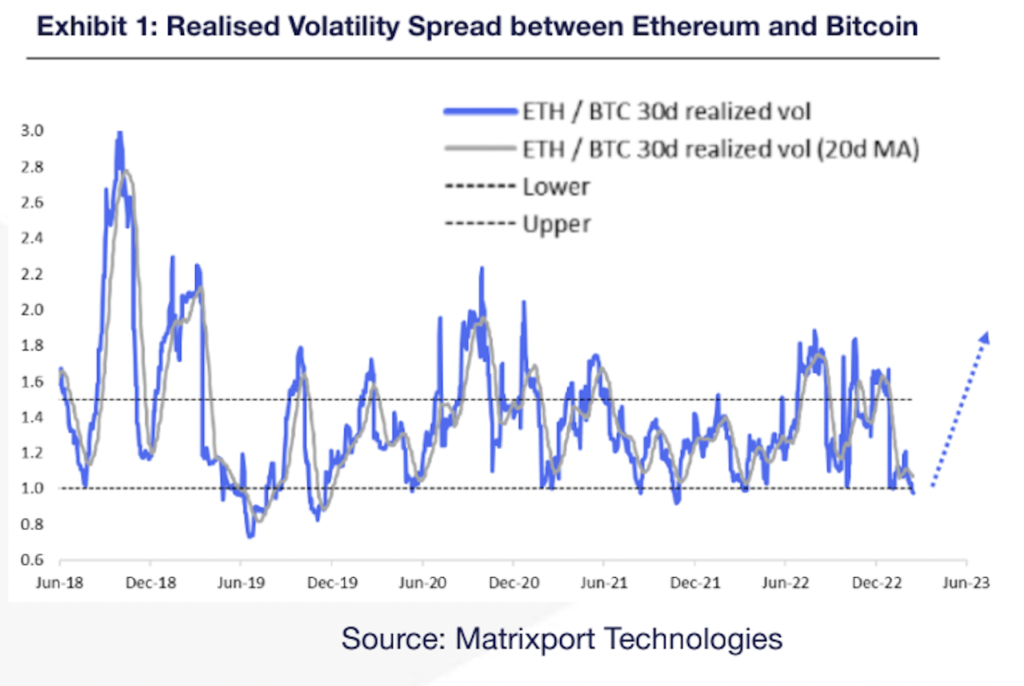

The idea of this trade is based on the assumption that the annualized 30-day realized or historical volatility spread between ETH and BTC will jump from its current abnormally low levels. This, combined with Ethereum’s “Shanghai” upgrade, means that ETH calls will be priced relatively higher than BTC calls.

“The volatility spread between ETH and BTC has compressed below 1. This is a rare occurrence, with the spread trading above 1 93% of the time in the last four years,” Thielen said. pointed out.

Volatility is mean-reverting and has a positive impact on option prices. In other words, periods of unusually low volatility are followed by more price volatility, resulting in more demand for options and higher prices. Therefore, traders tend to buy options when volatility is below their long-term average.

Realized volatility or historical volatility measures the daily change in the price of a security over a specified period of time. (Matrixport Technologies)

Realized volatility or historical volatility measures the daily change in the price of a security over a specified period of time. (Matrixport Technologies)The realized volatility spread between ETH and BTC looks low by historical standards and could return to average as we head towards the “Shanghai” upgrade, where price volatility is expected.

Regarding the rationale for selling BTC calls and buying ETH calls, Thielen said, “The spread is averaging 1.39 over the course of the year, and there is huge risk/return potential here.”

A “Shanghai” upgrade, a non-backwards-compatible hard fork slated for the next few weeks, will enable the withdrawal of ETH staked on the Ethereum network after December 2020. This upgrade will reduce staking risk, increase capital efficiency, and open the door for more investor participation and possibly a higher ETH price.

Binance Research said in a report last month, “The wave of new entrants that has been sidelined so far could put further buying pressure on ETH if it can attract institutional capital. “It has said.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: Matrixport Technologies

|Original: Ether Call Options Look Attractive Relative to Bitcoin as Volatility Spread Dwindles

The post Ethereum’s Call Option Looks Attractive: Report | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

92

2 years ago

92

English (US) ·

English (US) ·