The “crypto asset winter” has passed, and it was full of heat as if a warm spring day, no, a hot midsummer had arrived. On February 20, Financier, which develops a token-issuing crowdfunding service, held a business strategy presentation. Coincheck, a major crypto asset (virtual currency) trading service, has announced an IEO (Initial Exchange Offering).

Financier’s crypto asset “Financier Token (FNCT)” will be sold on Coincheck and then listed on the company’s exchange. The target amount of funds raised by the IEO is 1.06 billion yen. After the purchase application started on February 21, the fund raising target amount was exceeded in just one hour. Sales by IEO will be conducted in a lottery format, so applications will be accepted on March 7th. After that, a lottery will be held, and the tokens will be delivered and notified of the lottery results on the 8th and 9th of the next day. From 12:00 on March 16th, coin check will be available.

IEOs: Companies and projects list their own crypto assets (virtual currencies) on exchanges to raise funds, in contrast to IPOs (initial public offerings) in which unlisted companies list their shares on the stock exchange and raise funds. to do. By conducting listing examinations by exchanges, the reliability of companies and projects is ensured compared to ICOs (initial coin offerings).

Based on the funds raised, we will expand the core business “FiNANCiE” business, NFT planning and support business, and IEO support business. We have also opened a new official discord and official Twitter to support the development of these businesses and increase awareness.

Discord: https://discord.gg/fnct-official

twitter:https://twitter.com/Fnct_Official

Twitter (English):https://twitter.com/Fnct_Officialen

Video message from Keisuke Honda and Yuto Nagatomo

At the business strategy presentation, Financier Representative Director and CEO Hironao Kunimitsu first introduced the company’s growth history with the vision of “realizing a creator economy that supports the challenges of 1 billion people”.

Financier CEO Hirohisa Kunimitsu

Financier CEO Hirohisa Kunimitsu“We launched the service in March 2019. At that time, there were no terms such as Web3 or DAO. It is deeply moving that four years have passed since then, and Web3 has become a national strategy.”21 IEO will start on the same day, and application for purchase of Financier Token will start on Coincheck. Furthermore, in the 3rd or 4th quarter of this year, he is thinking about expanding into the United States, and said, “This year’s theme is one word, to the world,” and expressed his enthusiasm for IEO and future development.

In the middle of Kunimitsu’s talk, advisors Keisuke Honda and Yuto Nagatomo appeared as video messages. The venue was instantly heated by the messages of the two, who each attracted a lot of attention at the World Cup.

Keisuke Honda

Keisuke HondaMr. Honda said, “I’m looking forward to FiNANCiE becoming a platform that supports more people’s self-actualization!” I gave two points of FiNANCiE that I can receive it. Mr. Honda is also using FiNANCiE in his team in Uganda, which he owns.

Yuto Nagatomo

Yuto NagatomoMr. Nagatomo did not say the words, but he sent a message saying, “From now on, individuals can grow with the power and support of various people.” Start.

Developing three businesses

Financier will develop three businesses based on the funds raised through the IEO.

The first is FiNANCiE, a token-issuing crowdfunding platform that is also the company’s core business.

For example, sports club teams can raise funds by issuing community tokens (CT) that can be used within FiNANCiE and selling them to fans and supporters.

On the other hand, fans who own CT will be able to obtain benefits provided by the club and participate in events limited to holders, creating a community centered on CT. Currently, it is used by more than 200 groups and individuals, mainly for more than 80 sports groups and athletes.

