Macroeconomics and financial markets

In the US NY stock market on the 13th, the Dow Jones Industrial Average rose 383 dollars (1.14%) from the previous day, and the Nasdaq Index closed at 236 points (1.9%) higher.

The growth of the US Producer Price Index (PPI) in March fell short of market expectations, confirming a slowdown in inflation, prompting concerns about a slowdown in the pace of monetary tightening.

connection:U.S. IT stocks, etc. rebound sharply Good impression of PPI in March | Financial Tankan on the 14th

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 2.1% from the previous day to $3,0773.

BTC/USD Weekly

Global inflation (currency depreciation), credit instability caused by the bankruptcy of major banks, and geopolitical risks surrounding the situation in Ukraine have increased demand for safe havens. It is a tailwind for the Bitcoin (BTC) market.

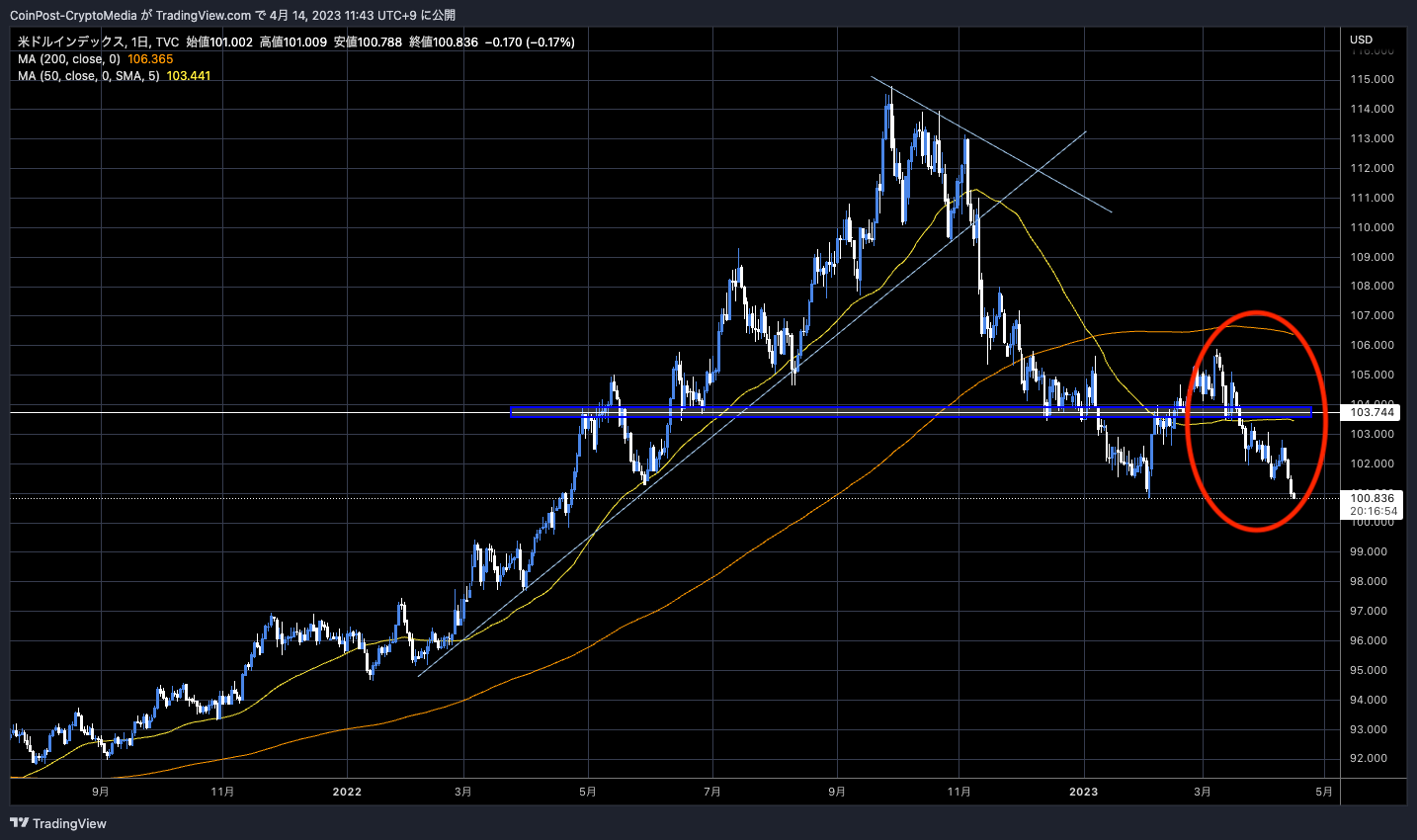

In the foreign exchange market, the dollar index (dollar index), which is inversely correlated with risky assets, continues to fall sharply, breaking below the 102-point level, turning a corner from last year’s historically strong dollar.

