12/8 (Saturday) morning market trends (compared to the previous day)

traditional finance

- NY Dow: 36,247 +0.3%

- Nasdaq: 14,403 +0.4%

- Nikkei average: 32,307 -1.6%

- USD/JPY: 144.9 +0.5%

- Gold futures: 2,020 -1.2%

- NVIDIA: $475 +1.9%

- AMD: $128.9 +0.4%

Last night’s US employment report was better than expected, but the NY Dow and Nasdaq continued to rise.

The number of non-farm employees in the US in November increased by 199,000 compared to the previous month, exceeding the expected increase of 185,000, and the unemployment rate fell to 3.7% from 3.9% in October. Additionally, the average hourly wage increased by 0.4% from the previous month.

The main reason for this increase in the number of employees was the return to work of employees of major automakers who had been on strike. The latest data does not confirm a slowdown in the labor market, and some say the market’s expectations for an early Fed rate cut next year are not justified. Jason Furman says: “Overall, the recession risk is smaller than expected and the inflation risk is a bit larger. However, as soft landings predominate, there may actually be a small amount of each risk.” I showed you my point of view.

Overall this suggests a bit less recession risk than you might have thought (Sahm indicator down from 0.33 to 0.30, which is still enough to be nervous about). & a bit more inflation risk. But really only a bit of each–with soft landing dominant. https://t.co/YXd8aEvDhN

— Jason Furman (@jasonfurman) December 8, 2023

Additionally, the market still expects the FOMC to leave interest rates unchanged next week. Employment data ends this week, ahead of next week’s CPI (Consumer Price Index) release. If the result is lower than expected, expectations for multiple interest rate cuts next year will rise again.

Today’s main market materials are as follows:.

- University of Michigan Consumer Survey in December = Consumer sentiment has improved significantly; perceptions of high prices remain deep-rooted

- US bond yields rise across the board following employment data

- The dollar-yen temporarily appreciated by 0.8%, and on a weekly basis the yen rose on expectations that the Bank of Japan would revise its easing policy.

connection: VanEck predicts the amount of capital inflow upon approval of Bitcoin spot ETF, taking into account gold ETF cases and economic environment

Important economic indicators/events from this week onwards

- 12/12 (Tue) 22:30 U.S. November Consumer Price Index (CPI)

- 12/14 (Thu) 4:00 US FOMC policy rate announcement

- 12/15 (Friday) 22:30 December New York Fed Manufacturing Industry Index

- 12/19 (Tuesday) Morning Bank of Japan Monetary Policy Decision Policy Interest Rate Announcement

- 12/19 (Tue) 15:30 Regular press conference by Bank of Japan Governor Kazuo Ueda

- 12/21 (Thursday) 22:30 U.S. quarterly real gross domestic product (GDP, final value)

- 12/22 (Fri) 22:30 US November personal consumption expenditure (PCE deflator)

connection: Stock investment recommended for virtual currency investors, “10 representative virtual currency stocks in Japan and the United States”

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Virtual currency related stocks significantly higher

- Coinbase|$146.6 (+7.6%)

- MicroStrategy | $599 (+4.9%)

- Robinhood Markets | $11.7 (+2.2%)

- Marathon | $16.7 (+8.1%)

connection: Bitcoin market capitalization rises to 9th place, surpassing Tesla and Berkshire, approaching 1/16th of the gold market

Virtual currency market Solana soaring

- Bitcoin: $44,237 +2%

- Ethereum: $2,361 +0.1%

- Solana: $75.2 +10%

Bitcoin has returned to the 44,000 level following news of Fidelity’s SEC meeting.

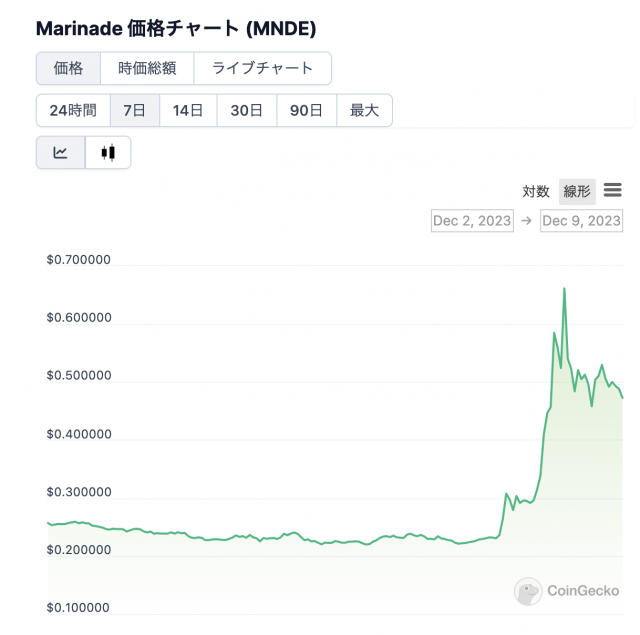

Solana rose significantly in conjunction with the implementation of the “JTO” airdrop and the trading volume of NFTs exceeding that of Ethereum NFTs, once again setting a year-to-date high. Additionally, Solana Liquid Staking’s Marinade “MNDE” reacted to the soaring price of JTO and at one point soared to three times its price.

Source: CoinGecko

connection: Solana NFT surpasses Ethereum NFT volume for the first time to become the No. 1 chain

CoinPost Special feature for virtual currency beginners

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7

— CoinPost (virtual currency media) (@coin_post) November 15, 2023

The post Expectations for an early interest rate cut are slightly set back due to strong U.S. employment statistics. Cryptocurrency-related stocks rise significantly as Bitcoin rebounds | 8th Financial Tankan appeared first on Our Bitcoin News.

1 year ago

148

1 year ago

148

English (US) ·

English (US) ·