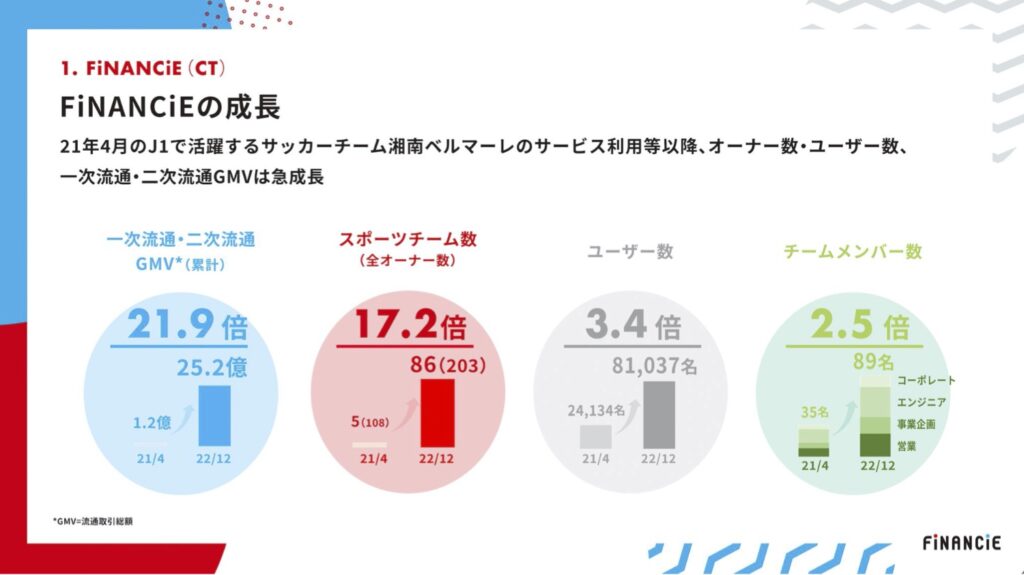

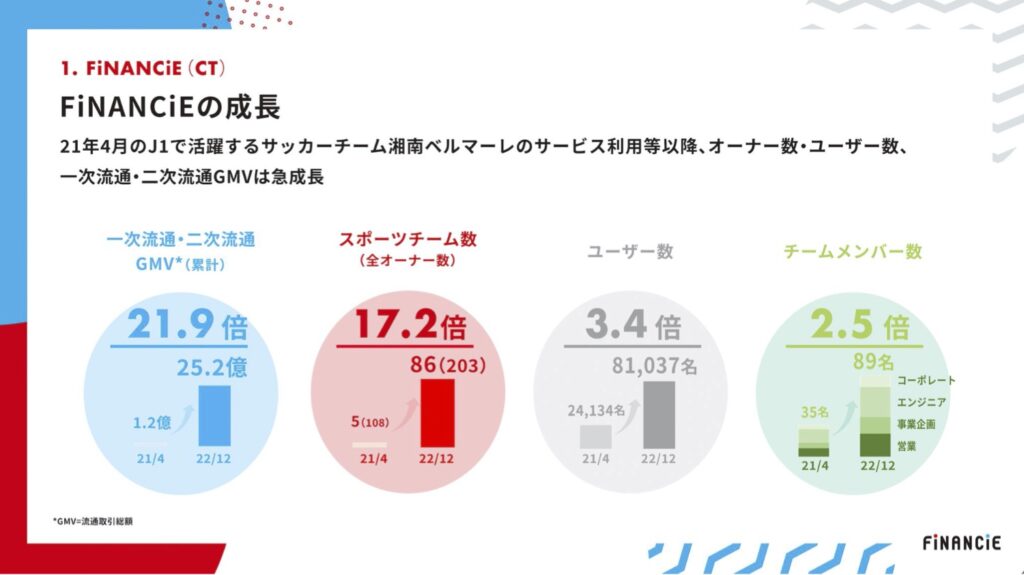

In particular, the use of FiNANCiE has expanded since April 2021 when Shonan Bellmare of the soccer J-League issued club tokens using FiNANCiE. Recently, fields such as entertainment and regional revitalization are also expanding.

(From materials)

