The post From Bitcoin’s Recovery to Sui’s Rise: CoinEx Research Unpacks August’s Crypto Market Trends appeared first on Coinpedia Fintech News

CoinEx Research has released its comprehensive report on the cryptocurrency market for August, highlighting significant volatility, recovery, and key developments throughout the month. This report is significant as it offers insights into the evolving dynamics of the crypto space, helping investors and stakeholders navigate the complexities of a market in flux.

Bank of Japan Rate Hike

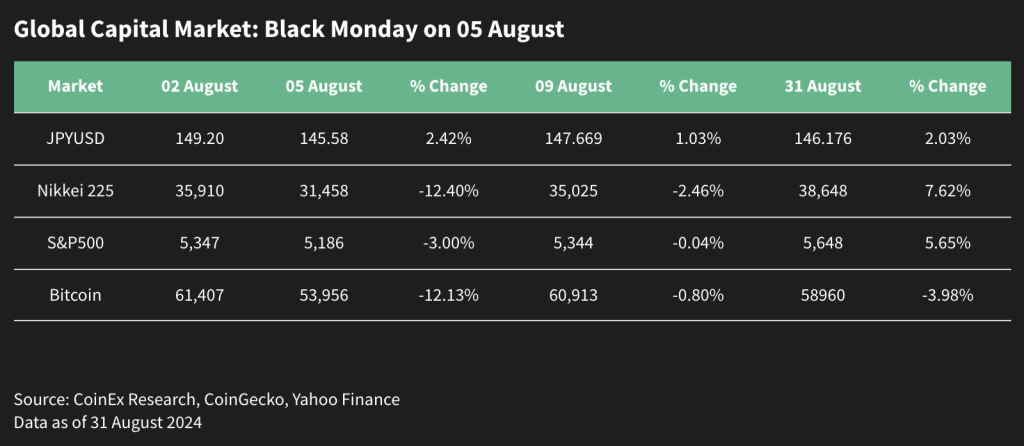

The decision by the Bank of Japan to increase interest rates led to significant market turmoil, triggering a global sell-off during the week of 04 August. While the U.S. equity markets swiftly rebounded from their losses, the crypto market failed to mirror this recovery. Bitcoin initially showed a gradual recovery, reaching its August opening levels, but subsequently tumbled further, closing the month near the $58,000 mark. Bitcoin balances on exchanges dropped to a 2024 low of 2.39 million BTC, indicating a growing tendency among investors to hold Bitcoin rather than liquidate positions.

Market Condition

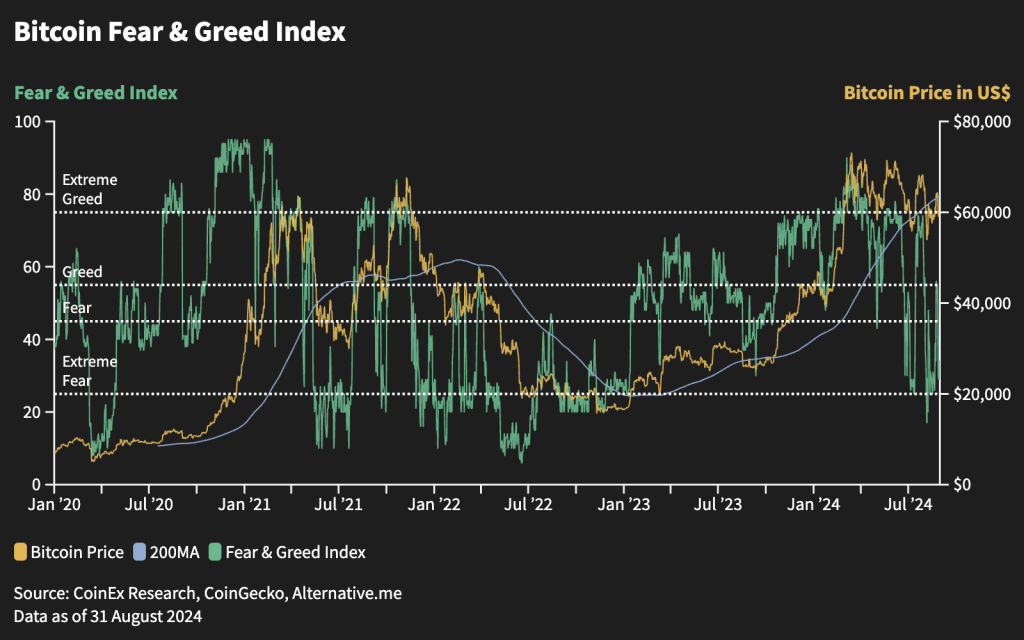

The market is in limbo, lacking clear direction, with the Fear & Greed Index slipping into “Extreme Fear” territory. The rate cut by the Federal Reserve in September is widely seen as market consensus and appears to be largely priced in. This could present a buying opportunity for long-term investors willing to weather the volatility.

