Ethereum (ETH) staking is nearing an important milestone, with deposits in staking contracts reaching 20% of total ETH supply. But deposits are slowing after an initial rush as investors become wary of regulatory risk.

Investors have deposited 23.9 million ETH into the staking network, including pending ones. That number is about a fifth of the 120 million ETH supply, according to the Dune Analytics dashboard compiled by hildobby.

The Ethereum blockchain was able to withdraw from staking with the upgrade “Shanghai” in April, unlocking new staking demand.

Since Shanghai, an influx of investors wanting to stake has led to deposits far exceeding withdrawals, worth $8.4 billion at today’s prices.

The deposit pace is in principle

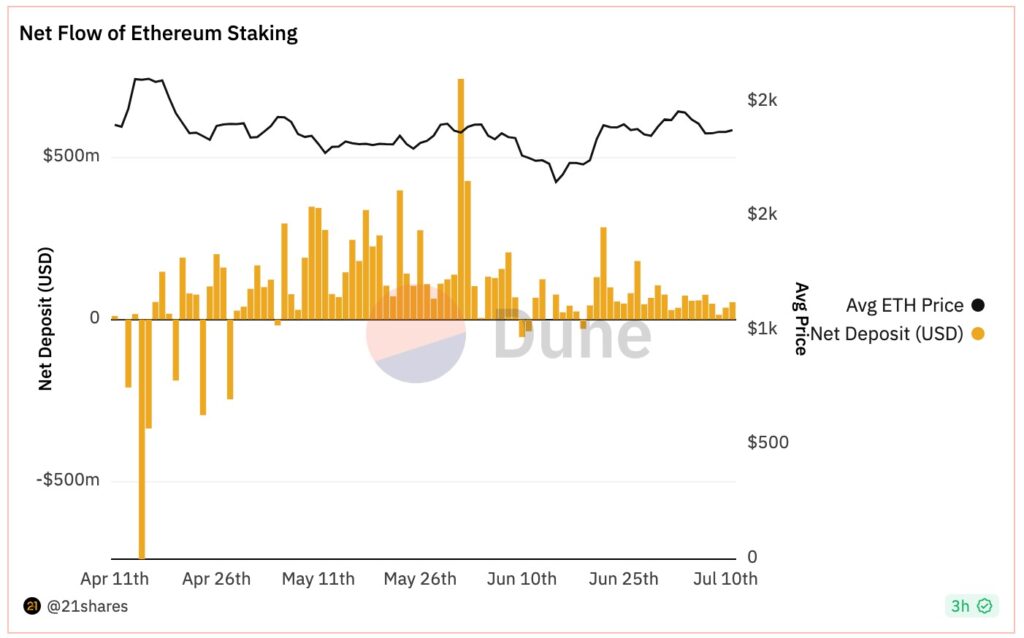

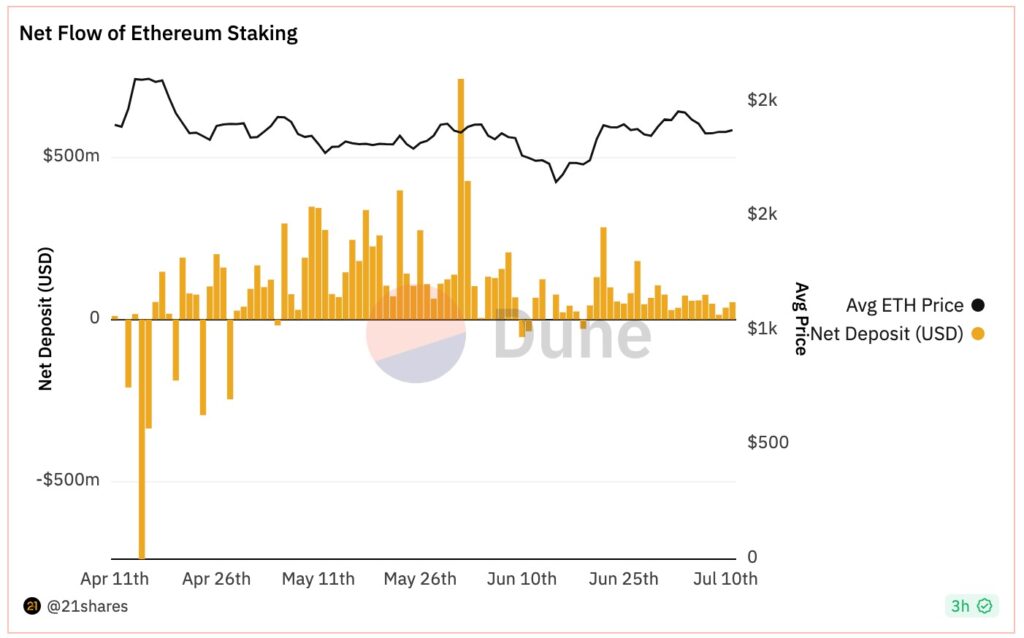

However, the pace of deposits slowed in June compared to the beginning.

“The slowdown is likely due to regulatory scrutiny of centralized exchanges,” Tom Wan, a research analyst at digital asset manager 21Shares, wrote in a statement.

Earlier in June, when the U.S. Securities and Exchange Commission (SEC) sued crypto exchanges Binance and Coinbase, Wang said, it was a “major turning point” for depositing funds. The SEC is suing both exchanges for providing staking services for unregistered securities. Both exchanges had a large share of Ethereum staking services.

According to a Dune Analytics dashboard compiled by 21Shares, net Ethereum staking inflows plummeted after the SEC lawsuit, and even went negative for the first time since early May. After that, it returned to positive, but it is at a lower level than in May.

Dune Analytics/21Shares

Dune Analytics/21SharesValidator wait time eased

The slowdown in demand has led to a reduction in the waiting time for adding new validators to the network, i.e. joining staking. Wait times have been reduced from about 46 days at the peak in early June to 36 days.

Ethereum blockchain manager at staking service Everstake, Irina Timchenko, said that increasing the limit of validators added to the network per day also helped reduce the wait time. I am tweeting that I have reduced it.

John Lo, managing partner at investment firm Recharge Capital, said the still-long waiting times were a disadvantage for investors, and that inflows into staking were “definitely down. We will,” he told CoinDesk.

Tokens waiting to join will not earn rewards and the effective yield will be lower, he said.

But Katie Talati, head of research at digital asset investment firm Arca, said waiting times are unlikely to affect inflows.

“Investors are more concerned about unstaking, or how long it takes to unstake and take their money out.”

Featured decentralized staking

The risks associated with centralized staking services appear to have pushed investors toward decentralized solutions.

“Decentralized staking protocols like Rocketpool and Lido have seen a massive increase in staking assets,” Talati said.

The two decentralized staking protocols have grown 5.4% and 6.3% respectively over the past month, surpassing Coinbase and Binance.

|Translation: CoinDesk JAPAN

|Editing: Takayuki Masuda

| Image: Dune Analytics/hildobby

|Original: Ether Staking Ratio Nears Key Milestone as Inflows Slow Amid Regulatory Pressures

The post Ethereum’s staking rate approaches a major milestone ── regulatory pressure slows deposit pace | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

1 year ago

93

1 year ago

93

English (US) ·

English (US) ·