shanghai upgrade

The crypto asset (virtual currency) Ethereum (ETH) is about to implement the next upgrade “Shanghai” from March to April 2023. The main purpose of Shanghai is to unlock the withdrawal function of validators (transaction validators on the network).

In the case of Ethereum, each validator stakes 32 ETH and is rewarded with an annual interest rate of 4% to 6%. However, once the Shanghai upgrade is complete, these staking ETH and rewards will be available for withdrawal for the first time.

According to the official website, as of March 9, there were 543,000 validators on Ethereum, and 17.38 million ETH (approximately 3.66 trillion yen), or 14.63% of the ETH supply, was locked in staking contracts. there is Approximately 1.03 million ETH has been accumulated as validator rewards.

Analysts believe the Shanghai upgrade will lead to increased demand in the medium to long term, even if it causes some selling pressure in the short term. This is because investors who have been concerned about liquidity risk and uncertainty may start staking new ETH.

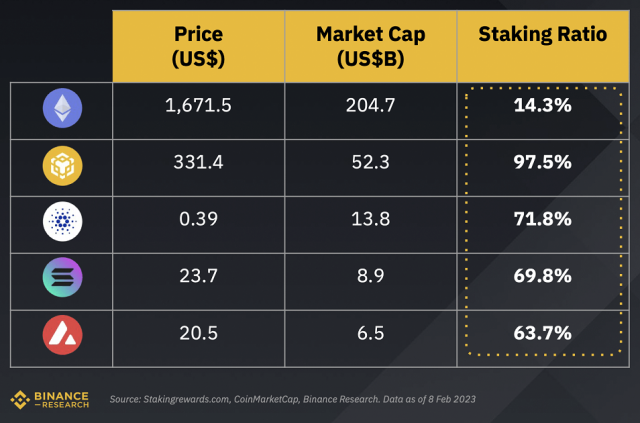

According to Binance Research, the staking share of Ethereum (ETH) supply is 14%, the lowest among other Layer 1 blockchains. With an average of 58% and just over 90% for BNB, there is still room for expansion.

Source: Binance Research

- Staking service

- What is LSD (Liquid Staking Derivative)?

- What the ETH-LSD market looks like

- Lido

- Rocket pool

- Stader

- StakeWise

- Frax Ethereum

Staking service

Staking platforms can be broadly divided into centralized exchanges (CEX) such as US virtual currency exchanges Coinbase and Kraken, and decentralized platforms such as Lido and Rocket Pool.

Many users have used the staking service because it entrusts infrastructure operation for staking in exchange for a fee and can be used from any amount regardless of the requirement of 32 ETH.

However, the bankruptcy of the former major virtual currency exchange FTX exposed the counterparty risk of centrally managed services. Furthermore, the U.S. Securities and Exchange Commission (SEC) has cracked down on Kraken and regulatory risks have surfaced, reassessing the risks of CEX.

Kraken was fined $30 million for providing staking services without proper risk disclosure. According to Etherscan, Kraken has a market share of around 7.5% by Ethereum staking volume, placing it third behind Lido and Coinbase.

Under these circumstances, interest in decentralized staking platforms has increased, and the need for liquid staking derivatives (LSDs) in particular has skyrocketed.

What is LSD (Liquid Staking Derivative)?

Liquid staking is a mechanism that allows you to receive derivative tokens (LSD) issued 1:1 through smart contracts and operate them in DeFi (decentralized finance) while receiving cryptocurrency staking rewards.

Staking typically has the downside of locking liquidity and eroding opportunities for yield in DeFi. Using liquid staking has the advantage of improving capital efficiency, which in turn increases liquidity throughout the DeFi ecosystem.

Liquid staking has been adopted in blockchains that employ PoS (Proof of Stake), but it is mainly developed in Ethereum (ETH).

Major ETH liquid staking providers include Lido and Rocket Pool, where users receive LSD (stETH, rETH, etc.) in exchange for deposited Ethereum. These LSDs are widely integrated in DeFi, and can be used as collateral for borrowing on DeFi such as Aave, and additional revenue can be obtained through market making on DEX (distributed exchange).

After the implementation of “Shanghai”, you will be able to earn staking rewards when burning LSD and redeeming the original capital, but you can immediately close your position by selling LSD on the market even before implementation. can.

What the ETH-LSD market looks like

Overall, liquid staking derivatives (LSDs) are the hottest category in the DeFi market this year. “Total Value Locked (TVL),” which indicates the total amount deposited in the DeFi protocol, has increased by 60% since the beginning of the year. It is second only to TVL’s top category ‘DEX’, surpassing the scale of ‘decentralized lending’.

Lido, which has the top share in LSD, has surpassed the stablecoin “Maker Protocol” and the lending protocol Aave to become the sole leader in the DeFi market in terms of TVL. Lido’s governance token LDO rose 220% in 2023, and Lido’s rival governance token also surged.

