Macroeconomics and financial markets

On the 6th, in the US New York stock market, the Dow Jones Industrial Average closed 141.2 points (0.37%) higher than the previous day, and the Nasdaq Index closed 11.3 points (0.07%) higher.

U.S. stocks related to crypto assets (virtual currency), which have been on a steep rise and fall since the beginning of the year, showed a rebound, with Coinbase up 2.1% and Riot up 4.3%.

CoinPost app (heat map function)

connection:Ranking of recommended securities accounts for the stock market that can be used at a profitable price

connection:Why Sumitomo Mitsui Card Platinum Preferred is rapidly gaining popularity as a new NISA savings investment

Virtual currency market conditions

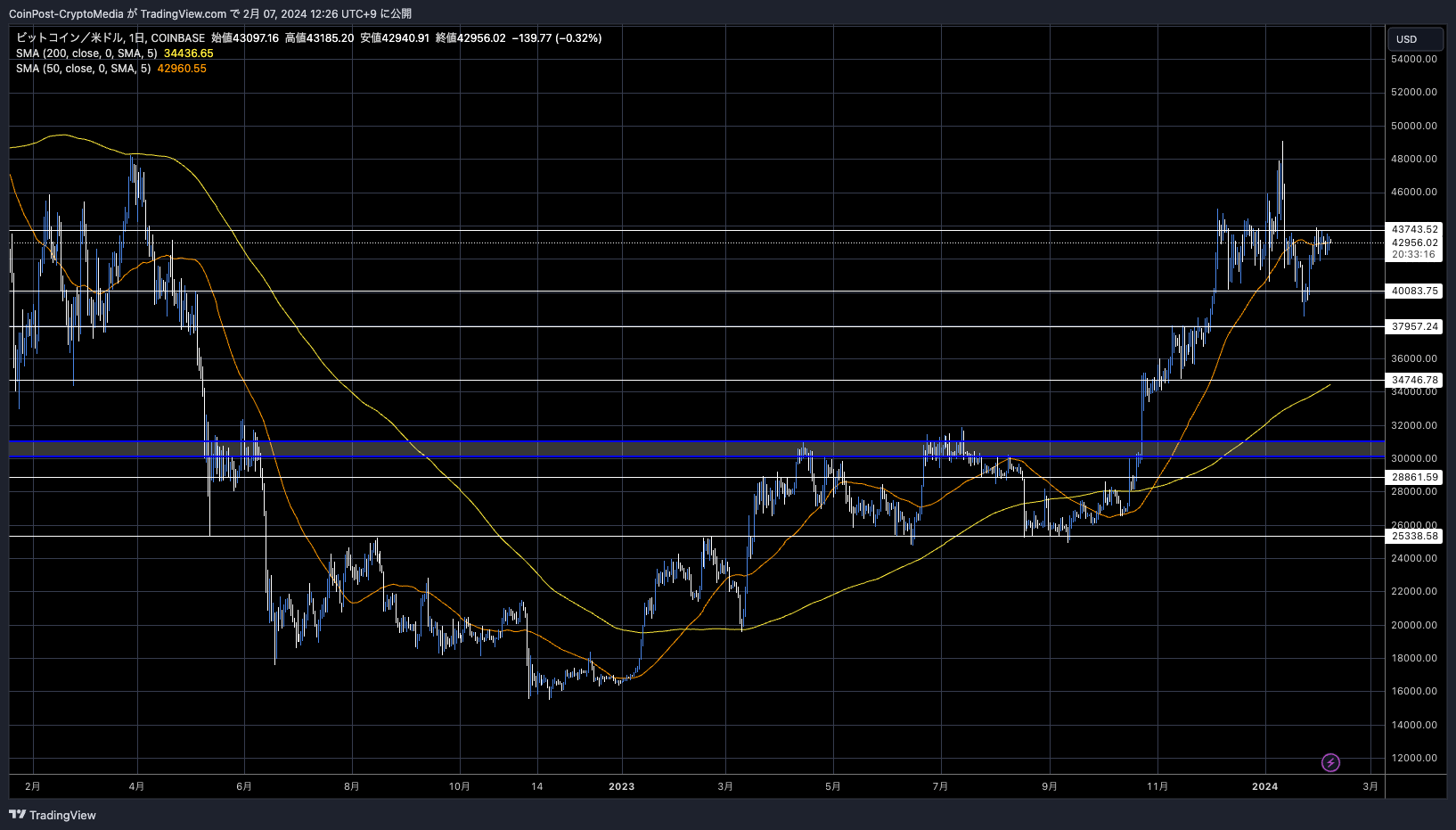

In the crypto asset (virtual currency) market, the Bitcoin price rose 0.31% from the previous day to 1 BTC = $42,953.

BTC/USD daily

It has been revealed that MicroStrategy, which holds a large amount of Bitcoin (BTC), continued to purchase 850 BTC (equivalent to $37 million) in January of this year, reaching 190,000 BTC.

In January, @MicroStrategy acquired an additional 850 BTC for $37.2 million and now holds 190,000 BTC. Please join us at 5pm ET as we discuss our Q4 2023 financial results and answer questions about our #bitcoin strategy and business outlook. $MSTR https://t.co/j5SbcELsue

— Michael Saylor (@saylor) February 6, 2024

(@saylor) February 6, 2024

connection:MicroStrategy buys more Bitcoin in January, resulting in unrealized gains of over 300 billion yen

