1/14 (Sat) morning market trends (compared to the previous day)

- Bitcoin: $19,479 +3%

- Ethereum: $1,429 -0.2%

- AGIX: $0.15 +60%

- FETs: $0.23 +14%

- OCEAN: $0.25 +5%

- NY Dow: $34,295 +0.3%

- Nasdaq: $11,079 +0.7%

- Nikkei Average: ¥26,119 -1.2%

- USD/JPY: 127.8 -1%

- USD Index: 102 -0.06%

- 10-year US Treasury yield: 3.5 +1.5% annual yield

- Gold Futures: $1,922 +1.2%

crypto assets

AI related token

traditional finance

Today’s New York Dow and Nasdaq continue to grow. The market began with selling ahead in response to the earnings of several major U.S. banks announced before the start of trading, but the January University of Michigan Consumer Confidence Index and the U.S. Consumer Inflation Expectation Index, which were announced later, are expected to ease the decline. became.

The January University of Michigan Consumer Confidence Index surpassed last month’s confirmed figures and market expectations. It was the highest level since April 2022. Some believe that an expected peak in inflation and an easing of supply chain disruptions have boosted consumer willingness to buy durable goods, pushing the index higher. (The Preliminary University of Michigan Consumer Confidence Index is an economic indicator that represents consumer sentiment in the United States and is released monthly by the Survey Research Center at the University of Michigan).

- University of Michigan Consumer Confidence Index (preliminary figures): This time 64.6 Forecast 60.5 Last time 59.7

It was also revealed that the expected inflation rate one year ahead (preliminary figure) released by the University of Michigan in the United States declined in January to the level for the first time in almost two years. The preliminary estimate of the expected inflation rate one year ahead was 4.0%, lower than expected from December’s 4.4%. The short-term inflation expectations index fell for the fourth month in a row. Meanwhile, the expected inflation rate five years ahead rose to 3.0% from 2.9% in December. This is in the form of heightened expectations by US consumers that upward pressure on prices will ease significantly over the next year.

Relation: Financial market rebounded after CPI announcement, bitcoin temporarily recovered to the $19,000 level

Relation: What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market?

US stocks (3 consecutive holidays on weekends)

Last night, major U.S. banks including JPMorgan Chase, Citigroup, Bank of America and Wells Fargo reported results. Overall, earnings per share exceeded and fell short of market expectations, and each bank also showed a stance of preparing for a downturn in the US economy. Their stock prices are JP Morgan +2.4%, Bank of America +2.2%, Citigroup +1.5%, and Wells Fargo +3.1%.

Some IT/high-tech stocks continued to rise. By individual stock, Big Bear ai (AI related) -22%, C3.ai (AI related) +5%, Amazon +3%, Microsoft +0.3%, Apple +0.9%, Tesla -1%, Meta +0.3% , Coinbase +5%, MicroStrategy +3%, Marathon Digital +9%. This week marks the beginning of the earnings season for US companies, including banks.

Relation: Morning on the 13th | CPI declining trend Cryptocurrency mining stocks soared Dollar yen sharply depreciated

US dollar/yen fall: 127.8

The dollar/yen continued to drop and fell below 127 at one point. Dollar-buying temporarily dominated following a positive improvement in the U.S. import price index (up 0.4% from the previous month). It is a form that encourages sales. U.S. Treasuries fell.

US Treasury Secretary Janet Yellen’s warning that the US debt limit will be reached on the 19th also contributed to the dollar’s selling. On the other hand, expectations grew that the Bank of Japan would raise interest rates early at its monetary policy meeting (January 17-18), and yen buying accelerated as long-term interest rates rose.

Source: Tradingview

Relation: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

Virtual currency market

Bitcoin (BTC) Rebounds to $19,000 and Continues Towards $20,000. It rose 18% from the previous week.

Source: Binance

In addition, the AI-related token AGIX soared +60% from the previous day, +242.5% from the previous week. AGIX is the native token of the AI electronic market called SingularityNET. On the morning of the 14th, it was announced that the development of the AI Domain Specific Language Project (AI-DSL) related to the electronic market has completed the second phase and is preparing for the launch of the third phase.

1) The AI-DSL project has completed Phase 2 of development, and is preparing to launch Phase 3!

