In recent years, many generations have moved away from low-interest bank deposits and are aiming to manage their assets through investment trusts and stock investments. Meanwhile, NISA (Small Investment Tax Exemption System), which started in 2014, has been attracting attention as an attractive option that even beginners can easily take up.

The new NISA starting in 2024 will bring significant benefits to investors with more advanced system content.

In this article, we will explain the “5 major benefits” of the new NISA and the main differences from the current NISA in an easy-to-understand manner, and explore its appeal as a new option that expands investment possibilities. Additionally, we will introduce four points to keep in mind to make the most of the new NISA. We will provide detailed information to help our readers manage their assets more effectively with the new NISA.

table of contents- What is NISA/New NISA?

New NISA “growth investment frame”

New NISA “Fresh investment allowance” - 5 benefits of the new NISA

- Tax-free holding period for current NISA and new NISA

- Four points to note regarding the new NISA

- Use the new NISA wisely and invest at a good price

1. What is NISA/New NISA?

NISA (Small Investment Tax Exemption System) is a system in which profits earned through investments such as stocks are tax exempt. The purpose behind the establishment of the system is primarily to support individual investors who invest small amounts of money.

Generally, profits earned from mutual funds and stocks are subject to a 20.315% tax, which is deducted from the gross profit. However, by using NISA, this tax is exempted and there is no need to file a tax return. This system is especially useful for beginners and those who want to start investing easily.

Current NISAs include the “General NISA” for adults and the “Tsumitate NISA” that specializes in savings investments, and investors choose between these. In addition, “Junior NISA” has been set up for minors, and these accounts have limits on opening period and tax-free holding period depending on age.

Current NISA (until 2023)

| 400,000 yen | 1.2 million yen | 800,000 yen |

| 20 years | 5 years | 5 years |

| 8 million yen | 6 million yen | 800,000 yen |

| From January 2014 | From January 2018 | From April 2016 |

| Investment trusts suitable for long-term accumulation and diversified investment (Limited to investment trusts that meet Financial Services Agency standards) |

Listed stocks/ETFs Publicly offered stock investment trusts/REITs, etc. | Same as general NISA |

| Over 20 years old | Over 20 years old | Under 20 years old |

(Source: Financial Services Agency New NISA points)

This current NISA started as a temporary measure in 2014, but the deadline for the general NISA was 2023, and the deadline for the accumulated NISA was 2042 (the new one was until 2023). This time-limited framework required investors to develop their investment strategies with a short-term perspective.

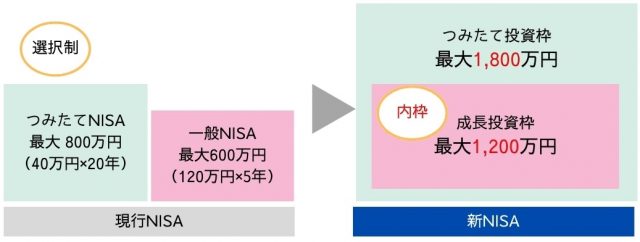

However, with the new NISA starting in 2024, this system will be made permanent, allowing for longer-term asset management. As a result of this change, “Junior NISA” will be abolished, and investment options will be consolidated into two: “Build-up investment limit” and “Growth investment limit”.

Overview of the new NISA (from January 2024)

| 1.2 million yen | 2.4 million yen |

| Indefinite period | |

| 18 million yen: Total of accumulated investment limit and growth investment limit (Growth investment limit is limited to 12 million yen) |

|

| Permanence | |

| Certain investment trusts suitable for long-term accumulation and diversified investment (Same as products eligible for Tsumitate NISA) |

Listed stocks, investment trusts, etc. (excluding some high-risk products) |

| People 18 years or older residing in Japan (as of January 1st of the year in which the account is opened) | |

(Source: What is NISA?)

Under the new NISA, you will be able to open an account at any time under certain conditions, and the tax-free holding period will be extended indefinitely. Furthermore, favorable conditions for investors have been improved, such as expanded annual investment limits and increased tax-free holding limits.

1-1. New NISA “Growth Investment Allowance”

| composition | Cannot be used with Tsumitate NISA | Fresh investment allowance andCan be used together |

| Tax-free holding period | for 5 years | Indefinitely |

| Account opening period | Until 2023 | Permanence |

| Annual investment limit | 1.2 million yen | 2.4 million yen |

| Tax-free holding limit | 6 million yen | 12 million yen |

| Investment target products | Listed stocks/ETFs Publicly offered stock investment trusts/REITs, etc. | Listed stocks/ETFs Publicly offered stock investment trusts/REITs, etc. (Excludes stocks under liquidation and supervision, trust periods of less than 20 years, monthly distribution type investment trusts, and certain investment trusts using derivative transactions.) |

The new NISA’s “growth investment limit” is designed to follow the conventional general NISA limit. Within this framework, it is possible to invest in a wide range of financial products such as listed stocks and investment trusts, and the feature is that investors can aim for high returns according to their risk tolerance. It is especially suitable for those who want to invest in a variety of financial products or those who are considering investing with large amounts of capital.