(From materials)Key players from the sports and entertainment world appear

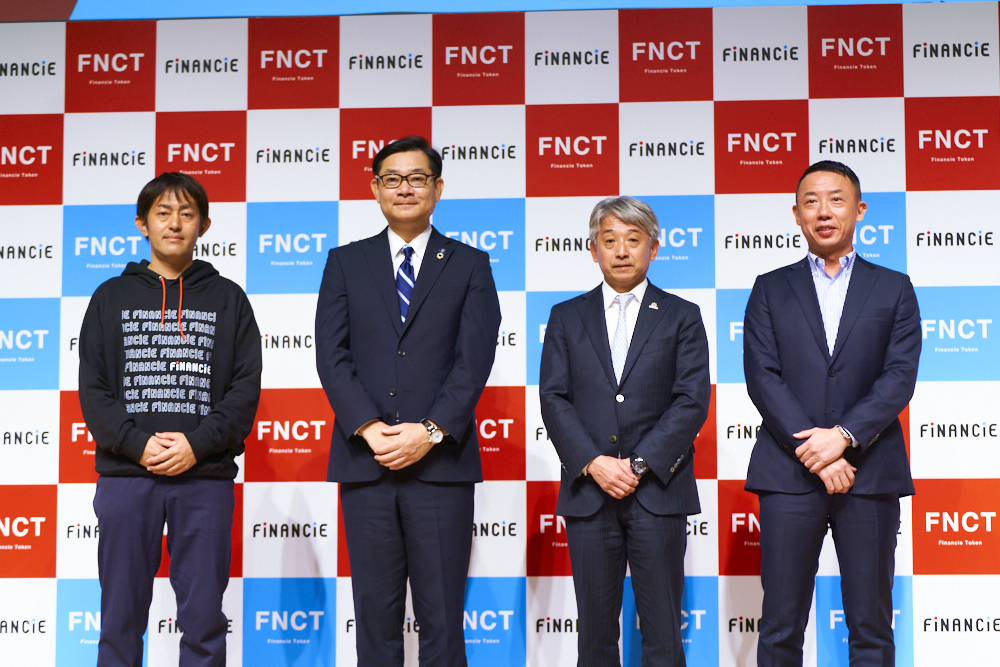

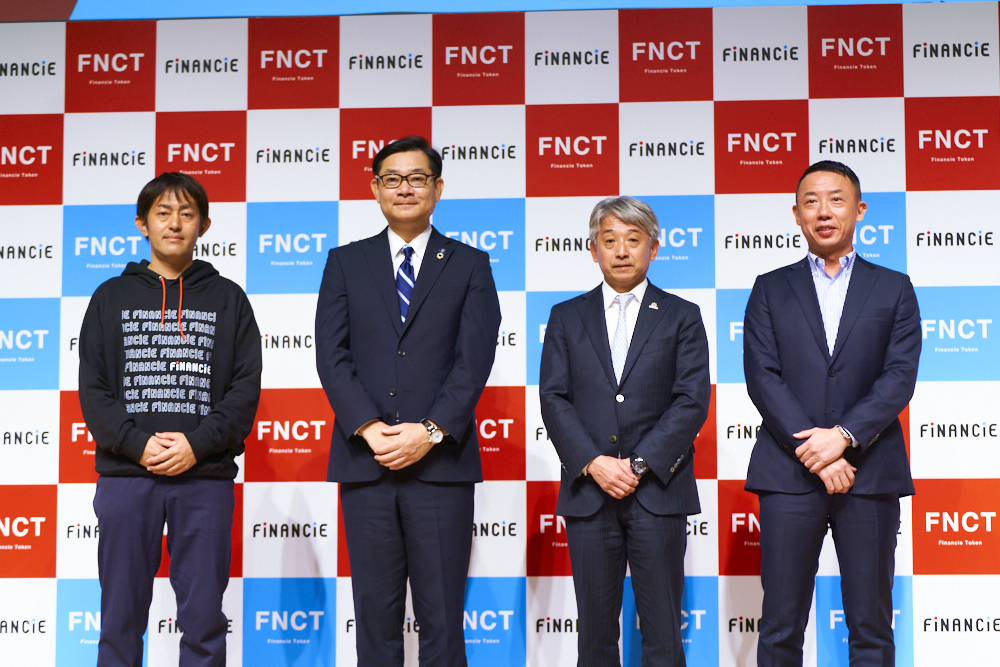

At the business strategy briefing, a talk session was also held by representatives of projects that are actually using FiNANCiE.

From the sports world, Mr. Takashi Kawamori, CEO of Avispa Fukuoka of the J League, Mr. Ukyo Katayama, former F1 racer and chairman of the Japan Cycle League, and Mr. Hayakawa, President of Ryukyu Astida Sports Club, which runs the professional table tennis team Ryukyu Astida. Mr. Shusaku was on stage. Ryuichi Tanaka, COO and CMO of Financier, acted as moderator.

From the left, Mr. Tanaka, Mr. Kawamori, Mr. Katayama, Mr. Hayakawa

From the left, Mr. Tanaka, Mr. Kawamori, Mr. Katayama, Mr. HayakawaAvispa Fukuoka held a “token holder limited event” in which Ms. Rumiko Koyanagi, who is known as a soccer fan and is from Fukuoka, participated by voting on the title of the special match and the design of the commemorative T-shirt. Mr. Kawamori said, “I want people with ideas to become holders, make decisions together, and bring about innovation.” .

Mr. Katayama said, “Bicycle road racing is a competition that does not use a stadium, and uses the city as a stadium.” He said it was the perfect way to deliver a “special experience.” He said that he would like to develop a soft side that can realize regional cooperation, such as watching the race runners running side by side with a double-decker bus of a local bus company.

Ryukyu Astida, to which Tomokazu Harimoto, the ace of the Japanese table tennis world, belongs, is the first professional table tennis player in the world to receive a club token when Harimoto joins the team. “Traditionally, fan clubs and sponsorship contracts were short-term and consumption-oriented, but I’ve been thinking about changing them to long-term, asset-based ones,” he said, explaining the reason for using FiNANCiE. At a talk event with outside director Ai Fukuhara, he said, “There were holders who cried tears of joy.”

From the comments of the three speakers, in the big trend of Web3, we explored new forms of sports support, and also worked on regional revitalization and regional revitalization, and the possibilities of FiNANCiE as a solution. I got a glimpse of it.

Filmmaking with “Accomplices”

And the use of FiNANCiE is not limited to the sports field.

In the entertainment field, the project “SUPER SAPIENSS”, which brings together three film directors representing Japan, Yukihiko Tsutsumi, Katsuyuki Motohiro, Yuichi Sato, and film producer Takeshi Moritani, raises funds by issuing tokens. Based on this, we are working on original creation, video production, comicalization, goods production, etc.

Mr. Tsutsumi, Mr. Motohiro, and Mr. Moritani from SUPER SAPIENSS took the stage at the business strategy briefing. Together with Mr. Tomoya Yamada, Financier executive officer and entertainment business manager, he talked about FiNANCiE utilization cases in the entertainment industry and future developments.