DXY/USD

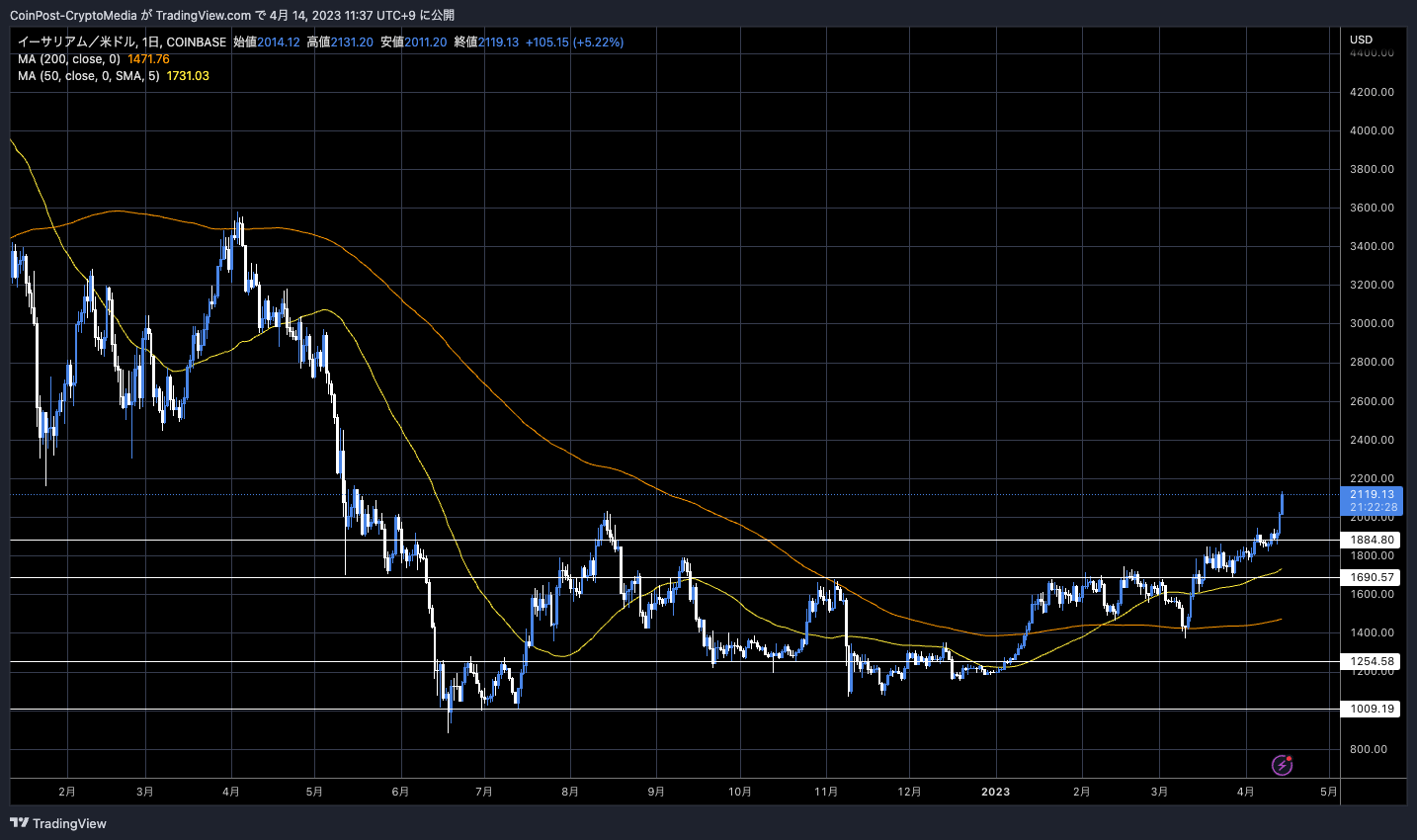

Ethereum (ETH) surged 11.03% from the previous day.

