January 19 (Thursday) morning market trends (compared to the previous day)

- NY Dow: $33,370 -1.6%

- NASDAQ: $10,979 -1%

- Nikkei Stock Average: ¥26,791 +2.5%

- USD/JPY: 128.8 +0.46%

- USD Index: 102.4 +0.05%

- 10 year US Treasury yield: 3.36 -4.7% annual yield

- Gold Futures: $1,905 -0.2%

- Bitcoin: $20,772 -2.5%

- Ethereum: $1,527 -3.4%

traditional finance

crypto assets

Today’s New York Dow, Nasdaq, and S&P500 fell. While weak economic data point to a slowdown in inflation, fears of a recession have also increased.

The US Producer Price Index (PPI), a leading price indicator, was released last night by the U.S. Department of Labor last night, which fell significantly below expectations from the previous month to the lowest level since the start of the coronavirus pandemic. Core PPI was also below expectations m/m. On the same day, the U.S. Department of Commerce announced that U.S. retail sales (seasonally adjusted) for December were down 1.1% from the previous month. It fell more than the market forecast (-0.9%), and it was the first decrease in a year. The latest data seems to justify the easing of interest rate hikes by the US Fed as inflationary pressure has continued to ease over the past few months.

However, the faster-than-expected rate of decline is also an indication that the economy is decelerating, and anxiety about the future of the economy has increased.

- US PPI: Current -0.5% Forecast -0.2% Previous 0.3% (MoM)

- US PPI Core: 0.1% this time, 0.2% forecast, 0.4% last month (MoM)

Meanwhile, former U.S. Treasury Secretary Summers told the World Economic Forum in Davos, Switzerland on the 19th that economic data were better than expected three months ago, and that the soft landing could ease interest rate hikes and avoid a recession. He said that the observation of (soft landing) has increased.

US stocks

Evidence of an economic slowdown appears to be starting to appear in corporate earnings. Microsoft will announce a job cut plan before the start of the transaction, cutting 10,000 jobs, or about 5% of its workforce. Amazon and Goldman Sachs also recently announced plans to cut jobs on a large scale.

Energy, banking and IT/tech stocks also sold. By individual stock, Big Bear ai (AI related) +3.2%, C3.ai (AI related) -1.1%, Amazon -0.2%, Microsoft -1.7%, Apple -0.2%, Tesla -2.6%, Meta -1.5% , Coinbase – 7.2%, Microstrategy – 6.2%.

Relation: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

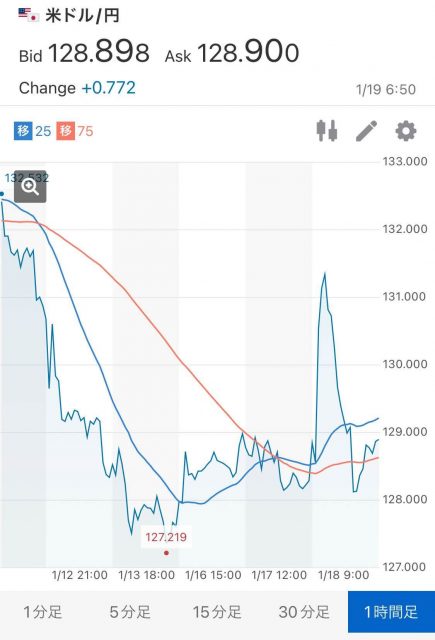

USD/JPY: 128.9 +0.5%

Yesterday, the dollar/yen exchange rate soared temporarily to the 131 yen level against the dollar as the Bank of Japan maintained its policy status quo. However, dollar selling accelerated in response to data such as weak PPI. The 10-year US Treasury yield fell sharply to -4.7% as the dollar sold.

Source: Yahoo! Finance

The domestic financial market on the 18th moved in the direction of yen depreciation, stock prices, and bond prices. At yesterday’s monetary policy meeting, the Bank of Japan decided to maintain the status quo of large-scale monetary easing measures centered on the Yield Curve Control (YCC) policy, which manipulates short- and long-term interest rates. Maintaining the policy of applying minus 0.1% to short-term interest rates and keeping long-term interest rates (10-year government bond rates) at around 0%, the upper limit of long-term interest rates is set at around 0.5%, which was revised in December last year. didn’t change either.

Regarding the outlook for the consumer price index, the year-on-year rate of increase in the core CPI, excluding fresh food, which has a high rate of fluctuation, has been revised upwards from 2.9% to 3.0% in FY2010. 1.8% for FY2012. In a document related to the decision on the 18th meeting, the Bank of Japan said, “Aiming to achieve the price stability target of 2% (omitted). We will continue the policy of expansion until we surpass it.” It seems that the government decided that continued monetary easing was necessary to support the domestic economy.

Relation: Bank of Japan monetary policy meeting on the 18th, “yen depreciation, dollar strength” sharp rise due to easing

Source: Tradingview

Relation: Bank of Japan de facto interest rate hike December 20

Relation: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase Global | $50.2 (-7.2%/+0.46%)

- Marathon Digital Holdings | $6.9 (-17.4%/-10%)

- Hive Blockchain Technologies | $2.8 (-14.7%/9.6%)

Virtual currency mining stocks have fallen sharply due to the decline of the NY Dow and Bitcoin.

Coinbase, a major exchange, announced yesterday that it will stop trading with existing Japanese customers and completely review its Japanese business, which also contributed to the acceleration of sales. In addition, it is said that it is not a withdrawal from Japan.

Relation: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

GM Radio 2nd Archive

https://t.co/nr8dNhvmzM

— CoinPost Global (@CoinPost_Global) December 22, 2022

Special guests this time are Yat Siu, chairman of Animoka Brands, a major Web3 (decentralized web) company, and Benjamine Charbit of Darewise Entertainment. He talks about the current challenges of Web3 games and NFTs, Darewise’s first title “Life Beyond”, and the outlook for the industry.

Relation: To hold the 2nd “GM Radio”, guests are the chairman of Web3 major Animoka Brands

The post Financial market tankan on the morning of the 19th | NY Dow and cryptocurrency-related stocks fall overall, growing concerns about economic slowdown appeared first on Our Bitcoin News.

2 years ago

166

2 years ago

166

English (US) ·

English (US) ·