Ethereum (ETH) staking deposits hit a record high last week due to the Ethereum blockchain mega-upgrade “Shanghai”. The inflow was driven primarily by institutional staking service providers and investors reinvesting rewards earned after withdrawals, crypto analysts said.

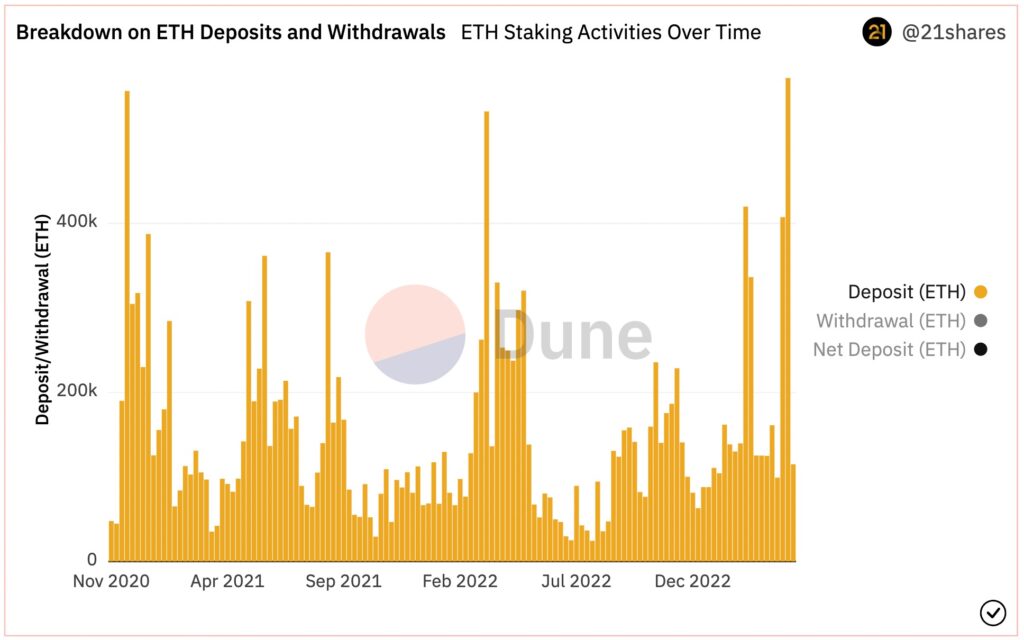

According to a Dune Analytics data dashboard created by Tom Wan, an analyst at crypto investment firm 21Shares, about 571,950 ETH, or about $1 billion, was staked last week. rice field.

Largest weekly inflow in the nearly two and a half year history of ETH staking.

Dune Analytics, 21Shares

Dune Analytics, 21SharesETH rose on the heels of Shanghai’s success, but last week saw a resurgence of macroeconomic concerns around inflation and recession, wiping out all gains as the broader cryptocurrency market fell.

ETH staking for institutional investors

Institutional staking services drove the surge in deposits, Wang tweeted.

After Shanghai, the top five institutional staking service providers (Bitcoin Suisse, Figment, Kiln, Staked.us and Stakefish) deposited 235,330 ETH, or about $450 million, according to the 21Shares dashboard. Climb to

In another tweet, Wang emphasized that the ability to withdraw ETH has greatly reduced the liquidity risk associated with staking.

3/ Institutional Staking Providers have significant inflows of $ETH Staked as Shanghai has reduced the liquidity risk for investors

Last 30 Days ETH Staked:

