Every industry scales through standardization. The move to Proof of Stake (PoS) on the Ethereum blockchain last year presented an opportunity to create a staking yield benchmark. This benchmark can serve as the basis for financial instruments based on historical yields.

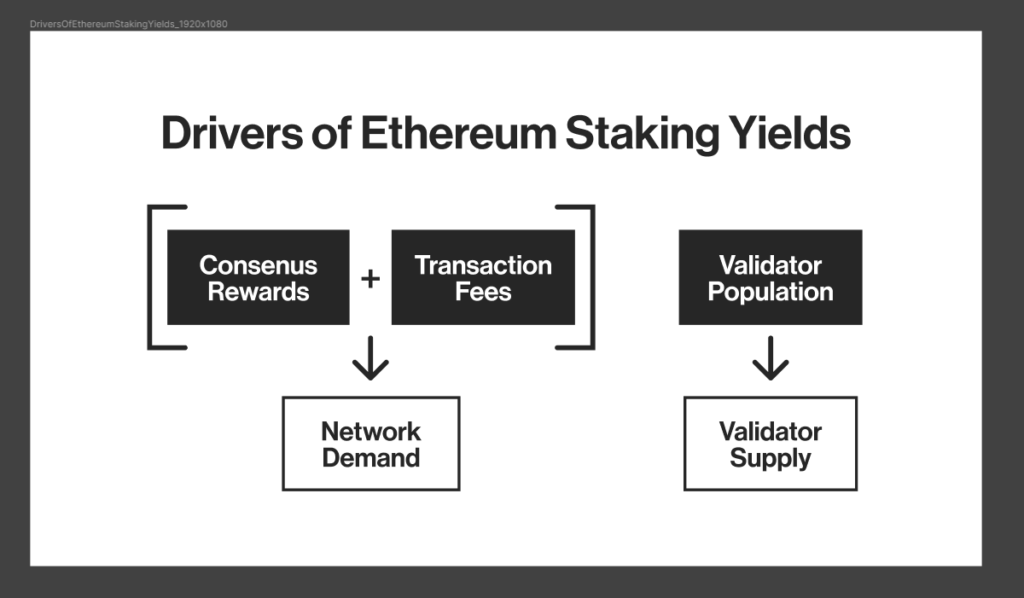

In PoS, Ethereum validators (also known as stakers) lock (deposit into the network) a portion of their Ethereum holdings as collateral to participate in the network’s consensus mechanism. As rewards, stakers receive newly issued Ethereum and transaction fees.

And by capturing and publishing the annualized average of on-chain rewards received by all validators on a daily basis, we can create a standardized benchmark and track our performance. Benchmarks are difficult to tamper with due to the inherent transparency and immutability of blockchain. In contrast, for example, to the manipulation of LIBOR (London Interbank Offered Rate), which has driven traditional finance (TradFi) credit markets for years.

A standardized Ethereum staking rate would immediately help in two ways:

- benchmark

- Tools for risk transfer

As a benchmark, Ethereum staking rates work similarly to traditional financial instruments such as Overnight Interest Rate Swaps (OIS), providing convenience as a reference rate. From new cryptocurrency-specific Sharpe ratios to price benchmarks, standardized Ethereum staking rates can be used to discount future cash flows, helping investors to invest in the Ethereum ecosystem. Better present value assessment.

Standardized staking rates also lay the foundation for important new tools for risk transfer. The interest of natural hedgers and future speculators, particularly validators, inevitably creates forward curves and swaps, futures and other derivative products. Basis swaps with traditional finance rates and currency swaps with fiat currencies can be entry points for staking rates and also create new structured bonds.

So the new staking rate has the potential to unlock the next generation of financial products while still functioning as building blocks for the Ethereum blockchain.

CoinDesk subsidiary CoinDesk Indices and crypto investment firm CoinFund jointly launched the Composite Ether Staking Rate (CESR) at the end of April. This is an important development in the evolution of the Ethereum ecosystem and represents a new frontier of innovation in DeFi (decentralized finance) and beyond.

|Translation: coindesk JAPAN

|Editing: Rinan Hayashi

|Image: Shutterstock

|Original: Ethereum Staking Needs Its (Honest) LIBOR

The post Ethereum staking, tamper-free benchmarks needed | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

119

2 years ago

119

English (US) ·

English (US) ·