Interest in Ethereum (ETH) staking, or locking coins into the Ethereum network for passive yield, has skyrocketed since Ethereum implemented an upgrade called Chapela or Shanghai on April 12. ing.

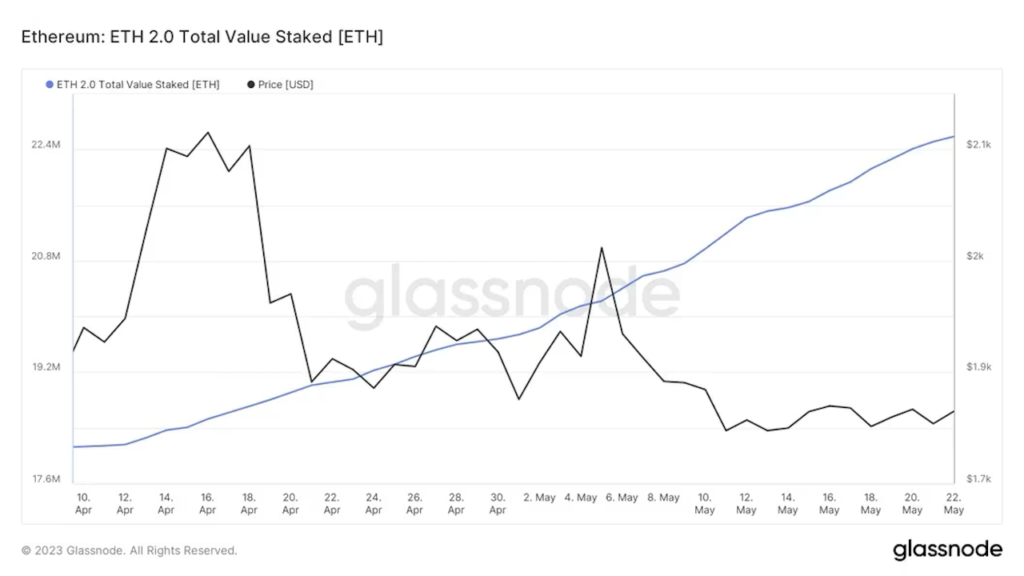

More than 4.4 million coins have been deposited into staking since April 12, bringing the total to 22.58 million, according to data tracked by Glassnode.

In a weekly report shared with CoinDesk on May 23, an analyst at cryptocurrency exchange Bitfinex said, “The surge in demand for staking is likely to be the result of liquidation of holdings. It is driven by large Ethereum holders who are looking for passive income without having to pay for it.”

The number of Ethereum staked in the network surged to a record high of 22.58 million. (Glassnode)

The number of Ethereum staked in the network surged to a record high of 22.58 million. (Glassnode)“We expect this trend to continue, especially given that the price of ETH is expected to rise as a result of deflation,” the analyst added.

Demand for staking, as reported, has surged despite wait times of over a month. Data from wenmerge.com shows that as of May 23, holders who want to become validators on the network will have to wait 36 days. There are currently over 50,000 validator candidates in the queue.

At the time of writing, Ethereum staking offers annual yields of 4% to 5%.

Validators are tasked with processing transactions and storing data on the blockchain, and must deposit at least 32 ETH.

ETH holders are trying to establish themselves as network validators, lured by the 4% to 5% annual yield from staking the token.

Chapela has taken the risk out of staking

Staking as a passive investment method started gaining popularity after the Ethereum beacon chain went live in December 2020. However, for the next three years, the staked coins were locked and could not be freely withdrawn, and were exposed to ETH price fluctuations.

The Chapela upgrade removed the risk of staking by allowing users to unlock coins at will.

“The staked ETH withdrawals made possible by the Chapela upgrade mitigate the risks many investors perceive,” said a Bitfinex analyst. “Prior to this upgrade, potential stakeholders may have been hesitant to deposit ETH out of concern that their funds would be locked up for an unacceptably long period of time.”

However, the increased demand for staking has not yet translated into a sustained rise in Ethereum. ETH rose 11.5% to $2,140 in four days after the Chapela upgrade, but has since retreated, trading around $1,855 at the time of writing.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: Glassnode

| Original: Number of Ether Staked Has Surged By 4.4 Million Since Shapella Upgrade

The post Ethereum staked, record high ─ 4.4 million increase after Chapela | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

73

2 years ago

73

English (US) ·

English (US) ·