The main improvements include expanding the annual tax-free investment limit from 1.2 million yen to 2.4 million yen, and extending the tax-free period indefinitely.

In addition, under the growth investment limit, it is possible to invest in products eligible for the Tsumitate NISA. However, if you only use the growth investment limit, the tax-free holding limit is 12 million yen. To make the most of the tax-exempt limit of up to 18 million yen, you need to use it in conjunction with the Savings NISA.

On the other hand, the new NISA’s “growth investment limit” excludes investment trusts that are deemed unsuitable for long-term asset formation and investment trusts that are particularly risky, such as investment trusts that use some derivative transactions.

As a result, the products that can be invested in will be narrower than before, but it can also be considered an improvement in line with the objective of protecting beginner investors and aiming for long-term asset formation.

1-2. New NISA “Fresh investment allowance”

| composition | Cannot be used with general NISA | growth investment framework andCan be used together |

| Tax-free holding period | for 5 years | Indefinitely |

| Account opening period | Until 2023 | Permanence |

| Annual investment limit | 1.2 million yen | 2.4 million yen |

| Tax-free holding limit | 6 million yen | 12 million yen |

| Investment target products | Investment trusts suitable for long-term savings and diversified investment (limited to investment trusts that meet Financial Services Agency standards) | Certain investment trusts suitable for long-term savings and diversified investment (same as products eligible for Tsumitate NISA) |

(Source: Financial Services Agency New NISA points)

From 2024, the current Savings NISA will be taken over as the New Savings Investment Allowance. The funds eligible for investment in this framework are the same as those for the NISA until 2023, and are limited to investment trusts suitable for accumulation and diversified investment, according to the Financial Services Agency regulations.

Funds with a fresh investment limit are designated with the following conditions and are suitable for long-term investments:

- Zero sales commission (no load)

- Operation and management costs are below a certain level (e.g. 0.5% or less for domestic stock index investment trusts)

- Trust contract term is unlimited or 20 years or more

- No operations are conducted through derivative transactions, except in specific cases such as for hedging purposes.

Furthermore, under the new NISA’s “Sumitatate Investment Limit,” the annual investment limit will be increased to 1.2 million yen, three times the current system, allowing investors to manage more funds.

2. 5 benefits of the new NISA

Next, let’s take a closer look at the contents of the new NISA system. The points of the new NISA can be divided into five categories.

- Growth investment limit and accumulation investment limit can be used together

- Expanded annual investment limit, allowing investments up to a total of 3.6 million yen

- Significant expansion of lifetime investment limit (up to 18 million yen)

- Indefinite tax-free operation period

- The tax exemption allowance is restored the year after the sale.

1. Growth investment limit and accumulation investment limit can be used together

source:

Under the current NISA system, regular NISA and savings NISA cannot be used together, and investors had to choose one or the other. Additionally, the system could only be switched once a year, and only when there were no purchases made with a NISA account.

However, under the new NISA system, you will be able to use both the growth investment limit and the accumulation investment limit. This allows investors to develop more flexible investment strategies and expand the range of investments that was not possible with the current NISA.

2. Expansion of annual investment limit, making it possible to invest up to a total of 3.6 million yen

Under the current NISA system, you have to choose between the annual investment limit of 400,000 yen for accumulated NISA and 1.2 million yen for regular NISA, and you can only choose one or the other. However, under the new NISA system, this restriction will be lifted.

The “Tsumitate Investment Limit” allows you to invest up to 1.2 million yen per year, and is especially suitable for investment trusts that are suitable for accumulation and diversified investment. Furthermore, you can invest up to 2.4 million yen per year under the “growth investment limit”, which includes listed stocks. The maximum annual investment amount will be a total of 3.6 million yen, which will be three times larger than the current general NISA.

For example, those using the current NISA system, the Savings NISA, can reach the annual limit of 400,000 yen by saving approximately 33,333 yen each month. Under the new NISA system, this amount can be increased to a maximum of 100,000 yen per month, making it possible to make larger savings investments.

3. Significant expansion of lifetime investment limit (up to 18 million yen)

source:

The new NISA system introduces a new system called lifetime tax-free limit. This system allows investors to purchase financial products of up to 18 million yen (including 12 million yen for growth investment) over their lifetime.

This upper limit is a different concept from the annual tax-free investment limit, and is set based on the purchase amount of investment trusts, etc.

In the case of the current NISA, the effective investment limit for a regular NISA is a total of 6 million yen over 5 years (1.2 million yen per year x 5 years), and for a savings NISA, a total of 8 million yen over 20 years (400,000 yen per year x 20 years). )was. The introduction of lifetime investment limits under the new NISA will provide even greater investment opportunities for many investors compared to these existing systems.