Read about the milestones and achievements achieved by the team so far: https://t.co/0ld1WGERiN#AI #Decentralized AI #AGI #Blockchain #CardanoCommunity #catalyst pic.twitter.com/cgxF4mYkGq

— SingularityNET (@Singularity_NET) January 13, 2023

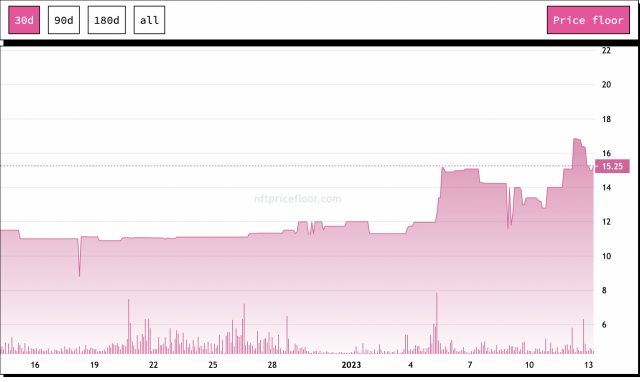

NFT trends

The NFT market is also showing vitality, coupled with the continuing price increase of Ethereum Solana and the favorable market sentiment.

The floor price (lowest price) and trading volume of Ethereum NFT representative collections BAYC and Azuki will rise in 2023.

Regarding BAYC, the release plan for the new game “Dookey Dash” was announced on the 12th. Obtaining a participation pass to the game increased the demand for NFTs, and the transaction volume of BAYC and MAYC also increased significantly.

Source: BAYC nftpricefloor.com

Relation: BAYC, transactions surge with new game Dookey Dash information release

In addition, anime art NFT “Azuki” announced on the 13th that it has launched a hub city “Hilumia” for community members and holders. Azuki’s weekly trading volume was 11,323 ETH, up 3.68% from the previous week.

Relation: Azuki’s 1st anniversary, release of online city “Hilumia”

Source: Azuki nftpricefloor.com

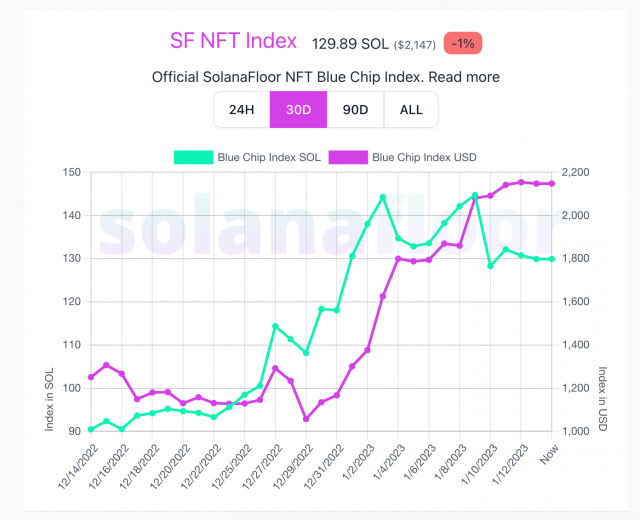

At Solana NFT, top collections such as DeGods, ABC, y00ts, and TaiyoPilots are also doing well.

In addition, the NFT project “BONKz” related to the meme token Bonk Coin (BONK), which was airdropped for the purpose of breaking Alameda’s dependence and activating the Solana ecosystem, was temporarily more than 10 times higher than its release price. rice field.

Source: solarafloor.com

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Marathon Digital Holdings|$7.6 (+9%/+87%)

- Hive Blockchain Technologies | $3.1 (-1.5%/+72%)

- Algo Blockchain | $1.4 (+3.5%/+3.5%)

- Iris Energy | $1.8 (+9.5%/+43%)

- Coinbase Global | $49.9 (+5.1%/+50%)

Relation: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

GM Radio 2nd Archive

https://t.co/nr8dNhvmzM

— CoinPost Global (@CoinPost_Global) December 22, 2022

Special guests this time are Yat Siu, chairman of Animoka Brands, a major Web3 (decentralized web) company, and Benjamine Charbit of Darewise Entertainment. He talks about the current challenges of Web3 games and NFTs, Darewise’s first title “Life Beyond”, and the outlook for the industry.

Relation: To hold the 2nd “GM Radio”, guests are the chairman of Web3 major Animoka Brands

The post Financial market tankan on the morning of the 14th | Dollar/yen continues to fall AI-related tokens such as “AGIX” soar appeared first on Our Bitcoin News.

2 years ago

205

2 years ago

205

English (US) ·

English (US) ·