Bitcoin Staking

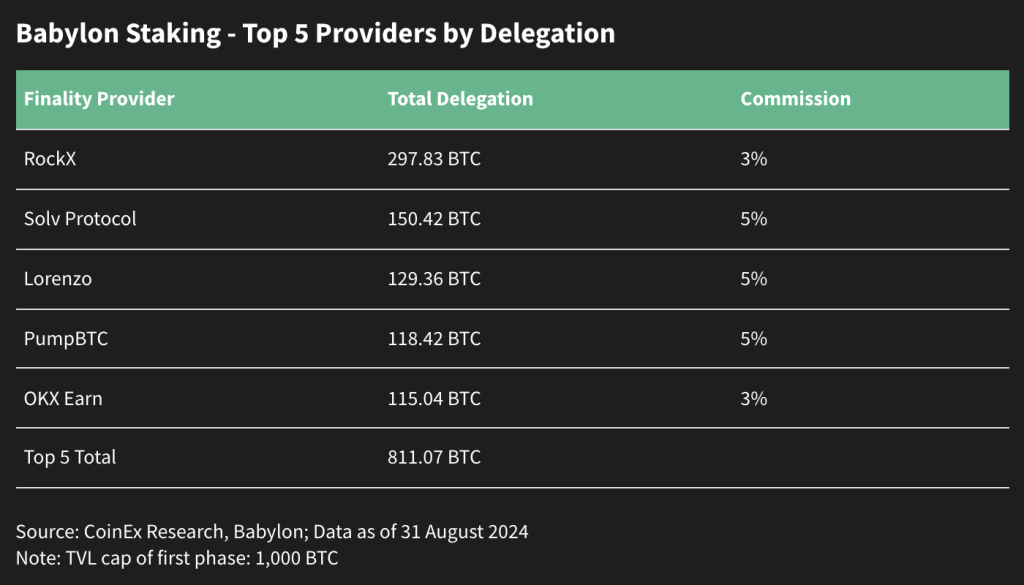

On August 22, Babylon’s launch of Bitcoin staking was met with enthusiasm, quickly reaching full subscription of 1,000 BTC, which was fully subscribed within just three hours by approximately 12,700 users. This initiative temporarily spiked Bitcoin gas fees, to as high as 800 sat/vB, reflecting strong demand for staking opportunities.

Ethereum’s Struggles

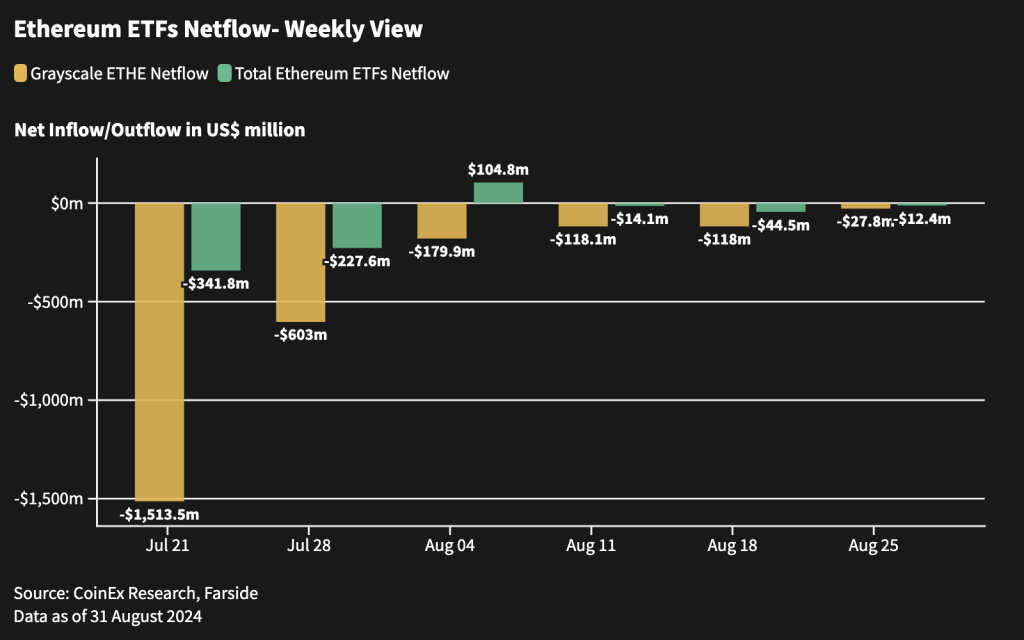

Ethereum ETFs saw a positive net flow in August, recording a net inflow of $6.2 million, compared to a significant net outflow of $541.8 million in July. Despite a small net inflow into Ethereum ETFs, the price of Ethereum continues to face downward pressure. This is occurring even as Grayscale’s ETHE outflows have slowed, indicating ongoing challenges for Ethereum in maintaining price stability. But Ethereum’s core value propositions, particularly in the DeFi sector, remain robust and sustainable.

Sui’s Rise

Sui is gaining traction as a strong performer, particularly in the GameFi sector. Backed by Grayscale’s launch of new trust products and strong endorsements from key opinion leaders (KOLs) and investors. Its unique value proposition sets it apart, even as it draws comparisons to Solana, highlighting the competitive nature of blockchain platforms.

