Last year robotic process automation (RPA) was all the rage, as we saw market leader UiPath go public at a huge valuation, while larger more established players began to scoop up smaller vendors. Yet RPA has always felt like an interim automation solution to deal with legacy processes before shifting to a more intelligent no-code approach.

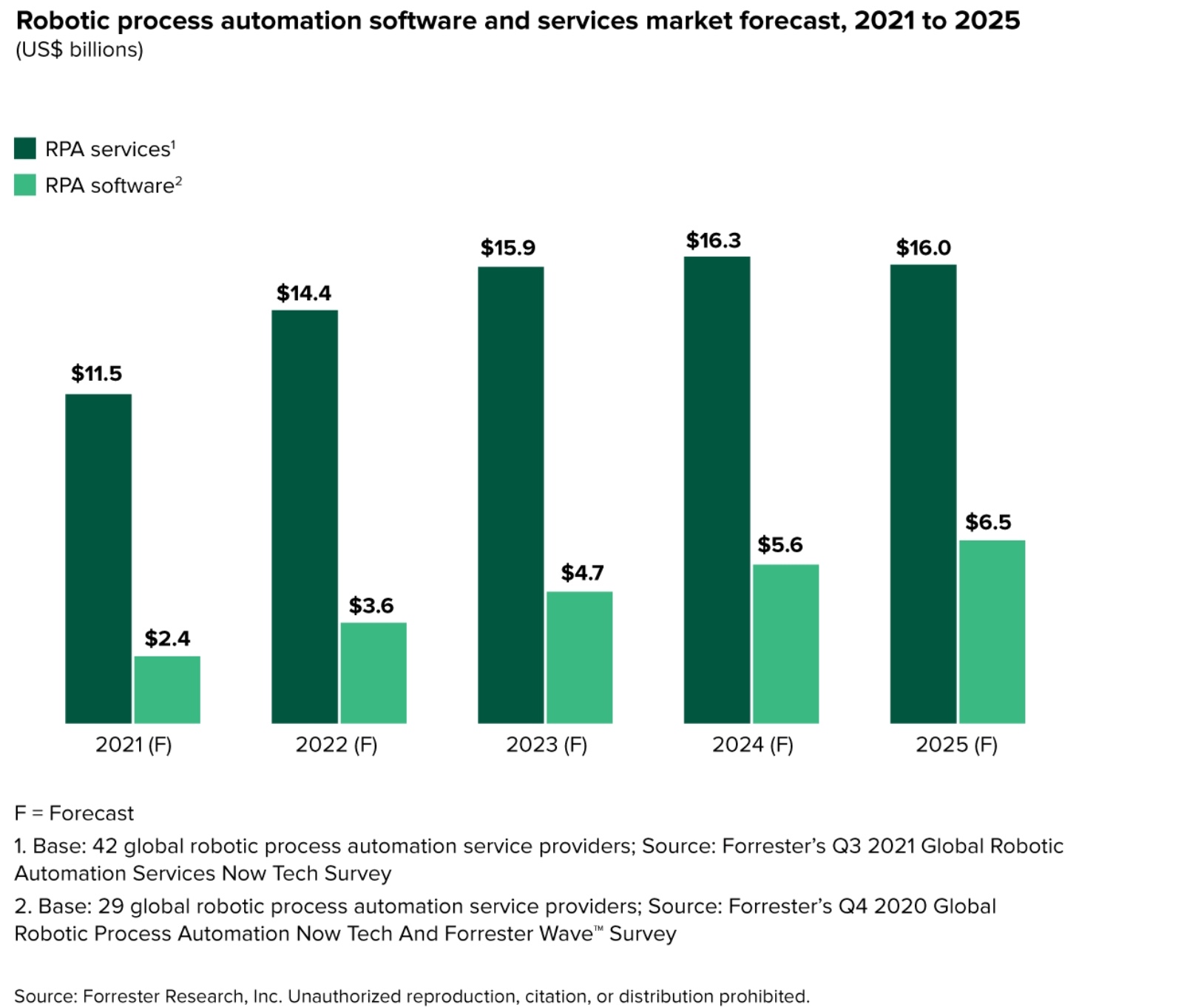

Forrester Research’s latest data appears to back this up, predicting the RPA software market will reach $6.5 billion by 2025, but with the caveat that growth will start to flatten as soon as next year as companies shift to more AI-fueled automation solutions.

“While we expect the tremendous market growth in 2021 to continue throughout 2022, fueled by pandemic-induced automation demand and ongoing digital transformation programs, growth rates will begin to flatten in 2023,” the company wrote in its latest RPA market report.

While $6.5 billion is up significantly from it’s 2018 report when the firm predicted the market would reach $1.1 billion in 2019, it is still a fairly small amount overall when you consider Salesforce just completed a quarter in which it reported over $7 billion in revenue on its own.

The services part of the market, helping implement these complex solutions, is expected to grow much more robustly compared to RPA software revenue. According to Forrester, RPA-related services could reach $16 billion by 2025, almost three times the software it’s trying to help implement. If you combine the services and software, it’s a much more impressive $25 billion market by 2025.

Image Credits: Forrester Research

Forrester analyst Leslie Joseph explained services revenue this way: “Services revenue counts the revenue that services vendors make by providing consulting, development, implementation, maintenance and support services around these products.” Service vendors include global systems integrators, consulting and advisory firms such as Accenture, IBM and EY, who may be partners or resellers of RPA software.

Forrester is predicting that some of the money going to RPA software today will begin to shift to broader AI automation solutions. It’s worth noting that while RPA has robotic in its name, it’s not really AI in a true sense. The bots in this case are more like scripts completing a set of highly manual tasks. By comparison, no-code automation solutions make it easy to create a workflow, presumably without consulting help. AI provides a way to intelligently implement tasks and take steps based on the data instead of moving through a set of highly defined hard-coded work.

This decline is coming in spite of investor enthusiasm for the market from investors who valued UiPath at $35 billion when it raised $750 million last year, its last private fundraise prior to its IPO. Today the company’s market cap sits at close to $15 billion, certainly a precipitous drop in value, even taking into consideration the big hit software companies have been taking in the stock market over the last year.

Meanwhile, we also saw some pretty significant consolidation as companies like SAP bought Signavio, ServiceNow acquired Intellibot and Salesforce snagged Servicetrace, as several examples. Blue Prism, which is one of the top-three pure-play RPA vendors, accepted a $1.6 billion offer from SS&C after rejecting overtures from Vista Equity partners. That deal is expected to close later this month.

When TechCrunch surveyed five investors last year about the RPA market, we asked them specifically about how RPA technology can stay relevant in the long term. For the most part, investors saw a market that could continue to expand, but if Forrester is correct, the market may be shifting as customers look to more modern AI automation services.

English (US) ·

English (US) ·