Issuing digital securities

Domestic companies such as Mitsubishi UFJ Trust and Banking and Rakuten Securities announced on the 21st that they will collaborate to issue publicly offered security token bonds (hereinafter referred to as ST bonds) with full interest payments made in electronic money.

Utilizing the blockchain-based platform “Progmat,” the public offering is scheduled to target individual investors. The electronic money received as interest is “Rakuten Cash” issued by Rakuten Edy. This is said to be the first publicly offered bond in Japan in which all interest, excluding taxes, is paid in electronic money.

What is a security token?

A token that digitizes securities such as stocks using blockchain technology. Also called “digital securities.”

Virtual currency glossary

Virtual currency glossary

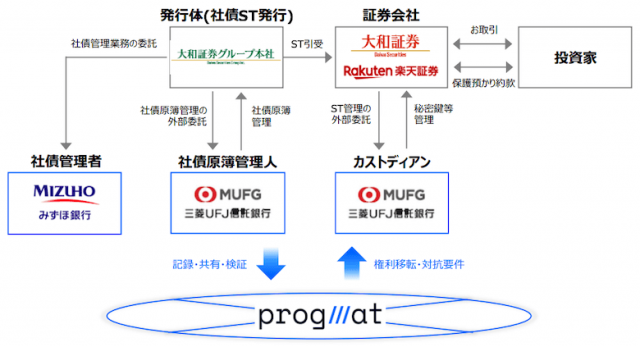

The following seven companies will collaborate on the issuance of ST bonds.

- Daiwa Securities Group Headquarters

- Daiwa Securities

- Rakuten Securities

- Rakuten Payment

- Mizuho Bank

- Mitsubishi UFJ Trust and Banking

- Progmat

The roles and schemes of each company are as follows.

Source: Announcement

The name of the ST bond is “Daiwa Securities Group Inc. 1st Unsecured Security Token Bond.” The total amount is 1 billion yen, the maturity is one year, and the interest rate is currently 0.8% per year. The payment deadline is the 21st of next month.

Regarding future plans, he explained that he would like to use the issuance of ST bonds as an opportunity to provide a new financing method to issuers considering interest payments other than cash. He also stated that the company will create attractive investment opportunities for investors and provide new value to society.

This time's point

In line with this announcement, Tatsuya Saito, the head of Progmat, explained ST bonds on “note'' on the 21st, and listed the following two points as compared to previous digital bonds and bond STs. .

- Rakuten Securities enters the public digital securities market for the first time

- All interest is paid electronically

Rakuten Securities explained that it is the second major online securities company to enter the market, following SBI Securities. He stated that from the perspective of expanding the investor base, it is extremely important to expand and diversify into channels other than face-to-face securities transactions.

In addition, regarding electronic money payment of interest, for regular book-entry transfer bonds through JASDEC (Japan Securities Depository Center), interest is only granted in cash, but for digital bonds and bond STs that are not through JASDEC, electronic money is used to earn interest. It is also possible, and explains the benefits of the new technology.

In addition, the mechanism for paying interest using electronic money is combined with the viewpoint of “support investment'' that represents a long-term investment commitment to a company and the sophistication of fan marketing, and a variety of mechanisms within the range of “interest payment to granting of benefits''. He said that it has the potential to lead to measures.

Progmat’s recent achievements

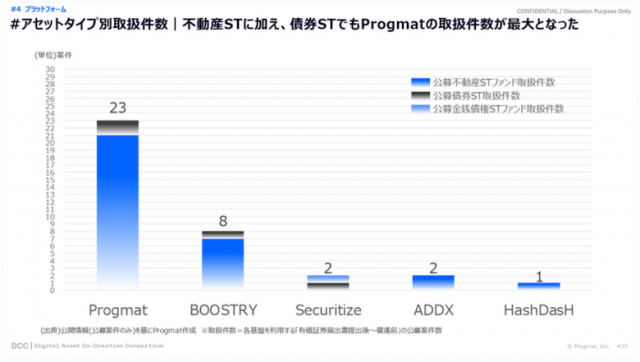

This commentary also includes Progmat's recent achievements. Progmat, a digital asset issuance and management platform operated by Progmat, which was spun off from Mitsubishi UFJ Trust and Banking, is attracting attention for its digital securities and stable coin businesses.

connection: Mitsubishi UFJ Trust and Banking to consider new stable coin in collaboration with Binance Japan

Mr. Saito reported that with this ST corporate bond, in addition to real estate ST, Progmat handled the largest number of bond ST.

Source: note

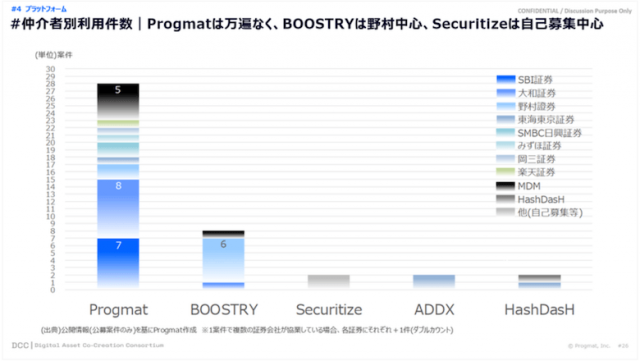

The company also explains that it has developed into a network with less bias in terms of the number of transactions by intermediary.

Source: note

Digital securities special feature

The post First in Japan to receive interest on digital securities (ST) with Rakuten Cash, Daiwa Securities and others to issue publicly offered bonds appeared first on Our Bitcoin News.

1 year ago

115

1 year ago

115

English (US) ·

English (US) ·