March 29 (Wednesday) morning market trends (compared to the previous day)

- NY Dow: $32,394 -0.1%

- Nasdaq: $11,716 -0.4%

- Nikkei Stock Average: ¥27,518 +0.1%

- USD/JPY: 130.9 -0.4%

- USD Index: 102.4 -0.4%

- 10-year US Treasury yield: 3.57 +1.2%

- Gold Futures: $1,992 +1%

- Bitcoin: $27,296 +0.5%

- Ethereum: $1,774 +3.5%

traditional finance

crypto assets

Today’s NY Dow fell slightly and closed at -37.83 dollars. The Nasdaq continued to fall as IT and tech stocks sold. Today’s stock market has little sense of direction ahead of this week’s release of US GDP and consumer spending data.

The hawkish St. Louis Fed President Bullard said in a paper published on the Fed’s official website on the 28th that the banking crisis in recent weeks has increased stress in financial markets, but the policy rate will not be cut. The FDIC and other regulators’ policies could help contain this stress, he said. On inflation, he said, “My personal view is that appropriate monetary policy can continue to push down inflationary pressures.”

In a lecture at a university two days ago, FRB Governor Jefferson said that the inflation rate had started to slow down, saying, “The goal of the Federal Open Market Committee (FOMC) is to push it down to 2% as soon as possible. “We are still learning about the full effects of monetary tightening so far.”

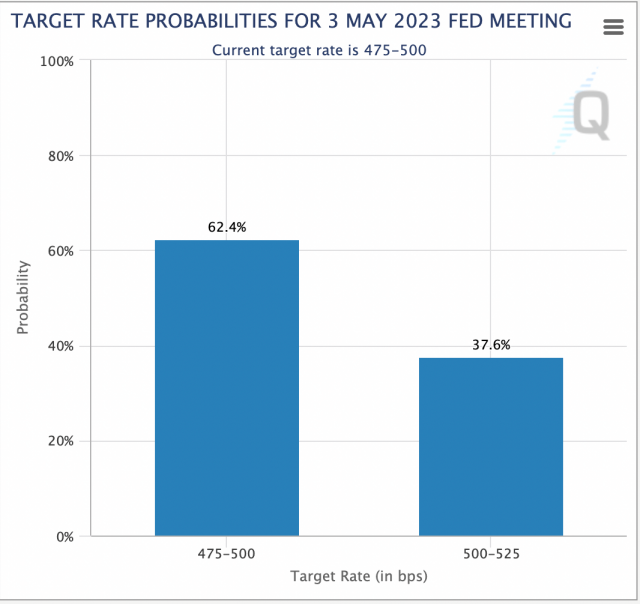

At last week’s FOMC meeting, a second rate hike of 0.25% was implemented, raising the target to 4.75-5.00%. Although concerns about financial instability have eased, speculation about an early halt to interest rate hikes appears to have not receded.

Source: CME

connection: FOMC additional interest rate hike, expectations for rate cut within the year recede

Economic indicators (Japan time), remarks by dignitaries

- March 30, 21:30 (Thursday): U.S. October-December Quarterly Real Gross Domestic Product (GDP, Final Value) (Quarterly Change Annual Rate)

- March 31, 21:30 (Friday): U.S. February Personal Consumption Expenditure (PCE Core Deflator) (MoM/YoY)

- March 31, 23:00 (Friday): March University of Michigan Consumer Confidence Index, final figures

- April 3, 23:00 (Monday): March ISM Manufacturing Index

connection: CFTC’s Binance lawsuit dominates cryptocurrency selling, XRP rises in retrograde over speculation in Ripple trial

US stocks

IT/tech stocks continue to fall as yields on US Treasury bonds continue to rise. NVIDIA -0.4%, c3.ai -4.1%, Big Bear.ai -4%, Tesla -1.3%, Microsoft -0.4%, Alphabet -1.4%, Amazon -0.8%, Apple -0.4% , Meta -1%, Alibaba -1.1%, Coinbase +0.8%, Micro Strategy +3.89%.

microsoft

Microsoft announced Tuesday the launch of its cybersecurity analysis tool, Security Copilot. Security Copilot uses OpenAI’s large-scale language model (LLM) “GPT-4”, which allows you to request suspicious files to be checked and conduct interactive natural language exchanges like ChatGPT.

Microsoft is a major shareholder of OpenAI.

Alibaba

Alibaba shares soared as high as 13% at one point. As for the company, yesterday it announced plans to split its $220 billion business into six major divisions, including media, e-commerce and cloud. Each division will transition to a holding company structure and consider raising capital or an initial public offering (IPO) at an appropriate time.

Bloomberg analysts said Alibaba’s move “is in line with China’s policy of undermining the monopoly nature of the tech giants.”

Alibaba Cloud, a subsidiary of the Alibaba Group, announced last week that it plans to launch a blockchain lab in Shibuya, Tokyo, in April to support Japanese game developers in the Web3 era.

connection: Alibaba Cloud to establish “Blockchain Lab” for game developers in Shibuya

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

The post |Financial Tankan on the 29th appeared first on Our Bitcoin News.

2 years ago

131

2 years ago

131

English (US) ·

English (US) ·