From the left, Mr. Yamada, Mr. Motohiro, Mr. Tsutsumi, Mr. Moritani,

From the left, Mr. Yamada, Mr. Motohiro, Mr. Tsutsumi, Mr. Moritani,SUPER SAPIENSS is a token holder of the project and calls its supporters “accomplices”. This name was also decided by vote from holder’s ideas. In addition, the cast for the actual work is selected from Holder through auditions, and Holder also participates as a staff member.

Mr. Tsutsumi said, “We are gathering friends to create challenging works,” and the approximately 100 million yen we have collected through FiNANCiE so far is “funds for the future, and more efforts are needed.” and showed willingness.

Mr. Motohiro said, “Currently, live-action movies are weak in Japanese movies, and anime movies are strong. I thought I had to change something,” revealing that the project was started with a sense of urgency in creating works. In fact, we are also making efforts such as making screenplay meetings open to “accomplices” and having professional screenwriters and fans cooperate to create screenplays.

Mr. Moritani, a film producer, points out that current film production is also a method of hedging risks, which is one of the reasons for creating a sense of blockage. He said, “I would like to promote co-creation and community-based movie production, and connect Web3 with entertainment.”

Furthermore, in addition to the sports and entertainment worlds, FiNANCiE is looking at regional revitalization as a major theme, and will promote “Web3 x sports, entertainment, and regional revitalization.”

NFT planning and support business, IEO support business

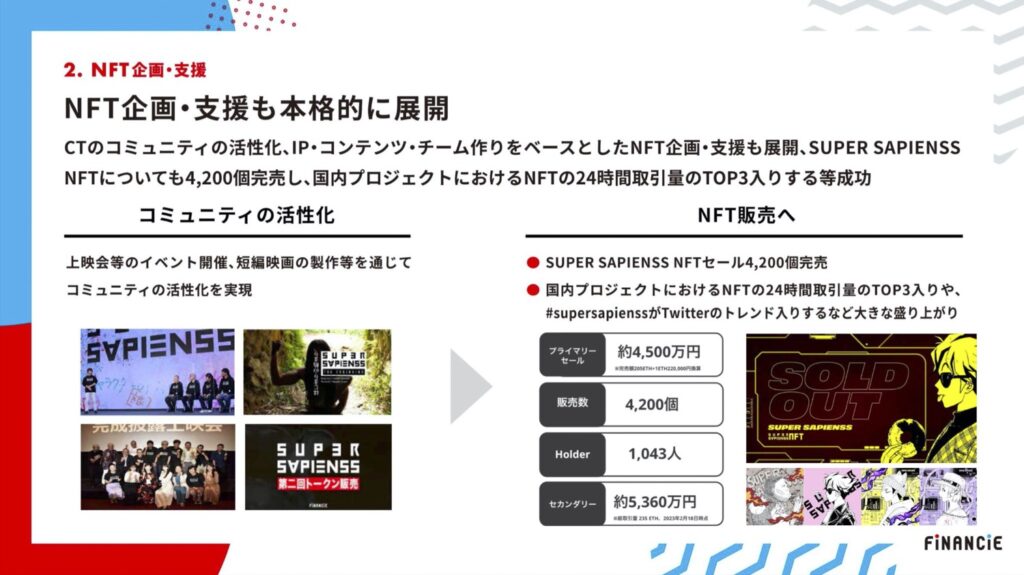

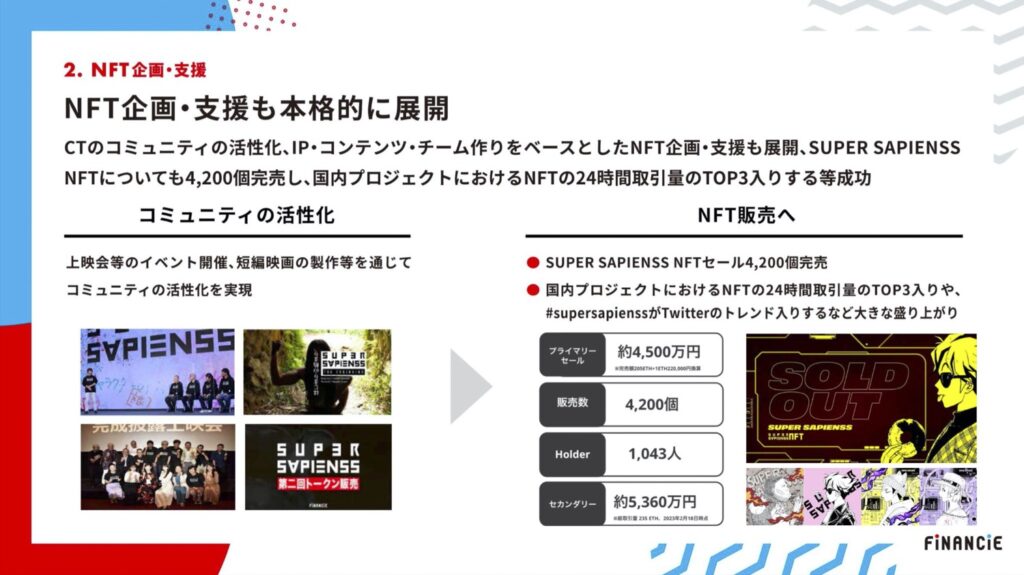

The second of the three businesses that Financier will develop is the activation of the CT community, NFT planning and support business based on IP, content, and team building.

