Ethereum (ETH) numbers on cryptocurrency exchanges are at their lowest level since July 2016 as staking sucks up available ether.

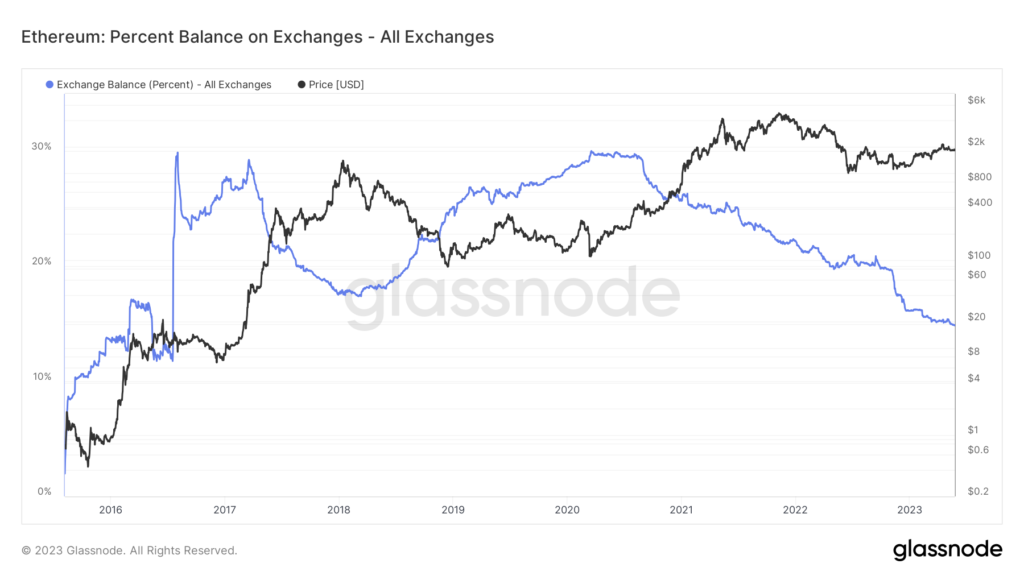

As of May 25, 14.85% of Ethereum was held in centralized exchange wallets, according to Glassnode data. It has never been this low since Ethereum was in its early stages in the summer of 2016.

Ethereum holdings on centralized exchanges have nearly halved in three years. (Glassnode)

Ethereum holdings on centralized exchanges have nearly halved in three years. (Glassnode)By contrast, during the 2021 bull market, exchange balances were around 25-26%. Low balances generally mean that there is limited Ethereum available for purchase, which puts upward pressure on prices and is a bullish signal.

Staking has been growing in popularity in recent weeks, absorbing supply from the market.

The introduction of the Chapela upgrade to the Ethereum network saw a surge in staking, with over 4.4 million new coins deposited since the upgrade.

“We expect this trend to continue, given that the forces of deflation will push Ethereum’s price up significantly,” Binfinex analysts said. “Prior to this upgrade, potential stakeholders may have been hesitant to stake their Ethereum due to concerns that their funds would be locked up for an unacceptably long period of time.” .

All of this is happening as cryptocurrency trading volumes drop by double digits.

Binance, the world’s largest cryptocurrency exchange, saw its spot trading volume fall by 48% in April for the second month in a row, to $287 billion, the second lowest since 2021. . Market share also fell to 46%, reflecting a broad industry decline of 40% due to macroeconomic uncertainty and the US banking crisis.

According to CoinDesk market data, Ethereum recently rose 2% to trade at $1,816.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: Glassnode

|Original: Ether Balance on Exchanges Nears All-Time Low

The post Exchange’s Ethereum Balance Approaching Record Low ── Impact of Staking Surge | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

82

2 years ago

82

English (US) ·

English (US) ·