- Federal Open Market Committee (FOMC) officials are cautiously optimistic about inflation and the economy, but still seem concerned about the possibility of a recession.

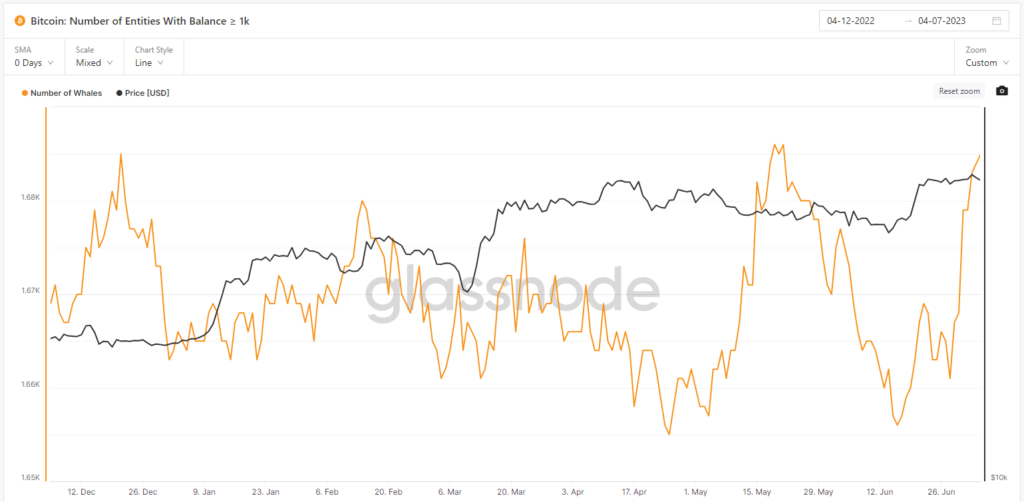

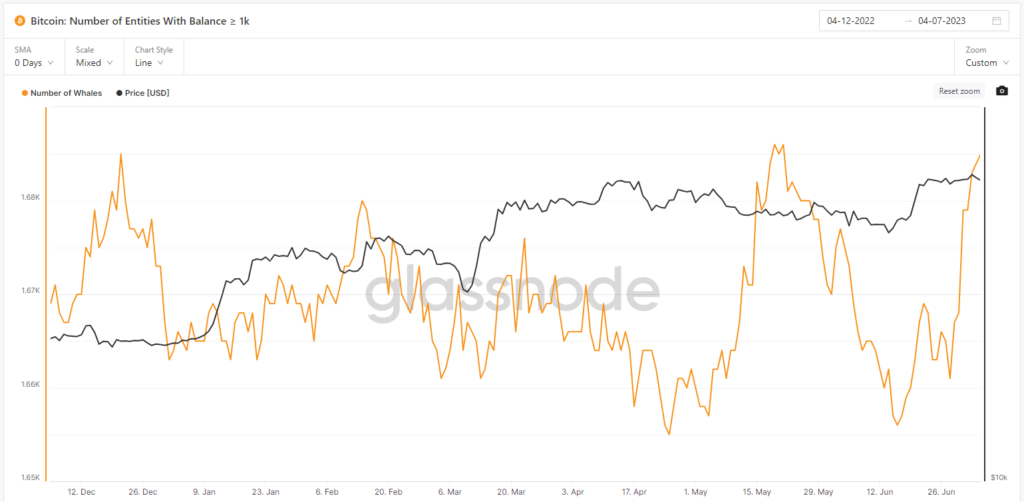

- The number of Bitcoin (BTC) whales is increasing, but they behave differently depending on their size.

The minutes of the FOMC’s June meeting, released Wednesday, suggest central bankers are uncertain about how the economy will behave in the coming months.

How officials’ thinking plays into their decision to raise rates will have a big impact on the cryptocurrency market. Meanwhile, while the number of Bitcoin whales has increased, their distribution has changed.

June FOMC Warning

Federal Reserve officials cautiously forecast a recession within the next six months, but believe a gradual recovery thereafter, according to FOMC minutes. It is shown.

Officials said they hoped such a recession would be “neither severe nor prolonged”.

Still, the recent decision to pause rate hikes appears to be walking a tightrope. The decision gives the impression of an approach to monetary policy that emphasizes harmlessness. The US economy has been more resilient than the FOMC expected. Uncertainty is created by conflicting economic data.

For example, the June ADP employment report showed that private sector jobs created more than 497,000 jobs, the highest since February 2022, well above the 228,000 expected. Meanwhile, the Trends in Employment Survey (JOLTS), released later, showed an unexpectedly large drop in job vacancies over the same period.

Whale response varies by scale

While the larger investment community is focused on macroeconomic data, some Bitcoin whales have scaled up with similar uncertainties as the FOMC.

Bitcoin whales are investors who hold 1000 BTC (4.35 billion yen, converted to 145 yen to the dollar) or more. The number of Bitcoin whales has increased by 1.6% since June 14, the day before BlackRock, the world’s largest asset manager, filed for a Bitcoin exchange-traded fund (ETF). It reversed the short-term downward trend that had continued since May 20.

The different distributions of holdings among whales mean different levels of trust in Bitcoin.

Since June 14, the holdings of groups holding between 1,000 and 10,000 BTC increased by 90,396 BTC (2%). The same is true for groups holding more than 100,000 BTC, with their holdings increasing by 107,883 BTC (3%).

On the other hand, the BTC holdings of groups holding 10,000 to 100,000 BTC decreased by 184,153 BTC (10%). This group has a different view of risk and has less trust in Bitcoin than the other two groups.

With the macroeconomic environment in the spotlight, investors should see which groups made more profitable decisions.

|Translation: CoinDeskJAPAN

|Editing: Rinan Hayashi

| Image: Glassnode

|Original: FOMC Minutes Show Uncertainty, Cautious Optimism. Large Bitcoin Investors Are Taking Divergent Paths

The post FOMC Minutes Uncertainty and Cautious Optimism ──Bitcoin Whale’s response is mixed | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

1 year ago

79

1 year ago

79

English (US) ·

English (US) ·