Already at the aforementioned “SUPER SAPIENSS”, in addition to holding events such as screenings, we have achieved results such as selling out 4200 NFTs.

(From materials)

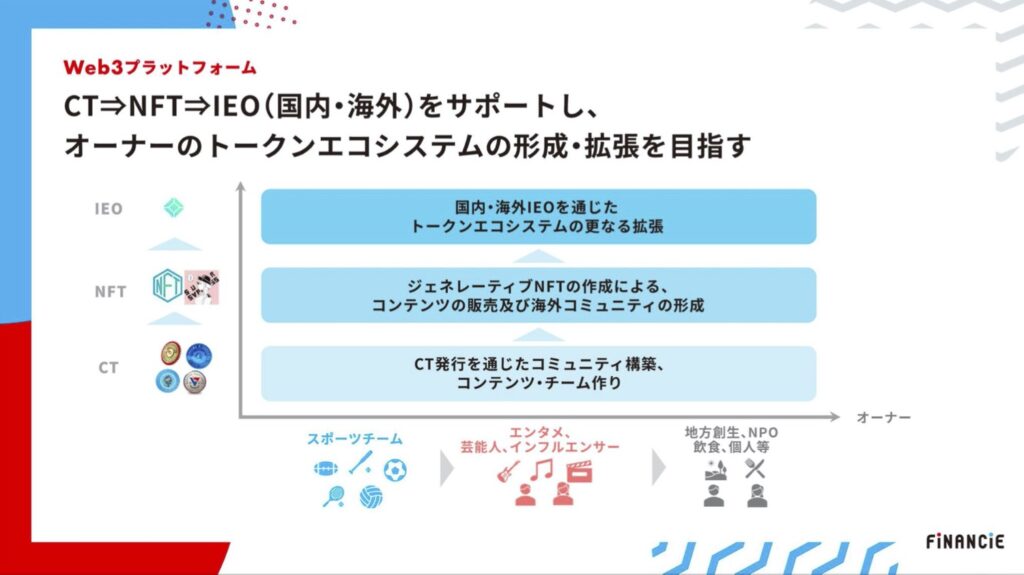

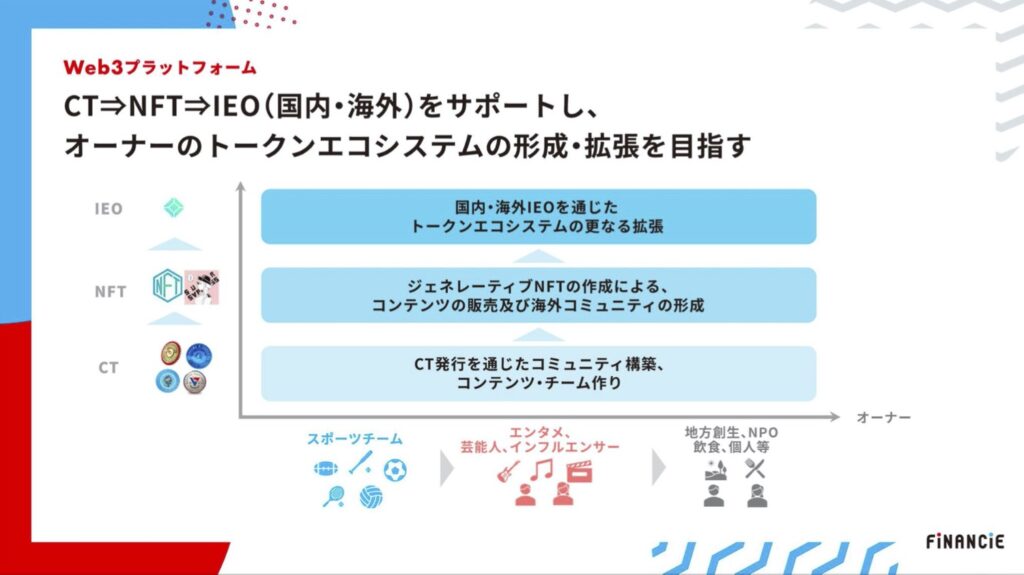

(From materials)The third is the IEO support business. This time, we will utilize the know-how we have accumulated while proceeding with the coin check and IEO process, and start an IEO support project for partner companies promoting Web3 business in Japan, or sports clubs and entertainment projects using FiNANCiE. To go.

(From materials)

(From materials)In other words, by organically developing community tokens (CT) → NFT → IEO, we can form and expand the token economy centered on the three fields of sports, entertainment, and regional revitalization. Goal.

What is a Financier Token?

