Staking demand increases

For the first time, the ratio of staking volume to supply of the crypto asset (virtual currency) Ethereum (ETH) exceeded 25%.

The following is data provided by “The Block”. It shows the ratio of the quantity staked to the supply quantity. If you include people waiting for staking, this percentage exceeds 25% and is still on the rise.

According to data from Dune, the amount of Ethereum staked at the time of writing this article is approximately 30.17 million ETH (equivalent to 10 trillion yen). The number of validators is 943,015.

Ethereum implemented a staking withdrawal function in the upgrade “Shapella'' in April last year. Until then, it was a one-way situation where you could stake but not withdraw, but after Shapella, validators have the flexibility to leave the network.

connection:Bitcoin reaches the $30,000 level again, staking deposit and withdrawal amount reverses for the first time after Ethereum Shapella

Currently, there are platforms that allow liquid staking such as Lido Finance (LDO), and Ethereum holders can stake even if they do not have 32 ETH (equivalent to 11.5 million yen). In addition, demand for re-staking (re-staking) has also increased recently.

connection: Ethereum re-staking trend, total deposits of EigenLayer rapidly grow to 35 billion yen

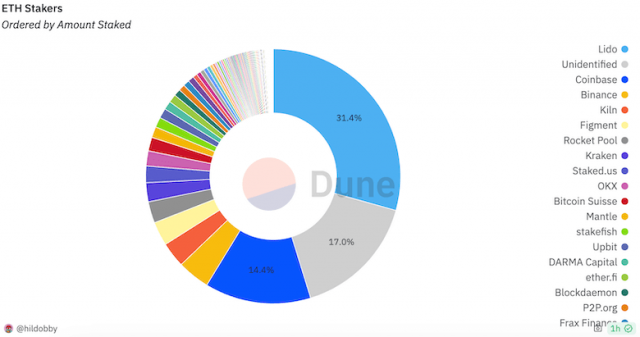

Currently, Lido Finance accounts for over 31% of Ethereum stakers. Coinbase and Binance have followed suit, but Ethereum co-founder Vitalik Buterin and others have expressed concerns about the centralization of nodes.

Source: Dune

connection: Ethereum co-founder Buterin: “Staking mechanisms need a major overhaul”

The graph of staking rewards is as follows. After Shapella, the APR (annual rate) increased to 8.6% in May 2023, but as the number of staking participants has increased, it has now decreased to the 3% range.

What is staking?

A system or service that allows you to earn rewards by depositing virtual currency for a specified period of time. By depositing virtual currency, you can contribute to the operation of the blockchain network and receive compensation in return.

Virtual currency glossary

Virtual currency glossary

connection:Thorough comparison of staking services of domestic exchanges | Ethereum staking procedure also explained

Interest in Ethereum

Ethereum has been receiving increasing attention recently. One of the reasons is that the next upgrade “Dencun” is approaching. Launching on the final testnet “Holesky'' was completed on the night of the 7th.

Dencun will implement a notable feature called “Proto-Danksharding”. This new feature will reduce data transfer costs from Layer 2 to Layer 1, resulting in significantly lower transaction fees for Layer 2 users.

connection: What are the importance and benefits of Ethereum's next upgrade “Dencun”?

In addition, with the approval of a Bitcoin spot ETF (exchange traded fund) in the US, some are expecting an Ethereum spot ETF to be the next, and the developments of the US Securities and Exchange Commission (SEC) will also be closely watched. are collecting.

connection: U.S. SEC postpones judgment on BlackRock's Ethereum spot ETF, industry insiders and Chairman Gensler's views

The post Ethereum, staking amount reaches 25% of supply for the first time, annual reward rate is in the 3% range appeared first on Our Bitcoin News.

1 year ago

80

1 year ago

80

English (US) ·

English (US) ·