ETH/USD daily

1ETH=$2100 is above the high of $2080 in August last year. It will be the first since the Terra (LUNA) shock that occurred in May last year.

In addition to the successful success of the large-scale upgrade “Shapella”, it is believed that the short positions and buybacks after adjusting the position, which had been on the rise, accelerated the rebound due to the expectation that selling pressure would increase due to the unlocking. be done.

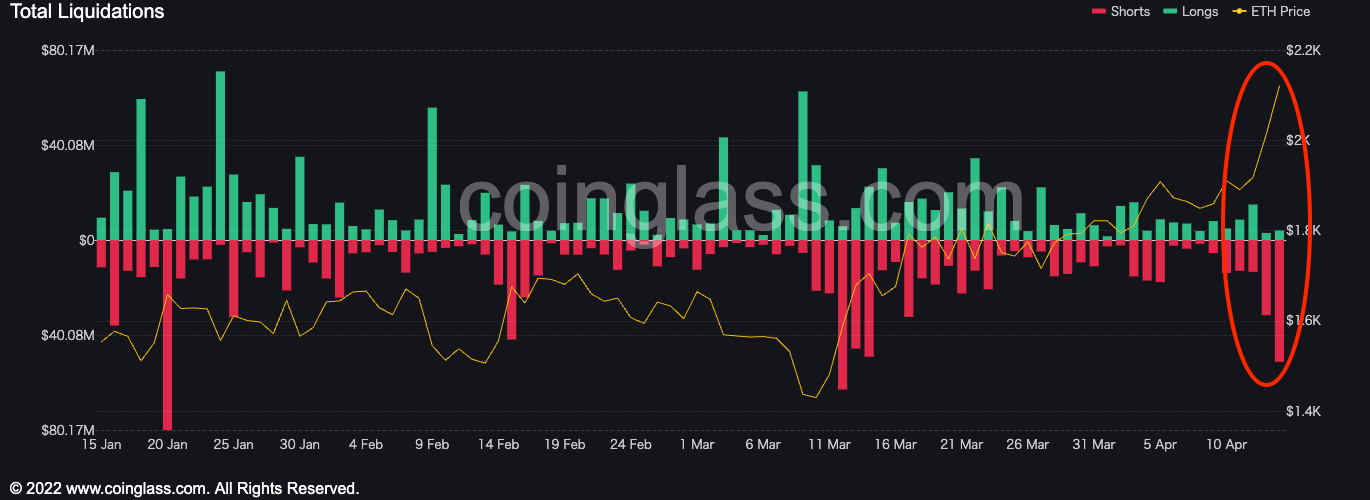

In the futures market, a short squeeze was confirmed during the surge phase, but it remained at about the third largest scale since the beginning of the year.