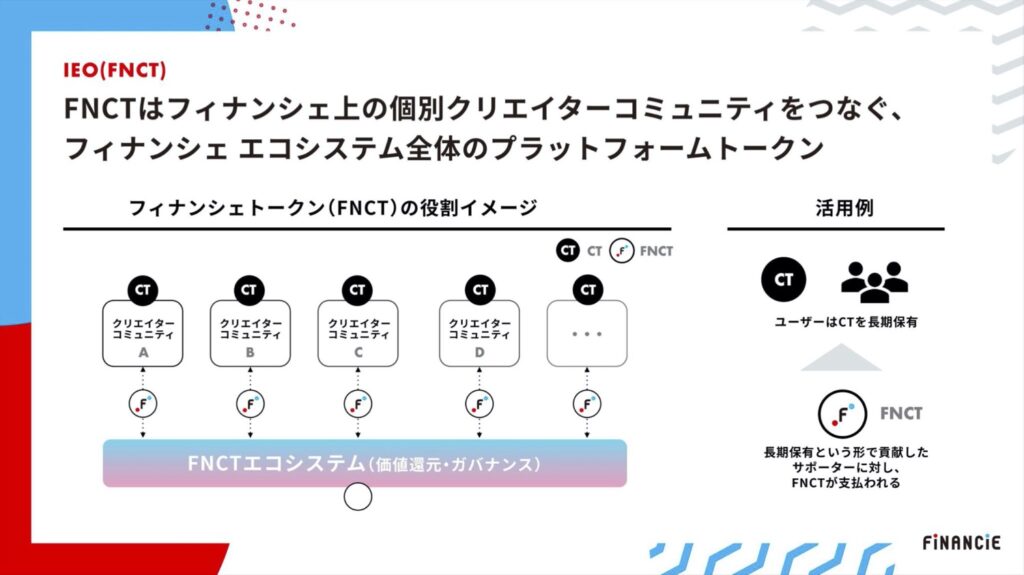

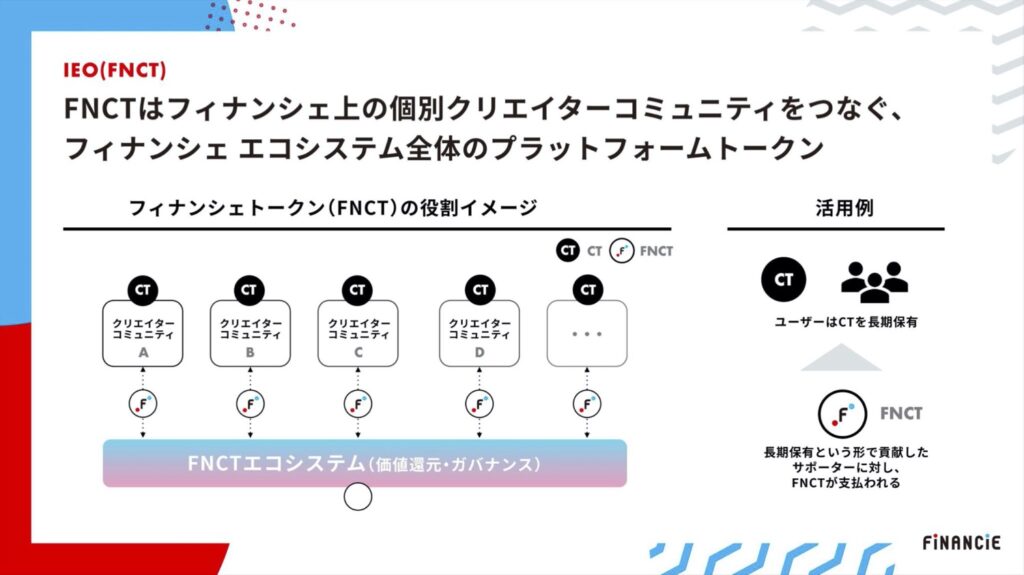

The IEO of “Financier Token (FNCT)” at Coincheck will be the driving force in promoting these three initiatives. Specifically, it plays a role in cross-linking various club teams, community tokens (CT) issued using FiNANCiE such as entertainment projects, and NFTs.

(From materials)

(From materials)According to CEO Kunimitsu, the Financier Token will be a “platform token for the entire Financier ecosystem that connects individual creator communities on the Financier”. For example, it is envisaged that it will be used for “community token holding,” where financier tokens are paid to users who hold CT for a long period of time.