4. Indefinite tax exemption period

Under the current NISA system, the tax-exempt operation period is limited to 5 years for general NISAs and 20 years for accumulated NISAs, and investors have had to formulate investment strategies based on this. There was also the issue of considering rollover to a new quota at the end of the tax exemption period.

Under the new NISA system, this tax-exempt operation period will be indefinite. This applies to both the growth investment framework and the accumulation investment framework, allowing investors to develop investment strategies with a longer-term perspective.

Under the new NISA system, the maximum amount of principal to be saved is set at a maximum of 18 million yen. What is important is that the return on this principal can increase over time due to compound interest. In other words, if you continue to invest over a long period of time, your assets can grow exponentially.

5. The tax exemption limit is restored in the year following the sale.

With the conventional “General NISA,” a tax-free investment limit of up to 1.2 million yen is set each year, and financial products can be withdrawn or sold at any time. However, in the event of a withdrawal or sale, the corresponding tax-free investment allowance could not be reused until the end of the five-year tax-free period.

Under the new NISA system, when you sell financial products purchased within a year, the lifetime investment limit can be reused from the following year onward. Under the new NISA, you can hold up to 18 million yen based on the acquisition price, and there is no limit to the number of times you can sell it. However, it is important to note that the amount of the investment limit to be recovered is based on the amount at the time of purchase (book value), not the sale price.

3. Four points to note regarding the new NISA

Finally, we have summarized four points to note regarding the new NISA. Be sure to fully understand the important points to avoid tax losses and carry out efficient procedures.

1. It is necessary to open a dedicated NISA account.

In order to use NISA, you must first open a NISA account at a bank or securities company. This account is a special account in which the profits earned from investments are tax-free, and its tax treatment differs from that of regular securities accounts.

There are over 600 financial institutions that handle NISA accounts, including credit unions, regional banks, major banks (mega banks), online banks, and online securities companies. Online securities companies are often particularly well-rounded in terms of the types of products they handle, fees, and ancillary services.

Opening of a NISA account is limited to one account per person and cannot be opened at multiple financial institutions. If you open NISA accounts at multiple financial institutions and it is discovered that the accounts are duplicated after a transaction is made, the transaction will be treated as a “general deposit” and you may be required to file a tax return.

2. Transfer procedures to another securities company are time-consuming.

When using a NISA account, it is possible to change the financial institution every year, but this change procedure requires time and effort.

If you wish to make a change, you must complete the procedure from October 1st of the year before the desired change to September 30th of the year in which you wish to make the change.Also, please note that once you make a purchase with NISA in the year you want to change, you will not be able to change it that year.

It is not possible to transfer existing assets to a new NISA account. You must continue to hold your past investments, such as stocks, in your old brokerage account, but any profits, dividends, or distributions you receive from these assets will continue to be tax-free when sold.

However, it is not possible to extend the term (rollover) of NISA accounts held at the original financial institution, and there is no other option than to sell them.

The main benefits of changing financial institutions include an expanded selection of products and differences in transaction fees. You need to carefully select the financial institution where you will use your NISA account in advance.

- 1.NISA Customer Satisfaction Ranked 1st

- 2. No. 1 online securities

- 3. Transaction fee is 0 yen

- 4.Over 2,700 investment trusts available

- 5.There are over 5,400 types of US stocks.

●Recommended for opening a NISA account is “SBI Securities”

3. Unlike regular stock investments, it is not possible to calculate profits and losses.

NISA accounts are not eligible for profit and loss aggregation and carryover deductions.

- Profit and loss total: You can receive tax benefits by deducting losses from profits.

- Carry-forward deduction: Losses that cannot be deducted in the current year are added up to profits for up to 3 years.

Additionally, other financial products such as Bitcoin (BTC) are also not eligible.

4. Cannot be used as margin or collateral for margin trading

Margin trading involves borrowing investment funds or stocks from a securities company using cash as collateral, but unlike regular physical stocks, NISA accounts cannot be used as margin or collateral for margin trading. This is because the new NISA aims to encourage investment to a wider range of investors, with particular emphasis on providing a safe investment environment suitable for beginners and small and medium-sized investors.

Margin transactions with high-risk, high-return characteristics do not meet the purpose of NISA, so they cannot be traded in a NISA account in the first place, and products in a NISA account cannot be used as collateral for margin transactions.

4. Use the new NISA wisely and invest at a good price

The content of the new NISA is more complete than the current NISA in many aspects. Making the system permanent and making the tax-free operation period unlimited will be a great benefit not only to beginners but also to those who already have investment experience in virtual currencies.

Why not give the new NISA a try while referring to the contents of this article?

The post Explanation of the “5 major benefits” of the new NISA, which triples the annual investment limit appeared first on Our Bitcoin News.

1 year ago

64

1 year ago

64

English (US) ·

English (US) ·