FAQ. Bitcoin (BTC) isstore of value”Is it?

Those in favor will answer “YES” without hesitation. But skeptics point to big declines in the past. That is correct.

In November 2021, Bitcoin climbed to around $65,000, compared to around $25,000 now, just a week ago it was around $20,000.

But it initially traded for less than a cent. Looking at price alone, the answer to the first question is “difficult to judge.”

Volatility should be expected for an asset that is speculative and in the price discovery stage. New opportunities and technologies attract the attention of speculators and traders, who often experience volatility as they try to determine their true value.

The growing interest and controversy with skepticism, obstacles along the industry’s growth path, and a roller coaster of highs and lows make sense in just 14 years.

Bitcoin has the sound qualities of money (durability, portability, scarcity, uniformity, divisibility), but the final concern is whether it will be widely adopted.

With the following on-chain metrics, we want to prove that Bitcoin users believe Bitcoin is a “store of value” despite its volatility.

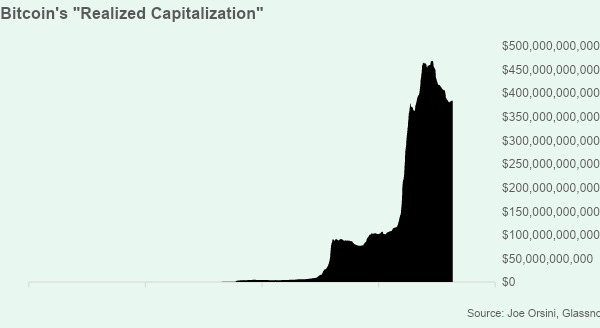

Realized Capitalization

One indicator that Bitcoin is being used as a “store of value” is “realized capitalization”. Unlike market capitalization, this metric takes into account the last transfer price of each coin.

In other words, Realized Capitalization is the total cost base (total acquisition price) of Bitcoin users, representing the amount of money accumulated in the Bitcoin network over time.

To me, this is an alternative to cash inflows. Realized capitalization rises when a stock trades higher than before and falls when it trades lower.

Bitcoin’s realized capitalization is about $380 billion, down from its peak of $460 billion, according to Glassnode. Importantly, however, this figure is four times higher than it was in December 2017 when Bitcoin was trading near its current price.

So money is flowing into the Bitcoin network – to store value.

Joe Orsini, Glassnode

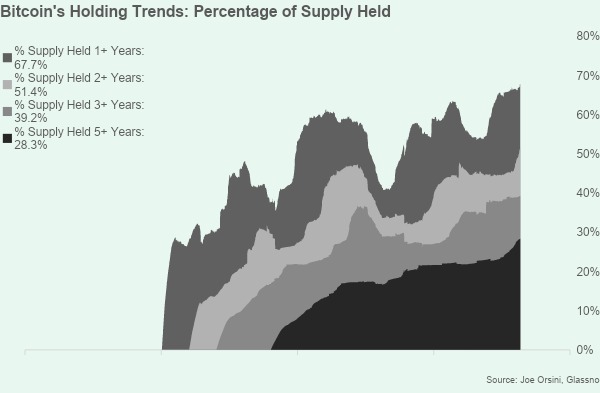

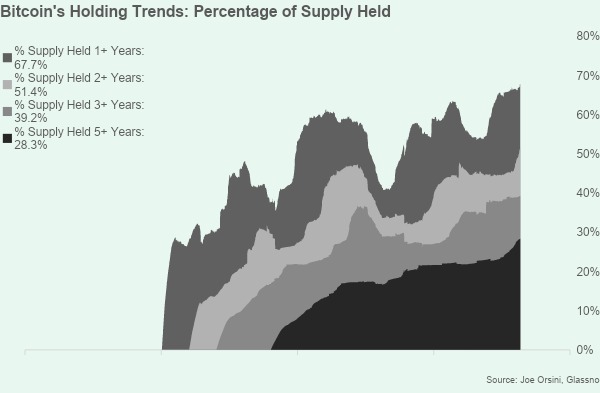

Joe Orsini, Glassnodeholding trend

Additionally, Bitcoin users are also long-term holders of Bitcoin. Last week, the percentage of bitcoin held for the long term hit a record high despite the price drop from late 2021.

As of March 7, the ratio by holding period (Glassnode data) is as follows.

- Over 1 year: 67.7%

- 2 years or more: 51.4%

- 3 years or more: 39.2%

- Over 5 years: 28.3%

Joe Orsini, Glassnode

Joe Orsini, GlassnodeConclusion

There is a saying “perception is reality”. We must not forget that Bitcoin is inherently purposeful in its very existence. Despite the noise and skepticism, money continues to flow into Bitcoin and users are holding onto it for the long haul.

Next time someone questions Bitcoin’s use as a “store of value”, show them these graphs. As Satoshi Nakamoto wrote, “If enough people think the same way, that becomes a self-fulfilling prophecy.(It would be a self-fulfilling prophecy if many people thought the same way.)

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: Shutterstock

|Original: Evaluating Bitcoin as a Store of Value

The post Evaluating Bitcoin as a “Store of Value”[Column]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

97

2 years ago

97

English (US) ·

English (US) ·