(From materials)

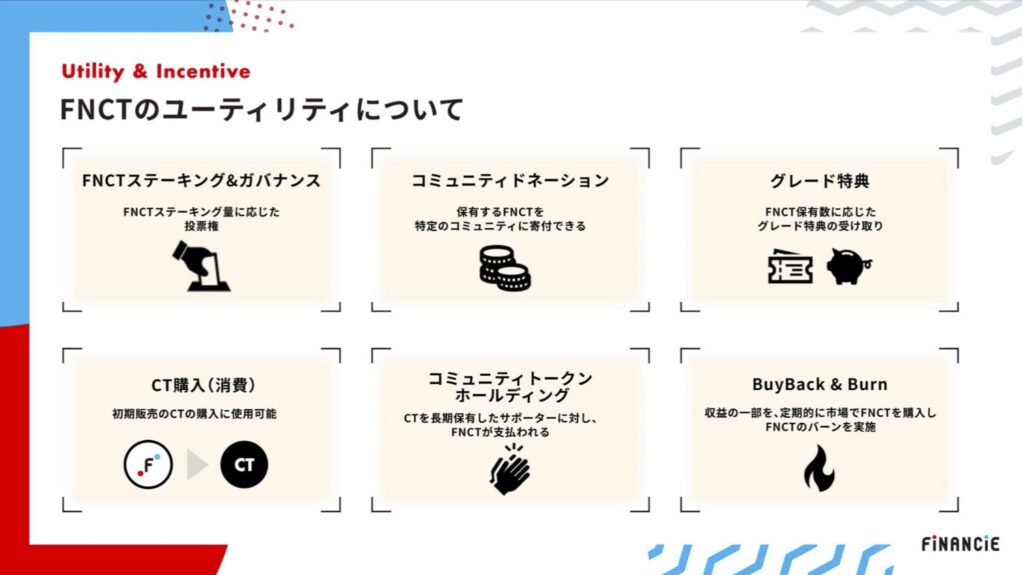

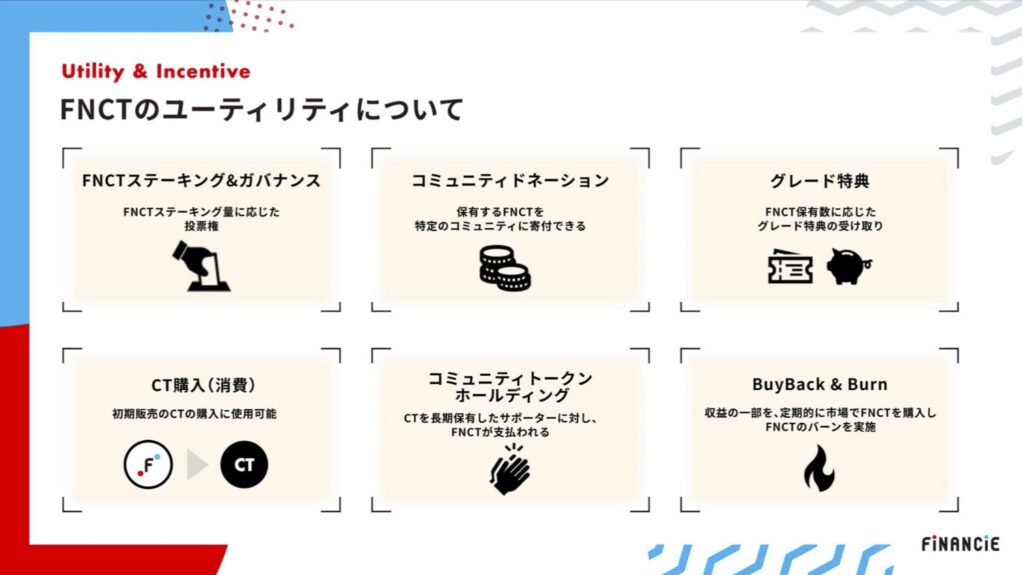

(From materials)After the IEO, we will work on revitalizing the ecosystem based on the utility of the Financier Token.

Specifically, “Staking & Governance” with voting rights according to the stake amount, “Community Donation” that can be donated to a specific community, “Grade Benefits” that can receive grade benefits according to the amount held, initial sales “CT purchase (consumption)” where CT can be purchased at a discount, the aforementioned “community holding”, and “BuyBack & Burn” which periodically buys and burns financier tokens from the market.

Technically, Financier Token uses ERC-20, a compatible standard for the Ethereum blockchain. In other words, it can be distributed within the global crypto asset ecosystem without being closed within FiNANCiE.

