January 13 (Friday) morning market trends (compared to the previous day)

- NY Dow: $34,184 +0.6%

- NASDAQ: $10,987 +0.5%

- Nikkei Stock Average: ¥26,449 +0.01%

- USD/JPY: 129.2 -2.4%

- USD Index: 102.2 -0.9%

- 10 year US Treasury yield: 3.4 -3.4% annual yield

- Gold Futures: $1,901 +1.2%

- Bitcoin: $18,932 +8%

- Ethereum: $1,430 +6%

traditional finance

crypto assets

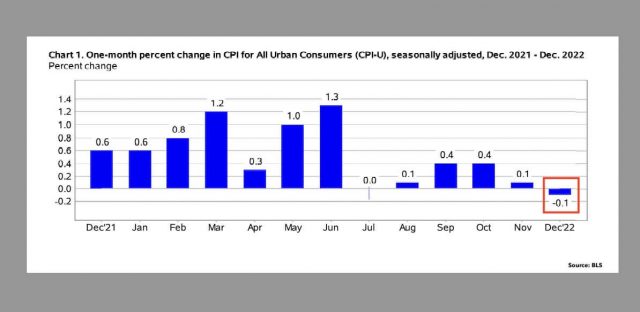

Today’s New York Dow and Nasdaq continue to rise after last night’s announcement of the US CPI (Consumer Price Index). Last December’s CPI, which released weak figures, indicated a slowdown in inflation, and the next FOMC seems to be more certain of raising interest rates by 0.25%. The FOMC rate hike last December was 0.5%.

【preliminary report】

December CPI data release

・CPI (vs. previous month): This time -0.1% Last time +0.1% Forecast 0%

・CPI (year-on-year): This time +6.5% Last time +7.1% Forecast +6.5%

・Core (vs. previous month): This time +0.3% Last time +0.2% Forecast +0.3%

・Core (YoY): This time +5.7% Last time +6.0% Forecast +5.7%

— CoinPost-virtual currency information site-[app delivery](@coin_post) January 12, 2023

Last December’s consumer price index, announced by the US Department of Labor last night, fell unexpectedly by -0.1% from the previous month. It was the first decline (negative) since May 2020. The year-on-year growth rate continued to slow to 6.5% from 7.1% in November. It was the lowest growth rate since October 2021.

Source: BLS

US President Biden held a press conference at the White House after the CPI announcement. He said he was “going in the right direction” given the slowdown in inflation, but he acknowledged the fact that inflation was still high and “there is still work to be done.” said.

Relation: What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market?

A Federal Reserve official also said on Wednesday that inflationary pressures were easing and the pace of rate hikes was likely to slow, but the terminal rate (the final destination of the policy rate) was set at He said he maintained his view on a level above 5% for the time being.

US stocks

Today’s stock market continues to buy back from the beginning of the year in a situation where fears of an economic recession are receding following the CPI results. As for US stocks, IT and high-tech stocks remained firm today. By individual stock, Big Bear ai (AI related) +243%, C3.ai (AI related) +1.2%, Amazon +0.01%, Microsoft +0.9%, Apple -0.1%, Tesla -0.2%, Meta +3% , Coinbase +8.6%, Micro Strategy +8%.

Big Bear ai, a publicly traded US company that develops artificial intelligence (AI) and machine learning, soared after it announced that it had won a $900 million indeterminate quantity contract (IDIQ) from the US Air Force. The company will serve as the primary contractor for the Air Force’s delivery systems and capabilities.

The company’s stock fell by -88% last year.

Source: Tradingview

Relation: Microsoft invests 1.3 trillion yen in OpenAI developed by “ChatGPT”

USD/JPY: 129.2

The dollar/yen fell sharply in response to the CPI results, hitting a new low since early June. Yields on 10-year and 30-year Treasuries fell to their lowest levels in nearly four weeks on speculation that the pace of rate hikes would slow. U.S. Treasuries continued to rise.

Source: Tradingview

Relation: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

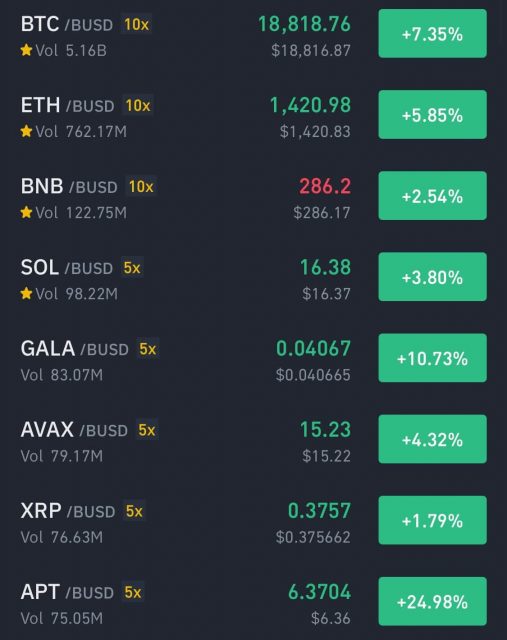

Virtual currency market

The cryptocurrency market rose across the board due to expectations of an inflow of funds into risk assets as inflation slowed. Bitcoin briefly hits $19,000.

Source: Binance

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Marathon Digital Holdings | $7 (+30%/+71%)

- Hive Blockchain Technologies | $3.18 (+37%/+74%)

- Algo Blockchain | $1.42 (+36%/-2%)

The stock prices of virtual currency mining companies soared due to the rise of Bitcoin. As for Hive Blockchain Technologies, it has deployed about a quarter of its new fleet of 5,800 customized mining machines powered by Intel processors as part of its “massive efficiency gains.” was considered material.

Relation: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

GM Radio 2nd Archive

https://t.co/nr8dNhvmzM

— CoinPost Global (@CoinPost_Global) December 22, 2022

Special guests this time are Yat Siu, chairman of Animoka Brands, a major Web3 (decentralized web) company, and Benjamine Charbit of Darewise Entertainment. He talks about the current challenges of Web3 games and NFTs, Darewise’s first title “Life Beyond”, and the outlook for the industry.

Relation: To hold the 2nd “GM Radio”, guests are the chairman of Web3 major Animoka Brands

The post Financial market tankan on the morning of the 13th | CPI declining trend Cryptocurrency mining stocks skyrocketed Dollar yen plunged appeared first on Our Bitcoin News.

2 years ago

189

2 years ago

189

English (US) ·

English (US) ·