June 15 (Thursday) morning market trends (compared to the previous day)

- NY Dow: $33,979 -0.6%

- Nasdaq: $13,626 +0.3%

- Nikkei Stock Average: ¥33,502 +1.4%

- USD/JPY: 140 0%

- USD Index: 103 -0.3%

- 10 year US Treasury yield: 3.79 -1.2% annual yield

- Gold Futures: $1,955.7 -0.1%

- Bitcoin: $25,098 -2.9%

- Ethereum: $1,648 -5.1%

traditional finance

crypto assets

NY Dow Nasdaq today

Today’s NY Dow fell sharply to -232.7 dollars. Nasdaq closed +53 dollars higher. As expected, the Fed temporarily paused rate hikes, but it seems to have grown tired of suggesting two more rate hikes this year.

FOMC

In the FOMC interest rate policy announced early in the morning of Japan time, it was decided to keep the interest rate unchanged as speculated by market participants. After a total of 10 interest rate hikes from March 2022, it will be temporarily suspended. The federal funds target range is 5-5.25%, unchanged since the rate hike in May.

Regarding the decision to keep interest rates unchanged, the FOMC said in a statement, “Given the delayed impact of repeated tightening on economic activity and the inflation rate, and economic and financial developments, we will maintain a stable target range. “This will allow the Committee to assess additional information and its implications for monetary policy.”

The pause in rate hikes was welcomed by the market, but the dot plot (interest rate forecasts) by FOMC participants indicated the possibility of two more rate hikes by the end of the year, suggesting that further tightening would be necessary to curb inflation. was agreed by most participants (12 out of 18).

At the moment, the probability of another 0.25% rate hike at July’s FOMC has risen to 70%, but a second rate hike is not certain. At this meeting, the FRB mentioned that further interest rate hikes would depend on indicators, so future economic indicators and other factors will likely determine the direction.

Source: Federal Reserve

On the other hand, as for the rate cut expected by the market, Chairman Powell said in a post-meeting press conference that it would likely be “about two years away,” as inflation had slowed markedly. “The Fed’s policy has covered a wide area, but the full effect of the tightening has not yet been realized,” he said. Dot Plot expects a rate cut as early as 2024.

May Wholesale Price Index (PPI)

May’s wholesale price index (PPI), released overnight, came in at -0.3% m/m overall, beating market expectations of -0.1%. Core PPI excluding food and energy increased 0.2% m/m in line with expectations. Compared to the same month of the previous year, it was +1.1%, the lowest growth since December 2020. Disinflation on the supply side continues.

The U.S. Consumer Price Index (CPI) data released the day before also showed a slowdown in the pace of inflation, which seems to be justifying the FOMC’s pause in interest rate hikes this time.

connection: The stock index rises as the CPI passes, but Bitcoin is dull, and BNB, which has fallen sharply, rebounds sharply

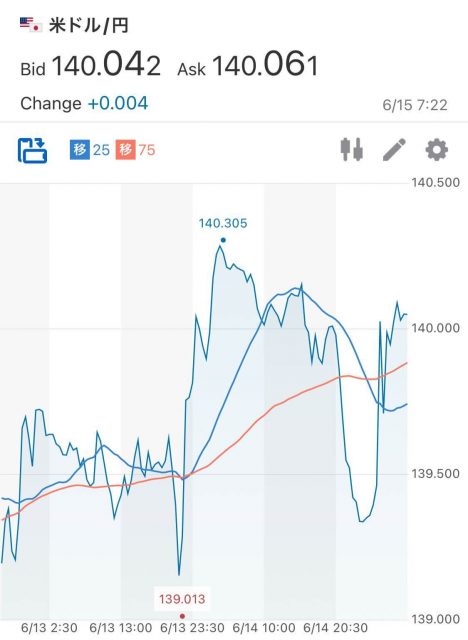

dollar yen

The dollar/yen exchange rate was hovering in the low 139 yen range before the FOMC, but was pushed back to 140.27 yen in response to the suggestion of an additional interest rate hike.

Source: Yahoo! Finance

economic indicators

- Thursday, June 15, 21:30: May retail sales

- June 16 (Friday): Bank of Japan Monetary Policy Meeting Policy interest rate announcement

- June 16 (Fri) 23:00: University of Michigan Consumer Confidence Index Preliminary for June

- Wednesday, June 21, 23:00: Chairman Powell’s remarks

- Thursday, June 22, 21:00: U.S. unemployment claims for the previous week

- Thursday, June 22, 23:00: Chairman Powell’s remarks

US stocks selling and buying mix

Today’s US stock market was mixed with buying and selling after the FOMC results were announced. The S&P 500 stock index rose slightly higher for the fifth straight day. Individual stocks compared to the previous day: Nvidia +4.8%, c3.ai -0.6%, AMD +2.2%, Tesla -0.7%, Microsoft +0.9%, Alphabet -0.1%, Amazon -0.1%, Apple +0.3%, Meta + 0.7%.

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

Virtual currency related stocks mixed

- Coinbase|$53.9 (+2.8%/+1.1%)

- MicroStrategy | $282.8 (-0.3%/+0.1%)

- Marathon Digital | $9.6 (+0.1%/+3.3%)

Bitcoin (BTC) fell sharply on the prospect of two more interest rate hikes this year, temporarily falling below $25,000.

Source: Binance

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post FOMC interest rate hike pause, but additional interest rate hikes may resume US stocks and Nasdaq slightly higher | appeared first on Our Bitcoin News.

2 years ago

142

2 years ago

142

English (US) ·

English (US) ·