1/7 (Sat) morning market trends (compared to the previous day)

- NY Dow: $33,659 +2.2%

- Nasdaq: $10,591 +2.7%

- Nikkei Stock Average: ¥25,973 +0.6%

- US dollar index: 103.8 -1.1%

- 10-year US Treasury yield: 3.56% -4.2% per annum

- Gold Futures: $1,871 +1.6%

- Bitcoin: $16,906 +0.3%

- Ethereum: $1,266 +1.1%

traditional finance

crypto assets

Today’s New York Dow rebounded significantly. Recorded gains of over $700. It looks like the two US economic indicators released last night are taken into account.

The December 2022 US employment statistics and the ISM non-manufacturing business index were announced on the evening of the 6th. Non-farm payrolls increased by 223,000 jobs, and the unemployment rate (market expectations of 3.7%) improved to 3.5% from 3.6% in the previous month, but wage growth was modest. The labor market showed strong conditions. Also, the ISM non-manufacturing business index was 49.6, well below the previous month’s 56.5 and the expected value. The increase in corporate expenditures is slowing down, suggesting expectations that the inflation rate will ease. As U.S. Treasury yields plummeted in response, speculation about the Fed’s eventual U.S. rate hike appears to have receded.

On the other hand, Atlanta Federal Reserve Bank President Bostic said in an interview with CNBC about the aforementioned U.S. employment data, “My outlook remains unchanged. I expect the U.S. economy to continue to decline from last summer’s boom. Inflation is still too high and we must resolve these imbalances.” In addition, he reiterated the view that it is necessary to raise interest rates further to curb inflation and maintain interest rates at peak levels in 2024.

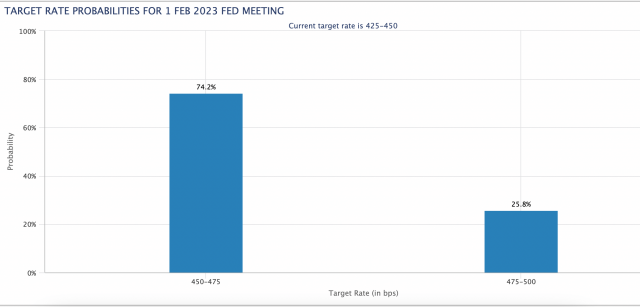

The next FOMC meeting will be held from January 31st to February 1st. About 74% expect a 0.25% rate hike, according to CME FedWatch. Given that the rate was raised to 0.5% in December last time, there is a strong outlook for continued easing of rate hikes. In this regard, Governor Bostic commented in the same interview that an improvement in the labor market could lead to a 0.25% rate hike.

Source: CME

US stocks rose across the board as yields on US Treasury bonds fell. By individual stock, Costco +7.4%, World Wrestling +18%, Amazon +3.7%, Microsoft +1.3%, Apple +4%, Tesla +2.8%, Meta +2.5%, Coinbase -0.8%, Silvergate Capital -2.6%. The earnings announcement season will begin next week.

Amazon plans to lay off more than 18,000 jobs on May 5. The 18,000 job cuts represent 6% of Amazon’s roughly 300,000 employees worldwide. About 1.2% of the 1.5 million people, including warehouse staff. Amazon’s massive job cuts have been seen by some as a sign of the beginning of a recession.

association: US Amazon announces a large-scale restructuring policy of 18,000 people

The company was selected to participate in the European Central Bank’s digital euro test last September, along with four other companies, including P2P online payment provider CaixaBank.

association: Five companies including Amazon to participate in the digital euro experiment

association: Commentary on the relationship between government bonds and interest rates, and the impact on the cryptocurrency market

Virtual currency market

The virtual currency market rose following the rebound of the NY Dow. Stocks such as Bitcoin (BTC) were slightly higher.

In addition, the virtual currency exchange Mt. Gox seems to have been considered as a material to ease the selling pressure of BTC yesterday by further postponing the payment due date.

Key economic indicators for January

- January 12: US Consumer Price Index (CPI)

- January 13: January University of Michigan Consumer Confidence Index, preliminary figures

- January 18: US December Retail Sales and Wholesale Price Index (PPI)/Core

- January 20: Japan December National Consumer Price Index (CPI)

association: What is the “dollar index” that also pays attention to the virtual currency market | Commentary for beginners

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase | $33 (-0.8%/-6%)

- MicroStrategy | $160 (+2.4%/+13.%)

- Silvergate Capital | $12.2 (-2.6%/-30%)

Silvergate Capital, a U.S. company that provides virtual currency-related services, announced provisional financial indicators for the 4Q (October to December) of 2022 on the 5th. It has become clear that the business situation is tough, with the amount of digital asset customer deposits decreasing from about 1.5 trillion yen ($11.9 billion) at the end of September 2010 to about 506 billion yen ($3.8 billion) at the end of December 2010. rice field. Following the announcement, the company’s stock fell 49% at one point, the largest drop since its listing. JPMorgan Chase and BofA Securities downgraded the company’s stock.

Source: Tradingview

association: US Silvergate, cryptocurrency-related deposits sharply decreased in 4Q 2022, to reduce employees by 40%

association: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

GM Radio 2nd Archive

https://t.co/nr8dNhvmzM

— CoinPost Global (@CoinPost_Global) December 22, 2022

Special guests this time are Yat Siu, chairman of Animoka Brands, a leading Web3 (decentralized web) company, and Benjamine Charbit of Darewise Entertainment. He talks about the current challenges of Web3 games and NFTs, Darewise’s first title “Life Beyond”, and the outlook for the industry.

association: To hold the 2nd “GM Radio”, guests are the chairman of Web3 major Animoka Brands

The post Financial market tankan on the morning of the 7th | NY Dow rebounds sharply, US 10-year bond yield drops sharply appeared first on Our Bitcoin News.

2 years ago

216

2 years ago

216

English (US) ·

English (US) ·