coin glass

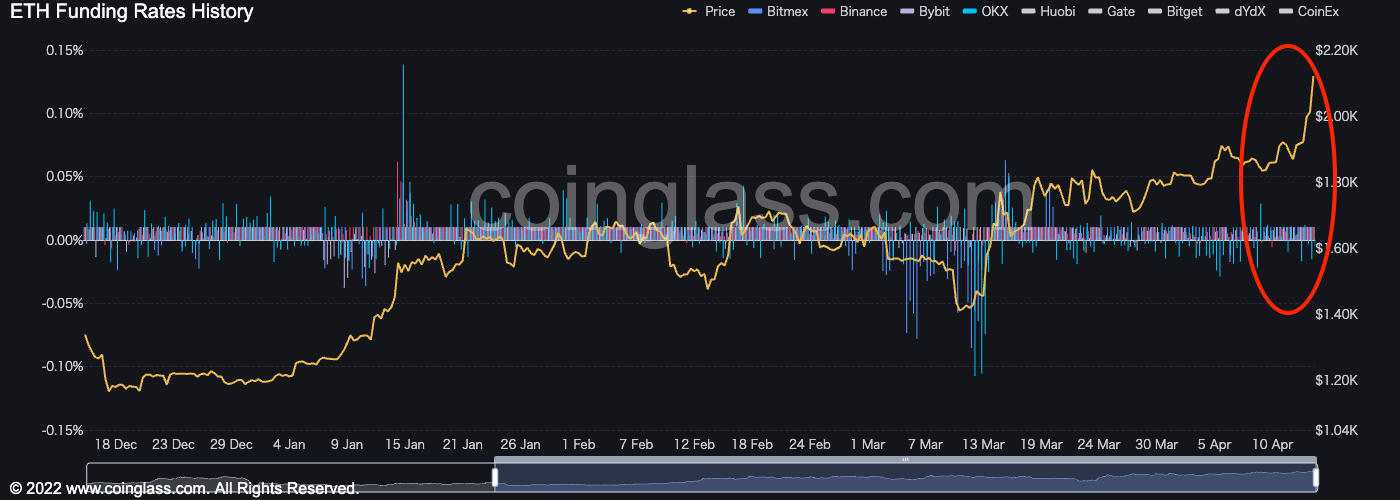

“FundingRate is flat and there is no particular feeling of overheating.

coin glass

Blockworks Research analyst Matt Fiebach points out that there were several derivatives that could hedge the exposure amid fears that around 18 million ETH ($34 billion) of ETH would become semi-liquid. . The market has already priced in the outlook for the future, he said.

According to TokenUnlocks data, more than 95% of the ETH withdrawn from the beacon chain on the first day after the Shanghai upgrade was for staking rewards.

TokenUnlocks

This means that many users chose “partial withdrawal” to withdraw only the accumulated reward, instead of “full withdrawal”, which means the validator’s withdrawal behavior.

Ethereum developers have set a limit of “1,800 (variable)” on the number of validators that can be unlocked per day to avoid sudden network instability. Considering the validator condition of 32 ETH, it corresponds to 57,600 ETH, but this is only a level of less than 0.05% of the supply.

According to the on-chain data, 96,000 ETH of new deposits were confirmed after Shapella, but the staking balance decreased by 121,170 ETH in about one day, so there is considerable selling pressure.

detail:What is the withdrawal status and future outlook for Ethereum (ETH) staking rewards?

“There is no doubt that institutional interest in Ethereum staking has increased in the wake of The Merge and the Shapella upgrade,” said a Liquid Staking platform official. We will be connected,” he said confidently.

The rationale is that the staking vertical has become more credible and the uncertainty around withdrawals and capital restraints has been dispelled.

The market size of liquid staking derivatives (LSD), which allows asset management with alternative tokens while staking, is also growing rapidly in recent years. About 60% of staked ETH is said to use the staking derivatives protocol.

According to DeFi Llama data, “Total Value Locked (TVL),” which indicates the total amount deposited by Lido Finance, which accounts for the majority of the LSD market share, has increased by more than 90% since the beginning of the year to $12.5 billion (1.37 trillion yen). Rocket Pool increased 112% to $970 million (¥107 billion).

Many stakers who have collected their ETH rewards over the years are likely to be willing to re-stake with liquid staking providers such as Lido and Frax to earn more yield. On the other hand, being able to unstake from ETH2.0 means lowering the superiority of the decentralized staking protocol “Lido” that utilizes the forced lock, so the power map will change as the competition rate intensifies. Changes are also worthy of attention.

connection:Explaining “LSD (Liquid Staking Derivatives)” that enables operation while staking Ethereum

More than two-thirds of the 833,000 ETH locked in the withdrawal request queue came from crypto exchange Kraken, according to crypto data provider Nansen. In February of this year, Kraken was sued by the U.S. SEC (Securities and Exchange Commission) as an unregistered security, forcing it to abolish its staking service for U.S. customers, but waiting for withdrawal requests to be implemented.

There is a view that the re-staking rate is high because Kraken participants, including those who wish to continue staking, will be forcibly terminated.

connection:How to view the US SEC’s Kraken indictment and consider the impact on Ethereum staking

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Ethereum soars to the $2,100 level for the first time in 11 months appeared first on Our Bitcoin News.

2 years ago

86

2 years ago

86

English (US) ·

English (US) ·