Countermeasures against fraudulent virtual currency remittances

Japan's Financial Services Agency, jointly with the National Police Agency, has requested that crypto-asset (virtual currency) exchanges strengthen measures against fraudulent remittances.

The request was made to nine organizations, including the Japanese Bankers Association, the National Regional Banks Association, and Japan Post Bank. We are calling for stronger protection of users, as there are many cases in which victims of special fraud such as fraudulent remittances through internet banking, refund fraud, and fictitious charge fraud are transferred to virtual currency exchanges. ing.

The Financial Services Agency and others made the request on the 6th. Subsequently, on the 7th, a Japanese version of the notice stating the request was released, and on the 14th, an English version was also released. It also includes examples of countermeasures so that countermeasures can be strengthened depending on the risk.

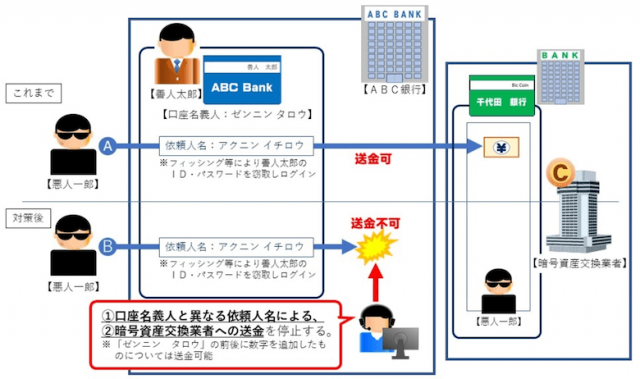

The first example of countermeasures is “suspension of remittance due to change of transfer name, etc.” We have described a case in which transfers or remittances made to a financial institution account of a virtual currency exchange using a client name different from the account holder name of the remittance source account will be refused. In this case, we request that users be informed in advance on their website, etc.

The second is “strengthening monitoring of illegal remittances.” He explained that monitoring transactions with virtual currency exchanges, which are the point of exchange for legal currency, is an effective method to ensure the effectiveness of risk reduction measures.

It also calls for strengthening monitoring of fraudulent remittances, including verifying and analyzing the effectiveness of rules and scenarios for pattern analysis and improving extraction criteria.

Impact on users

The first option that is likely to have a direct impact on users is “suspension of remittances due to change of transfer name'', which is attracting attention from overseas media as it reports that P2P remittances may no longer be possible. The following image is attached to the National Police Agency's guidance.

Source: National Police Agency

In the image above, it is pointed out that up until now, it was possible to send money to a virtual currency exchange even if the name of the remittance requester and the account name at the financial institution were different. On the other hand, it is illustrated that if financial institutions implement the measures mentioned above, they will be able to refuse such remittances.

This measure appears to be a measure to prevent identity theft and money laundering.

What is money laundering?

The act of concealing the source of proceeds obtained from a crime.

Virtual currency glossary

Virtual currency glossary

Japan's Web3 Policy Special Feature

The post Financial Services Agency requests financial institutions to strengthen measures against fraudulent remittances to virtual currency exchanges appeared first on Our Bitcoin News.

1 year ago

104

1 year ago

104

![Bittensor [TAO] drops 15% amid $48 mln derivatives outflows: Buyers step in](https://ambcrypto.com/wp-content/uploads/2025/10/Abdul-2-6.webp)

English (US) ·

English (US) ·