June 30 (Friday) morning market trends (compared to the previous day)

- NY Dow: $34,122 +0.8%

- NASDAQ: $13,591 -0.003%

- Nikkei Stock Average: ¥33,234 +0.1%

- USD/JPY: 144.7 -0.02%

- US dollar index: 103.3 +0.4%

- 10-year US Treasury yield: 3.84 -0.3% per annum

- Gold Futures: $1,916 -0%

- Bitcoin: $30,445 +1%

- Ethereum: $1,852 +1.2%

traditional finance

crypto assets

NY Dow Nasdaq today

Today’s NY Dow rebounded to +269.7 dollars. The Nasdaq was flat.

The US FRB announced the results of its stress test (examination criteria before March) after the close on the previous day. All major U.S. banks passed the test, and the confidence in the banking sector, which had fallen due to the bankruptcies of the U.S. regional banks in March, was recovering.

connection: Bitcoin 30,000 dollar milestone continues, Micro Strategy buys BTC equivalent to 50 billion yen

January-March Quarterly Real Gross Domestic Product

U.S. quarterly real gross domestic product (GDP, confirmed) increased by 2% annually from the previous quarter, a significant upward revision from the revised 1.3% increase and above the median forecast of 1.4%. .

The large upward revision this time is due to personal consumption and exports, and the fact that personal consumption in the retail, real estate, and restaurant industries grew at the highest rate for the first time in about two years suggested the resilience of the economy.

Also, corporate profits fell for the third straight quarter, but the decline was not as drastic as it was at the beginning.

According to Reuters, Scott Hoyt, senior economist at Moody’s Analytics, said: “The economy was expected to struggle in the wake of continued Fed rate hikes, but weak growth is a sign of a recession. It will lower inflation without triggering volatility,” he said.

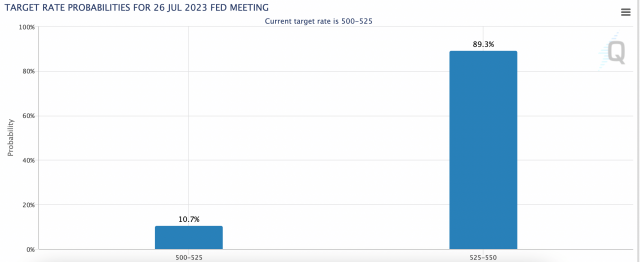

However, the index this time shows the strength of the US economy again, and there seems to be growing speculation that the Fed will need to raise interest rates two more times this year. The day before, Chairman Powell showed a hawkish stance at the ECB forum that he would not rule out the possibility of two additional interest rate hikes.

Source: CME

connection: What is the US monetary policy meeting “FOMC” that attracts the attention of global investors | Easy-to-understand explanation

U.S. initial unemployment claims plummet

Last week, the number of new U.S. unemployment claims fell sharply since October 2021. It seems that last week’s “Juneteenth” holiday had an impact.

Initial jobless claims for the week ending June 24 fell by 26,000 from the previous week to 239,000, well below the forecast of 265,000.

In the week ending June 17, the number of continuing unemployment insurance beneficiaries fell to 1,742,000.

Unemployment claims data will be wildly volatile in the coming weeks, following the Fourth of July holiday and automakers shutting down for annual equipment upgrades.

economic indicators

- Friday, June 30, 21:30: May US Personal Consumption Expenditure (PCE deflator)

- July 3 (Monday) 8:50: April-June Quarterly Bank of Japan Tankan Forecasts for Large Enterprises in Manufacturing

- Monday, July 3, 23:00: June US ISM Manufacturing Index

- Thursday, July 6, 3:00: Federal Open Market Committee (FOMC) Minutes

- Thursday, July 6, 21:15: June US ADP employment data (m/m)

- Friday, July 7, 21:30: June U.S. Unemployment Rate

US stocks

The Nasdaq was flat today, dragged down by declines in tech stocks such as Microsoft and Nvidia. Individual stocks compared to the previous day: Nvidia -0.7%, c3.ai +1.2%, AMD +0.9%, Tesla +0.4%, Microsoft -0.2%, Alphabet -0.9%, Amazon -0.8%, Apple +0.1%, Meta- 1.3%.

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

Cryptocurrency-related stocks continue to rise

- Coinbase|$72.4 (+2.3%/+17.8%)

- MicroStrategy | $340.2 (+4.5%/+3.3%)

- Marathon Digital | $13.8 (+5%/+8.7%)

connection: Fidelity submits Bitcoin ETF application US CME plans to offer ETH/BTC futures | Summary of important bulletins on the morning of the 30th

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post Fed’s stress test passed, major bank stocks rise, U.S. new unemployment insurance applications drop sharply | 30th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

102

2 years ago

102

English (US) ·

English (US) ·