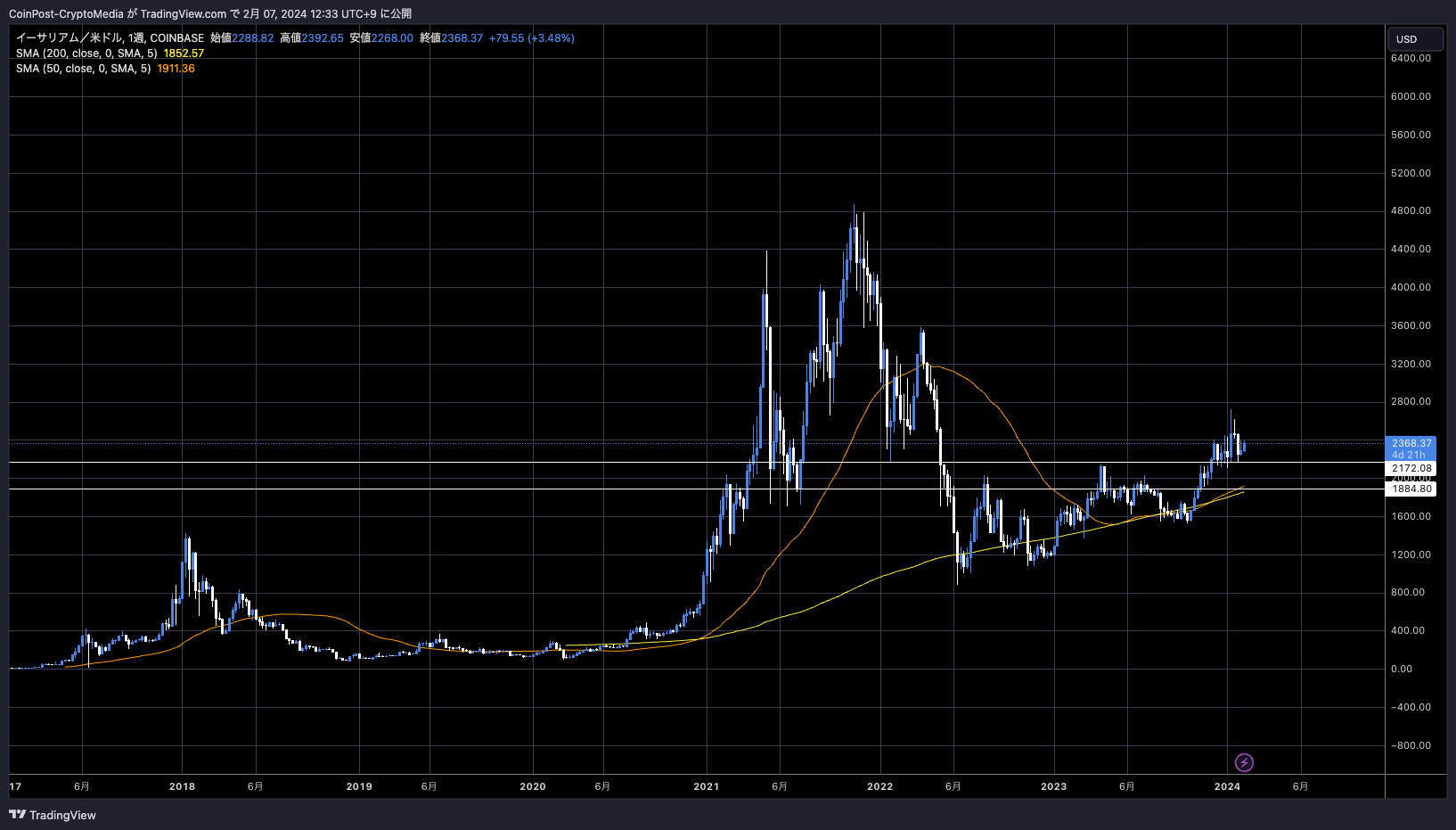

Ethereum (ETH) is trending relatively steadily, rising 2.2% from the previous day.

ETH/USD weekly

Rekt Capital said that the price movement of ETH shows positive signs technically.

$ETH already showing signs of price stability at this ~$2274 Range Low support

Still technically positioning itself for a repeat of last month’s move#ETH #Crypto #Ethereum https://t.co/3ljv7fTkm4 pic.twitter.com/zerO7PfOlJ

— Rekt Capital (@rektcapital) February 6, 2024

As the final testnet launch of the Dencun upgrade nears, and once the deployment is successfully completed, there are plans to decide on the Dencun mainnet launch date, as well as expectations for approval of the Ethereum spot ETF (exchange traded fund). It is seen as.

connection:Ethereum Dencun upgrade second test successful, final test on February 7th

Rekt Capital also mentioned the market capitalization of the altcoin market. If it breaks out of the milestone line, a hype cycle will begin in the first quarter.

From the perspective of encouraging capital inflows into crypto assets (virtual currencies), the US Federal Reserve’s intentions to cut interest rates early are receding due to strong economic indicators in the US. Chairman Powell, while using cautious language, effectively ruled out the possibility of a rate cut in March.

There is a growing view that capital inflows into risk assets will be restricted until the middle of this year, potentially exposing them to selling pressure, and the impact of the macro economy could have a strong impact on the market price after the Bitcoin halving. Dew.

