Soaring ETH staking reward rate

Over the first week of May, the cryptocurrency Ethereum (ETH) staking reward rate rose to a post-merge high of 8.6%. This is likely due to the rapid increase in gas prices due to the meme coin boom, resulting in a significant increase in validator fee income.

Staking rewards refer to the revenue earned in the consensus layer by validators responsible for building and confirming new blocks. Validators receive staking rewards generated for each block and a portion of transaction fees as rewards. *In addition, the staking reward varies according to the total amount of ETH staked.

In the first week of May, validators earned a total of 24,997 ETH, or ¥6.2 billion ($46 million), according to data from beaconcha.in, an information site run by data analytics firm ETH Store. Obtained. This is a 40% increase compared to the previous week’s 18,339 ETH worth 4.4 billion yen ($33 million).

The reason behind this is that the recent meme coin boom has led to a sharp increase in fees (gas costs) for using the Ethereum network. In particular, the PEPE token, which is based on the American cartoon character Pepe the Frog, has attracted a lot of attention, and the price of PEPE soared more than 266 times in just four days last month.

Tokens are traded primarily on decentralized exchanges on Ethereum, increasing on-chain activity. In PEPE-related transactions, decentralized exchange UniSwap processed more than 400,000 transactions, contributing to a significant rise in Ethereum transaction fees (gas fees).

Dune

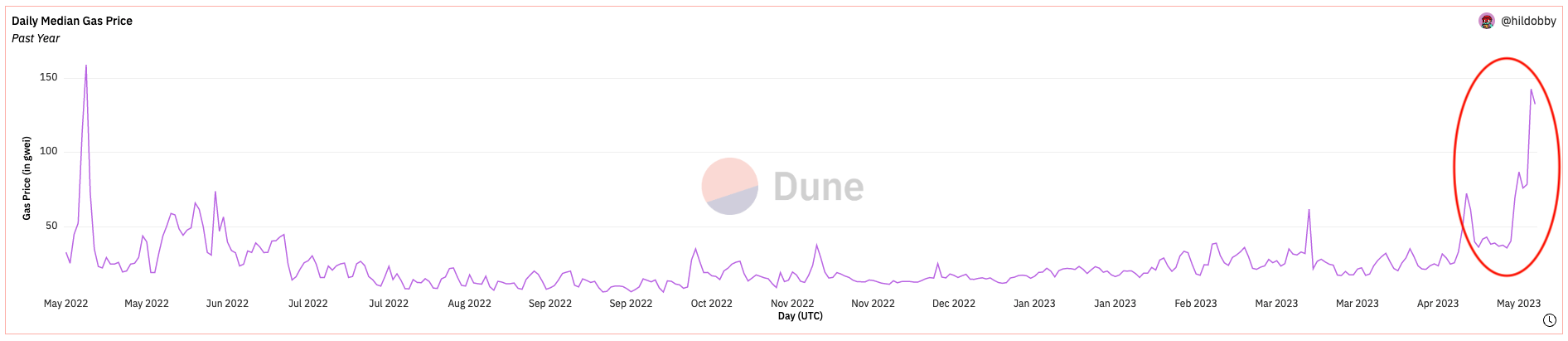

Ethereum’s average fee surpassed 100 gwei last week, the highest since May 2022. This brings the end-user swap cost to about ¥4,000 ($30) or more. As gas prices rise, more revenue will be generated for validators who receive a portion of transaction fees in addition to their regular staking rewards.

connection:VISA Releases Report On Major Ethereum Upgrade “Merge”

ETH staking environment

With a major merge update last September, the Ethereum blockchain completed its transition to a Proof of Staking (PoS) consensus mechanism. And with the Shanghai upgrade on April 13th this year, validators will be able to withdraw ETH for the first time.

With the completion of these major updates, investors who were wary of liquidity risk and uncertainty are now finding new opportunities to start staking ETH.

According to data site DUNE, Ethereum currently has 620,473 validators, up 9% from 567,000 at the time of the Shanghai update. Currently, 16,353,927 ETH (equivalent to approximately 4 trillion yen) is staked on the network. *To become a validator, you need to lock 32 ETH into the network.

connection:Ethereum staking release after Shapella implementation, total amount exceeds 1 million ETH

What is Meme Coin

A virtual currency born from a joke on the Internet, a typical example is Dogecoin (DOGE). General cryptocurrencies tend to fluctuate in price due to their use cases and development status being emphasized. Memecoins, on the other hand, are centered on their topicality, and there are cases where there are no use cases or they are built after the fact.

Cryptocurrency Glossary

Cryptocurrency Glossary

The post Ethereum Staking Reward Rate Rise, May Be Due to Meme Coin Boom Trading appeared first on Our Bitcoin News.

2 years ago

112

2 years ago

112

English (US) ·

English (US) ·