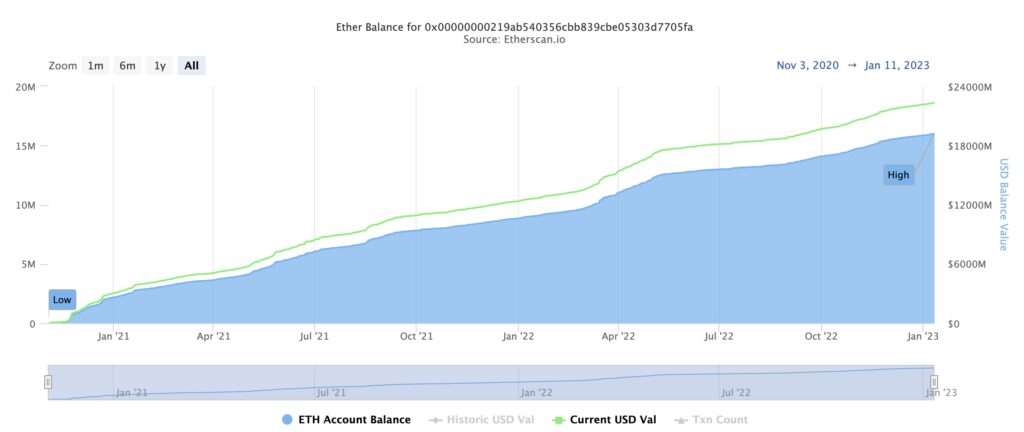

Nearly four months after the Ethereum blockchain successfully transitioned to Proof of Stake (PoS), Etherscan data shows Beacon Chain’s stake has exceeded 16 million Ethereum (ETH). rice field.

This figure represents more than 13% of the total Ethereum supply, worth about $22.38 billion at current prices. In 2020, PoS network beacon chain was introduced in advance and staking started.

Validators (the people behind the operation of the Ethereum blockchain, equivalent to Bitcoin miners) validate transactions and stake Ethereum for the chance to earn rewards. Staking Ethereum accrues yield, but cannot be withdrawn until the “Shanghai” upgrade, scheduled for March.

The increase in staked Ethereum can be interpreted as a positive sign for the security and adoption of the Ethereum blockchain, but it also creates pressure to expedite the work to enable withdrawals. obtain.

(Etherscan)

(Etherscan)According to blockchain data analytics company Nansen, there are about 92,500 unique people staking. There are about 498,000 active validators, according to BeaconScan data.

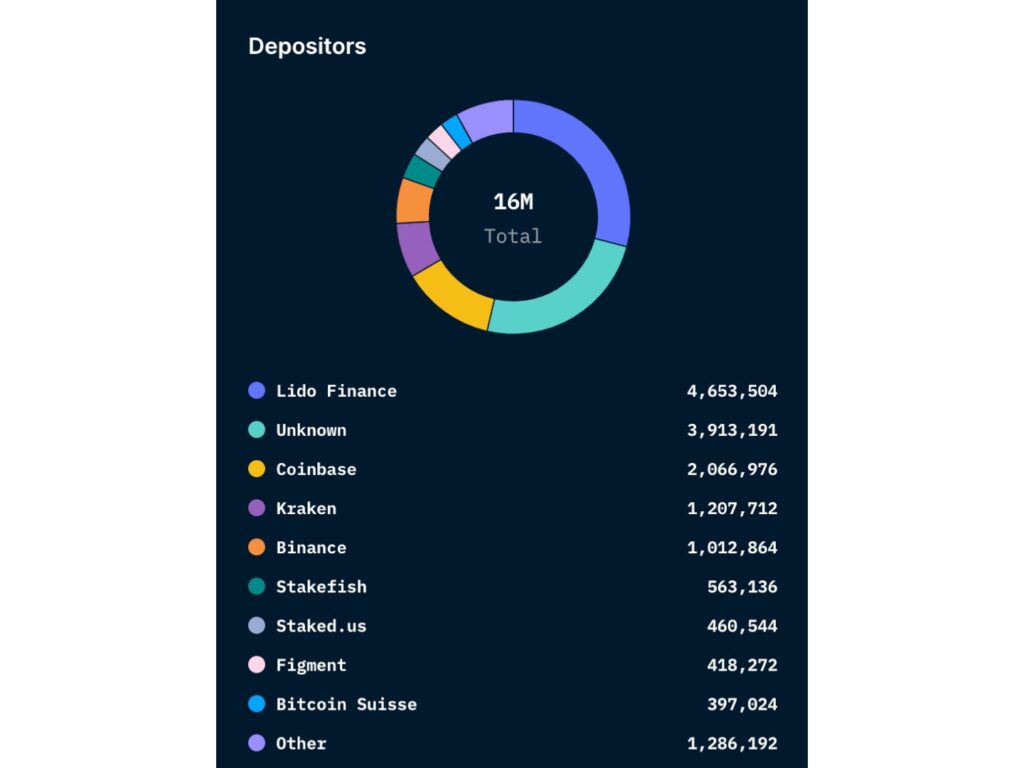

In theory, the more staked Ethereum, the harder it is for someone with bad intentions to harm the Ethereum blockchain. While this is positive, the bulk of the staking right now comes from a few large investors, raising concerns about over-centralization.

(Nansen)

(Nansen)Preview in new tab (opens in new tab)

Looking at Nansen’s data, out of the 16 million ETH staked, about 4.65 million ETH came from Lido. The four largest validators – Lido, Coinbase, Kraken and Binance – account for more than half, or 55.88%, of staked Ethereum.

Since the Merge last September, when the Ethereum blockchain transitioned from a former proof-of-work (PoS) consensus mechanism to PoS, staked Ethereum has increased by about 16.68%.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: Nansen

|Original: Staked ETH Passes 16M

The post Ethereum staking exceeds 16 million (less than 3 trillion yen) ─ Concerns about centralization are growing | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

160

2 years ago

160

English (US) ·

English (US) ·