Amid growing concerns about China’s economic recession, some are pointing to capital inflows from China based on the withdrawal of money from the sluggish stock market. This is believed to be due to the 8% plunge in the CSI 1000 index, which covers many Chinese stocks.

The CSI index fell -21.6% in 2021, 21.8% in 2022, and 11% in 2023, suggesting that global investors have retreated from the Chinese stock market. Chinese authorities are tightening regulations on short selling.

Reuters reported on the 25th of last month that some Chinese investors are starting to move their funds into crypto assets (virtual currencies). According to Bloomberg, mainland China and Hong Kong stock markets have lost $6 trillion (900 trillion yen) in market capitalization since their previous peaks.

connection:A number of Chinese investors are shifting their focus to virtual currencies following the severe slump in Chinese stocks = report

altcoin market

The Solana (SOL) blockchain has experienced its first major failure since February 2023.

connection:Solana Chain halts operations for 5 hours due to failure

Although SOL prices plummeted by more than 4% at one point, the impact remained slight, dropping 0.2% from the previous day as the price recovered.

According to a weekly report from asset management firm CoinShares, Solana received $13 million in inflows into exchange traded products (ETPs) last week, far exceeding Ethereum’s $6 million.

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Bitcoin ETF special feature

Click here for a list of past market reports

The post Ethereum, which is trending steadily, rose 3.8% from the previous week, while Solana, which suffered a major failure for the first time in a year, temporarily fell sharply appeared first on Our Bitcoin News.

1 year ago

131

1 year ago

131

English (US) ·

English (US) ·