4/26 (Wednesday) morning market trends (compared to the previous day)

- NY Dow: $33,530 -1%

- Nasdaq: $11,799 -1.9%

- Nikkei Stock Average: ¥28,620 +0.09%

- USD/JPY: 133.7 -0.1%

- US dollar index: 101.8 +0.5%

- 10 year US Treasury yield: 3.4 -3.2% annual yield

- Gold Futures: $2,007 +0.4%

- Bitcoin: $28,185 +2.8%

- Ethereum: $1,865 +1.8%

traditional finance

crypto assets

Today’s NY Dow fell sharply to -344 dollars. The Nasdaq closed at -$238. The US regional bank First Republic’s crash (-49.3%) seems to have affected the entire market.

connection: Bitcoin is weak at the $27,000 level, wait-and-see trend ahead of May FOMC

First Republic

First Republic, the 14th-largest midsize bank in the nation, announced its earnings yesterday. Deposits as of the end of March decreased by 40% from the end of last year, and concerns about bank credit risk reignited. In the background, the US Silicon Valley Bank collapsed on March 10, and many customers moved their deposits from some small and medium-sized banks to large banks such as JP Morgan.

Source: Tradingview

First Republic is also seeking to sell its holdings of $50-100 billion worth of long-term securities and other assets, the people said. Ratings agency Moody’s downgraded First Republic by three notches the day before, as well as banks such as Comerica, Western Alliance Bancorp and US Bancorp.

April US Consumer Confidence Index

Last night’s April US Consumer Confidence Index fell to 101.3 from March’s revision of 104. It fell short of expectations of 104, the lowest level since July 2022.

The expectations index also fell to 68.1 from 74 in March, raising expectations of a recession in the near future. A drop below 80 in the Expectations Index suggests heightened risks of a recession.

The expected inflation rate over the next year is 6.2%, down from 6.3% in March.

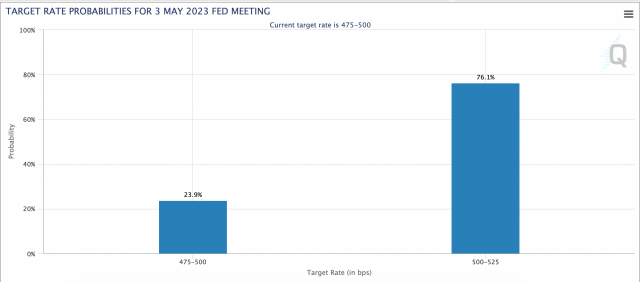

Expectations remain high that the US Federal Open Market Committee (FOMC) will raise interest rates by 0.25 percentage points at next week’s meeting (May 4), but the side effect of an economic slowdown following a year of aggressive monetary tightening is highlighted. seems to be becoming

Source: CME

Economic data from this week onwards

- April 27, 21:30 (Thursday): U.S. January-March Quarterly Real Gross Domestic Product (GDP, preliminary figures), Core PCE

- April 28, 21:30 (Friday): U.S. March Personal Consumption Expenditure/PCE deflator

- May 1, 23:00 (Monday): US April ISM Manufacturing Index

- May 4, 3:00 (Thursday): US Federal Open Market Committee (FOMC) policy interest rate announcement

connection: What is a real estate investment trust “REIT?” Explaining the main advantages and disadvantages

US stocks

Microsoft (+7.9%) and Alphabet (+1.4%), which announced their financial results after the close today, were favorably received by their strong performances and turned positive in after-hours trading.

U.S. IT Tech stocks compared to the previous day: NVIDIA-2.9%, c3.ai-0.9%, Tesla-1.1%, Microsoft-2.2%, Alphabet-2%, Amazon-3.4%, Apple-0.9%, Meta -2.4%.

Microsoft financial results

Microsoft’s financial results (January-March) surpassed market expectations with revenue of $52.9 billion, up 7%, and earnings per share of $2.45, up 10% year-on-year.

Specifically, sales of the cloud service “Azur” and business software “Office” were strong. In addition, the partnership with OpenAI and the excitement of the release of Bing with ChatGPT seems to be one of the reasons why investors are positive about it.

connection: Microsoft Azure, “Space & Time” blockchain data available

Alphabet closing

Google’s holding company, Alphabet Inc., also posted higher-than-expected sales and profits in the first quarter. Sales were $69.79 billion, compared to market expectations of $68.95 billion. Earnings per share were $1.17, beating market expectations of $1.07.

In terms of revenue growth, cloud business revenue exceeded $7.4 billion, up 28%. On the other hand, it is also pointed out that Amazon AWS and Microsoft’s Azure are still far behind.

Alphabet also announced a $70 billion share buyback.

Meta is due to report earnings on the afternoon of April 26th, and Silvergate Capital will be reporting on the morning of April 27th. (local time)

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase|$55.5 (+1.4%/-5.9%)

- MicroStrategy | $290.9 (+1.9%/+0.0%)

- Marathon Digital Holdings | $8.9 (+1.1%/+0.6%)

Today’s virtual currency-related stocks are high with the rebound of Bitcoin (BTC).

Coinbase yesterday filed a limited lawsuit against the SEC (U.S. Securities and Exchange Commission) in a federal court seeking a response to a “petition for regulatory clarification regarding the cryptocurrency industry.” It seems that I was favorably received by announcing that I went to

connection: Coinbase sues the US Securities and Exchange Commission for “clarification of regulations”

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post First Republic crashes, Microsoft rises sharply with good results | 26th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

73

2 years ago

73

English (US) ·

English (US) ·