Last week, the US dollar surged against a basket of major currencies, putting pressure on risk assets including Bitcoin (BTC). However, Bitcoin, the leading crypto asset (virtual currency), has maintained its major support line, a positive sign for the market.

The US Dollar Index (DXY), which shows the dollar’s performance against major currencies, rose more than 1.3%, its biggest one-week gain since February, TradingView data shows.

Meanwhile, Bitcoin fell 5.8%, living up to its notorious negative correlation with DXY. However, it did not break below the 200-Week Simple Moving Average (SMA), widely known as the technical line that capped the highs in February.

“By holding this critical average, the bulls have convinced the market of the long-term persistence of the bullish trend,” said Alex Kuptsikevich, senior market analyst at FxPro. said in an email.

According to Kapzykevich, bitcoin needs to rise above $28,500 to attract cautious buyers who have been on the sidelines looking for stronger evidence that the price decline is over. At the time of writing, Bitcoin was trading near $27,400, up 1.4% on the day, after hitting highs above $31,000 last month.

Some observers expect the dollar to continue to rise, restraining the rise of crypto assets.

“I think the time has come for the dollar to rebound as the market takes over the monetary easing implied by the futures curve. Driven by political considerations, but in the short term it boils down to central bank policy (changes in nominal interest rates), and depending on how hard the dollar rises, it could do short-term damage to assets like commodities and crypto assets. It could give,” Ilan Solot, co-head of digital assets at Marex Solutions, said in an email.

Analysts at Swissblock Insights made similar observations in a May 12th note to subscribers.

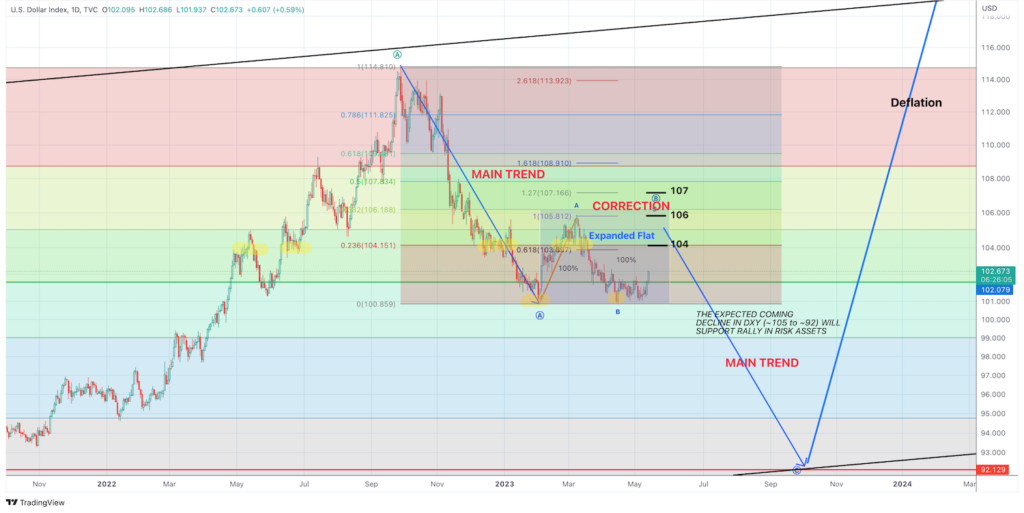

“Given that DXY has been above 102 since mid-March, it could reach somewhere between 104 and 107,” said the analyst, who said the firm’s relationship with TradFi (traditional finance) has strengthened. He added that another strong dollar could continue to put pressure on bitcoin because of the

Swissblock Insights expects the dollar index to re-enter the downtrend after a brief rebound. (Swissblock Technologies)

Swissblock Insights expects the dollar index to re-enter the downtrend after a brief rebound. (Swissblock Technologies)Meanwhile, according to Swissblock Technologies, a rebound in the dollar is likely to pave the way for a deeper decline in favor of crypto assets.

According to Swissblock Insights, “The structure of the past month will eventually come crashing down, with both assets looking for new prices, meaning Bitcoin going up and DXY going down.”

Sorott also expects Bitcoin’s decline to be short-lived and “a great entry point to take a position” for investors.

Wallets that have held bitcoin for at least six months have also accumulated coins during the recent bearish run, hinting at confidence in bitcoin’s long-term prospects.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: Swissblock Technologies

|Original: Bitcoin Holds Above 200-Week Average as Dollar Index Rallies Most Since February

The post Even though the dollar index soars, bitcoin remains above the 200-week average | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

98

2 years ago

98

English (US) ·

English (US) ·