How to make everyone happy

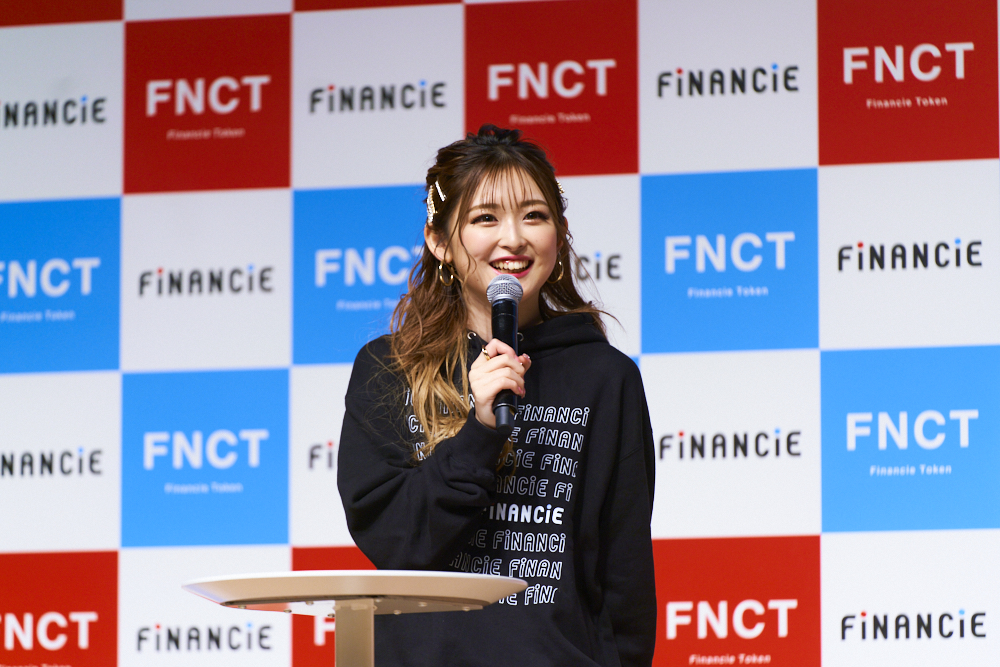

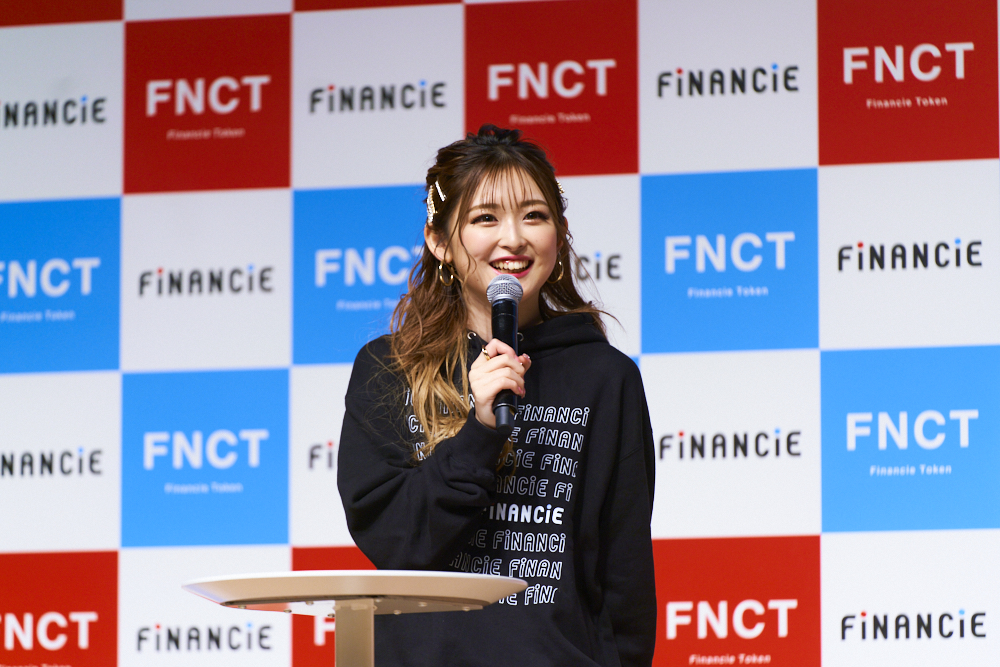

At the business strategy briefing session, talent Yuchami appeared as a special guest. She talked with CEO Kunimitsu, and Mr. Tsutsumi, Mr. Motohiro, and Mr. Moritani, who were on stage at the entertainment business talk session.

Mr. Yuchami said that “words are difficult” about DAO and tokens, but when he heard the explanation of DAO from CEO Kunimitsu, he said, “It’s modern” and “It’s nice that everyone is happy.” He excited the audience with his catchy remarks.

Yuchami-san

Yuchami-sanRegarding the efforts of SUPER SAPIENSS, he said, “I want to participate, too,” and appealed to the two directors and producers, saying, “You can also go neat and clean!”

Due to the existence of strict regulations, there is a paradoxical view that “Japan has nothing to do with ‘Crypto Asset Winter’.” In addition, there is a possibility that Japanese entertainment content and local tourism resources will attract global attention, and development on Web3, including NFT, is expected. There is no doubt that Financier will become an important platform and player.

Discord: https://discord.gg/fnct-official

twitter:https://twitter.com/Fnct_Official

Twitter (English):https://twitter.com/Fnct_Officialen

|Text and editing: coindesk JAPAN advertising production team

|Photographer: Keisuke Tada

The post Financier announces business strategy, talks about enthusiasm for FNCT’s IEO implementation, where 1.06 billion yen was collected in the first hour of application | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

219

2 years ago

219

![Ripple [XRP] – Could THIS bearish pattern drive prices to $2.60?](https://ambcrypto.com/wp-content/uploads/2025/08/Chandan-2025-08-02T164951.280_11zon.jpg)

English (US) ·

English (US) ·