– @stakefish: 90k

– @staked_us: 70K

– @Kiln_finance: 35K

– @BitcoinSuisseAG: 17K

– @Figment_io: 12K pic.twitter.com/aRQFkGLbqk

— Tom Wan (@tomwanhh) April 23, 2023

Reinvestment of rewards

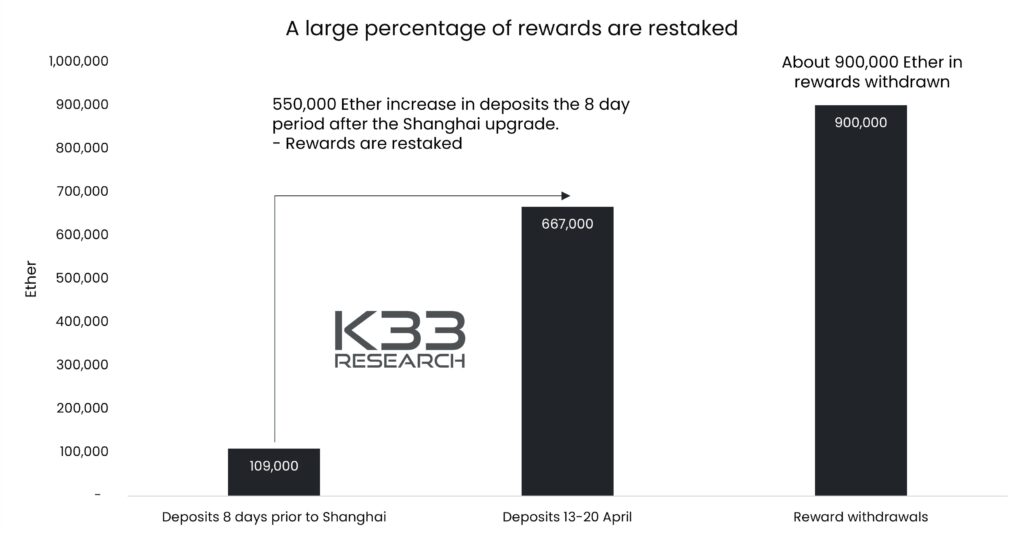

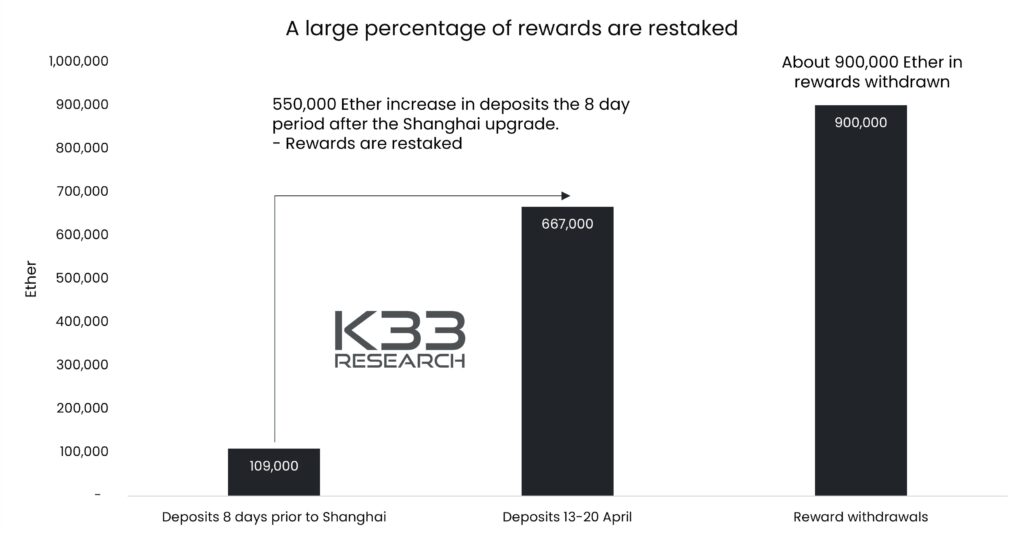

Anders Helseth, vice president of cryptocurrency market research firm K33 Research, said another reason for the record inflow was that investors were reinvesting the staking rewards they withdrew. rice field.

In the first eight days after Shanghai, investors withdrew around 900,000 ETH in staking rewards. Meanwhile, about 667,000 ETH was deposited, six times the amount deposited in the last eight days before Shanghai.

This indicates that investors have reinvested most of the rewards they withdraw, Helseth wrote.

Decrease in selling pressure

Noelle Acheson, former head of research at CoinDesk and market analyst, said Shanghai had a “net increase” in staking inflows, in a newsletter Wednesday.

“So far, excluding reward withdrawals, the pace of deposits has outpaced withdrawals.”

The difference between a reward withdrawal and a full withdrawal (withdrawal) comes from the staking mechanism. Users need to deposit 32 ETH into the network to open a node and get staking rewards. Leaving the rewards earned from staking on the node does not improve the node’s return. To increase returns, it is logical for users to withdraw rewards, deposit another 32 ETH and open new nodes, Acheson explained.

Reinvesting rewards also reduces selling pressure, a potentially positive sign for ETH price, he said.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: Dune Analytics, 21Shares

|Original: Ethereum Shanghai Upgrade Brings Record Inflow of 572k ETH Staked in a Week

The post Ethereum, weekly staking deposit hits record high ── Liquidity risk reduced in Shanghai | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

158

2 years ago

158

English (US) ·

English (US) ·