Curious about the $ETH Liquid Staking Derivatives market? @Lido Finance dominates with almost 33% of all staked ETH, while @coinbase comes in second with a considerable margin. Keep an eye on these key players as the market continues to grow. #ETH #LSD #DeFi #Investment pic.twitter.com/OwOFcqXpey

— IntoTheBlock (@intotheblock) March 6, 2023

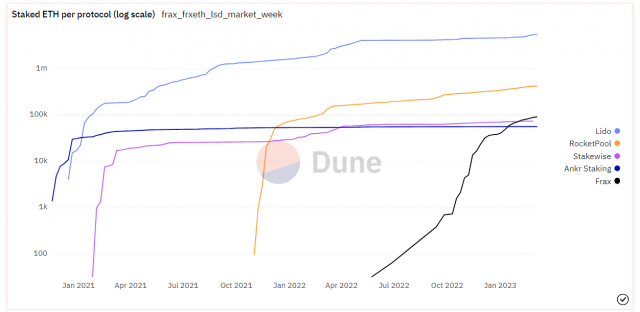

According to statistics site DUNE, 33.32% of total Ethereum staking (7,827,960 ETH) is locked in the Lido-centric liquid staking protocol.

Lido, which holds the top share in ETH liquid staking, holds 5,675,000 ETH, accounting for 32.59% of all Ethereum. At one point, Lido dominated the market, and there was concern about the risk of centralization.

Currently, as LSD service providers, Coinbase (Ethereum staking share: 6.58%), Rocketpool (2.3%), Ftax (0.6%), Stakewise (0.43%) are gradually penetrating the market. is preventing Lido from running alone.

In particular, decentralized services such as Rocket Pool and StakeWise will show their presence amid growing uncertainty over the US Securities and Exchange Commission (SEC)’s crackdown on staking services. In February, the SEC indicted Kraken for offering unregistered securities, sending Coinbase’s stock price down 14%.

Lido

Lido Finance (LDO) is the largest service provider for ‘liquid staking’. It accounts for 77.5% ($8.32 billion) of the total deposit assets (TVL) of the LSD platform of 7,607,536 ETH ($12.44B).

According to statistics site DeFillama, ETH has an annual yield (APY) of 4.60% with a 10% fee. The derivative token “stETH”, which is issued by depositing ETH, is the most popular in the DeFi ecosystem, and you can earn additional yield separately on Aave and Euler.

Lido was originally launched in collaboration with the industry’s leading staking providers, and the protocol has 27 node operators (for ETH Lido) as of the end of Q3 2022. Some point out that there is a risk of cartelization because the addition and removal are determined by the votes of governance token LDO holders.

On the other hand, the next upgrade “Lido V2” scheduled after the implementation of “Shanghai” will include a function that makes it easier for independent node operators to newly participate in the Lido protocol.

connection:ETH staking giant Lido to implement withdrawal function in V2

Rocket pool

Rocket Pool is a long-established project established in 2016. TVL is the third largest protocol for liquid staking on Ethereum. Its TVL has doubled since the beginning of 2023, reaching approximately 130 billion yen ($954.84 million) and 422,528 ETH. Issue “rETH” as a derivative token.

It adopts a more decentralized scheme than Lido in that anyone can become a node operator. About 2100 nodes are running in Rocket Pool. These nodes will receive all staking user fees (5-20% of ETH rewards) and will also earn Rocket Pool’s governance token RPL as a separate reward.

It takes 16 ETH to become a node operator and acts as an Ethereum validator by configuring another node and a minipool. In addition, a separate RPL collateral of 1.6 ETH is required to compensate for the penalty (slash) that occurs in Ethereum when the node stops.

Currently, the new mini pool has a fee of 15%, so the cost to the end user is higher than Lido, and the APY is 4.32%, which is lower than Lido (DeFillama research at the time of writing). Another issue is the high RPL inflation rate.

In January 23, it was revealed that Coinbase Ventures will participate in the DAO (Decentralized Autonomous Organization) involved in the operation of Rocket Pool.

connection:Coinbase Teams Up With Liquid Staking Rocket Pool

Stader

Stader is a latecomer to ETH liquid staking, and according to DeFillama data, it seems to have started in September 2022.

Originally developed in the defunct former Terra (LUNA) ecosystem, developer Stader Labs raised $12.5 million in a funding round led by Three Arrows Capital in January 2022 at a valuation of $450 million. million dollars.

Currently operating on 6 chains: Polygon (MATIC), Phantom (FTM), BNB, Near (NEAR), Hedera Hashgraph (HBAR), Terra 2.0, and Ethereum. Ethereum accounts for 50% of Stader’s overall chain TVL of 16 billion yen ($120 million).

Stader’s LSD is a “cToken” that is easy to integrate in the DeFi ecosystem, and is integrated with more than 40 protocols such as AAVE v3 (polygon), Balancer, Beefy, Quickswap, Apeswap, BeethovenX.

