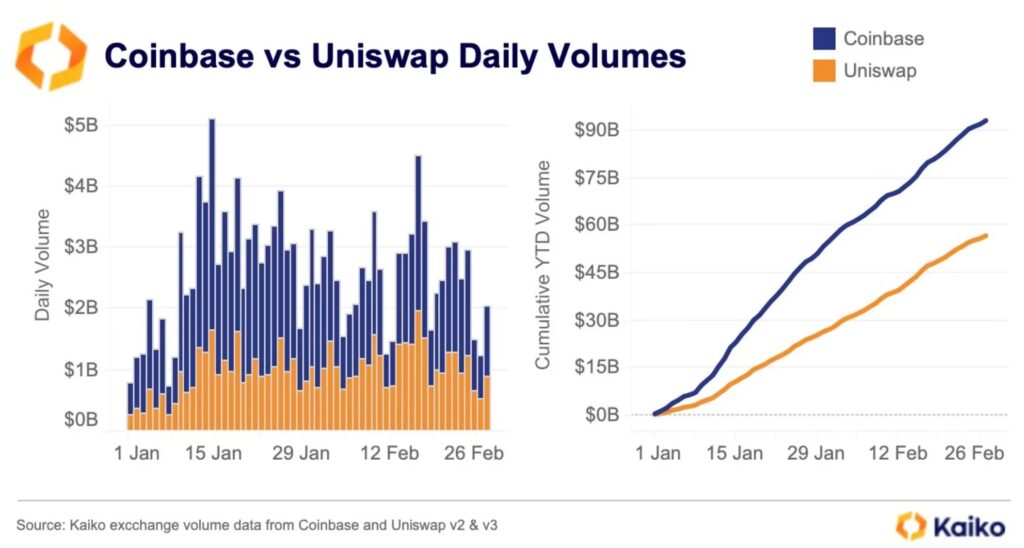

As of 2023, cryptocurrency trading giant Coinbase has surpassed the popular decentralized exchange Uniswap, according to data firm Kaiko.

As of February 28, Coinbase traded over $185 billion, nearly double Uniswap’s $93 billion. In 2022, there were times when it was about the same.

Poor UX

Following the collapse of centralized companies such as FTX last year, market players expected more traders to move to DEXs. At some point in 2022, it seemed like a real transition was happening. However, DEX seems to have a problem.

DEX trading volume surged to $113 billion in November 2022, the highest level since May, according to DefiLlama.

(kaiko)

(kaiko)Conor Ryder, a research analyst at Silkworm, said centralized exchanges (CEXs) play a key role in attracting the average investor, and calls for a move to DEXs are “a little too soon.” It was too much,” he said.

“Perhaps the average investor shuns some DEXs due to their poor user experience (UX). I think CEX has always been an important part of the exchange space,” said Ryder.

The number of new Ethereum addresses is also sluggish

Lucas Outumuro, head of research at blockchain analytics firm IntoTheBlock, said the surge in demand for non-custodial trading and DeFi (decentralized finance) has “fizzled out” after the FTX demise. .

Automulo emphasized that the number of new Ethereum addresses per day has been low on DEXs, as well as trading volume.

According to data from IntoTheBlock, the number of new Ethereum addresses per day reached about 228,000 on Nov. 24, the highest level since May 2021, but recently dropped to just under 90,000. there is

(Into The Block)

(Into The Block)“Getting started with Coinbase is pretty similar to using any other technology or financial platform. But using Uniswap is a completely different flow. It will take some time.” (Mr. Automuro)

Analysts at JPMorgan Chase & Co. wrote in a note to clients in November that DEX’s slow trading speeds, asset pools and order traceability features are likely to deter institutional investors from entering.

Analysts also noted that DEXs lack limit order/stop loss order functionality, rely on price oracles that obtain data from centralized exchanges, and are vulnerable to hacking. However, it cited the systemic risk posed by the chain of automatic liquidations as factors that would hinder its widespread adoption.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: Kaiko

|Original: Coinbase Trade Volume Surpasses Uniswap’s, Countering Expectations for a DEX Surge

The post Expectations for DEX were “too early” ── Coinbase trading volume exceeds Uniswap from the beginning of the year | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

145

2 years ago

145

English (US) ·

English (US) ·