3) Full-fledged DeFi integrations

We have 40+ DeFi integrations for our liquid staking tokens including:@AaveAave @Balancer @QiDaoProtocol @QuickswapDEX @ape_swap @beethoven_x and more! pic.twitter.com/Z5kaNRHglx

— Stader Ethereum (@staderlabs_eth) March 13, 2023

Stader has a “multi-pool liquid staking protocol” carefully designed to make node operations more democratized. It consists of a permissioned pool by affiliated nodes and a permissionless pool in which general nodes can participate. In the future, DVT (Distributed Validator Technology)-based validators that distribute the role of validator across multiple nodes instead of a single machine will also be able to participate.

According to the light paper released on February 27, anyone can participate as a validator in a permissionless pool by providing a minimum of 4 ETH + 0.4 ETH worth of SD (Stader’s governance token). Permission pools, on the other hand, allow a group of community-rated validators to contribute to the protocol without a 4ETH lockup.

Stader’s LSD (liquid staking token) on Ethereum is ETHx. The staking reward generated in the consensus layer of Ethereum can be compound interest operation that automatically re-stakes. Furthermore, it is a design that is expected to have a high yield, such as reflecting the “MEV (maximum extracted value)” and “tip (priority fee)” that occur in the execution layer.

End-users pay a 10% commission on staking rewards, split evenly between validator operators and Staders.

SD functions as compensation when thrashing occurs, similar to RocketPool. In the first year of operation of ETHx, we plan to implement an incentive program for node operators.

StakeWise

StakeWise (SWISE) is a liquid staking that launched on the mainnet on Ethereum in March 2021, a solution that creates a validator every time 32 ETH is collected in a pool where participants deposit.

TVL at the time of writing is $123 million. A fixed fee of 10% is collected on the rewards earned in the pool, and it is allocated to the development cost of the project. The utility of native token SWISE appears to be limited to use in StakeWise incentive programs and DAO governance.

StakeWise’s LSD uses the base “sETH2” and the reward “rETH2”, both of which can be exchanged for ETH on a one-to-one basis. DeFillama puts sETH2 at 5.01% APY.

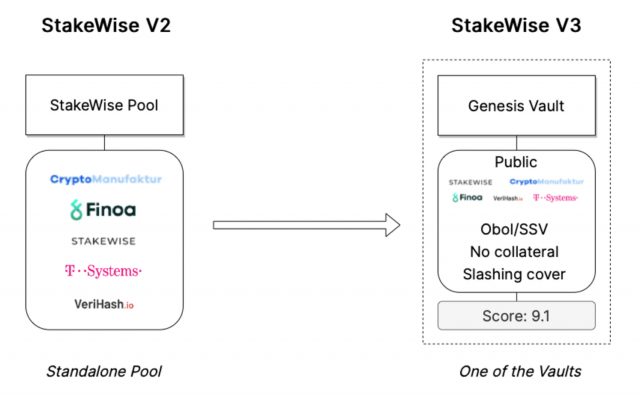

“StakeWise V3”, which was launched on March 1, has a decentralized structure, allowing anyone who can run a validator to be entrusted by general users to provide staking services.

Source: StakeWise Medium

End-users choose from a variety of operators in the Vaults Marketplace. In v3, sETH2 and rETH2 tokens will be replaced by Vault Tokens (VLT). In order to use it as LSD, it is necessary to stake VLT and issue “osETH”.

If you stake VLT equivalent to 100 ETH in Vault, users can issue osETH equivalent to 95 ETH and operate it as LSD. 5 ETH worth of VLT will act as property insurance.

Although V3 is still a testnet version with a managed node environment, there is interest from individuals and DAO-based validators.

Frax Ethereum

Frax Ethereum (frxETH) is an Ethereum liquid staking derivative that just launched in October 2022. The total issuance of frxETH exceeded 110,000 ETH in about 5 months, and the TVL is $159 million.

Source: dune.com/struct3r/frax-frxeth

The reason frxETH is indicated is that it achieves a relatively high APY of 6.68% against ETH (at the time of writing). The commission is 10%.

The issuer, Frax Finance, was originally a DeFi protocol that issued a stablecoin “FRAX” pegged to the value of the US dollar.

Frax has outstanding holdings of Curve, the main stablecoin DEX, and Convex’s native tokens “CRV and CVX”, which are optimized for earning interest on Curve. It is a form that is added as a reward.

summary

Besides Ethereum, there are LSD (Liquid Staking Derivatives) among other blockchains that adopt Proof of Stake (PoS) such as BNB, Avalanche (AVAX), Solana (SOL) and Cosmos (ATOM) blockchains. Having LSD has created a cycle where staking costs are lower, more tokens are staked, and LSD is more liquid.

LSD interoperability is also developing, with Lido’s stETH beginning to deploy (bridge) to Ethereum Layer 2. On the other hand, Lido’s development partner MixBytes has announced that it will stop supporting the liquid staking service “Lido on Polkadot” on Polkadot on August 1, 2023, and optimization of the development strategy is also progressing.

connection:Liquid staking giant Lido considers ending support for Polkadot (DOT)

The post Explaining “LSD (Liquid Staking Derivatives)” that enables operation while staking Ethereum appeared first on Our Bitcoin News.

2 years ago

141

2 years ago

141

English (US) ·

English (US) ·