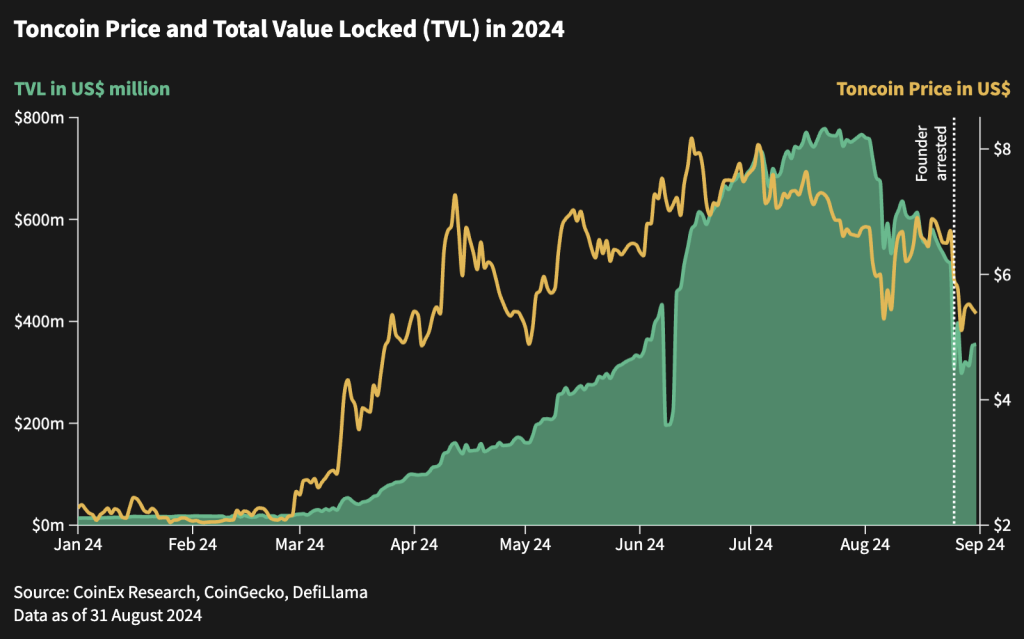

Ton Ecosystem

The arrest of Telegram founder Pavel Durov resulted in a decline in Toncoin’s price and total value locked (TVL), resulting in a 20% drop in Toncoin’s price and a 30% decline in Total Value Locked (TVL). However, the community has rallied, adopting the “Resistance Dog” meme coin avatar as a symbol of support and resilience.

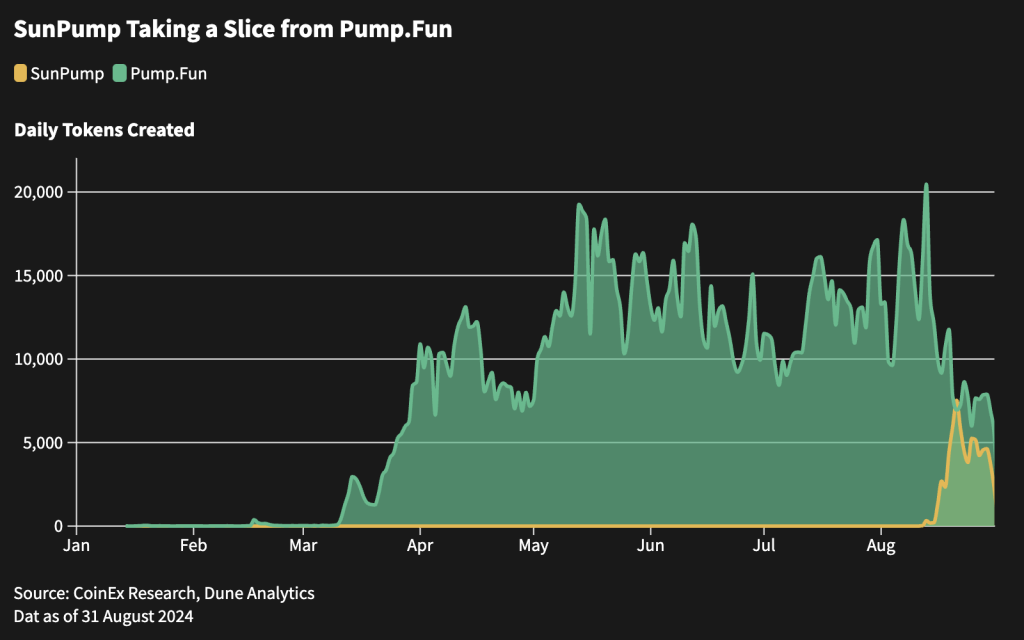

SunPump on Tron

SunPump is emerging as a popular choice among meme coin traders on the Tron platform, has facilitated the creation of over 63,000 meme tokens and generated over 25 million TRX in revenue, challenging the dominance of Pump.Fun and showcasing the dynamic nature of meme coin markets.

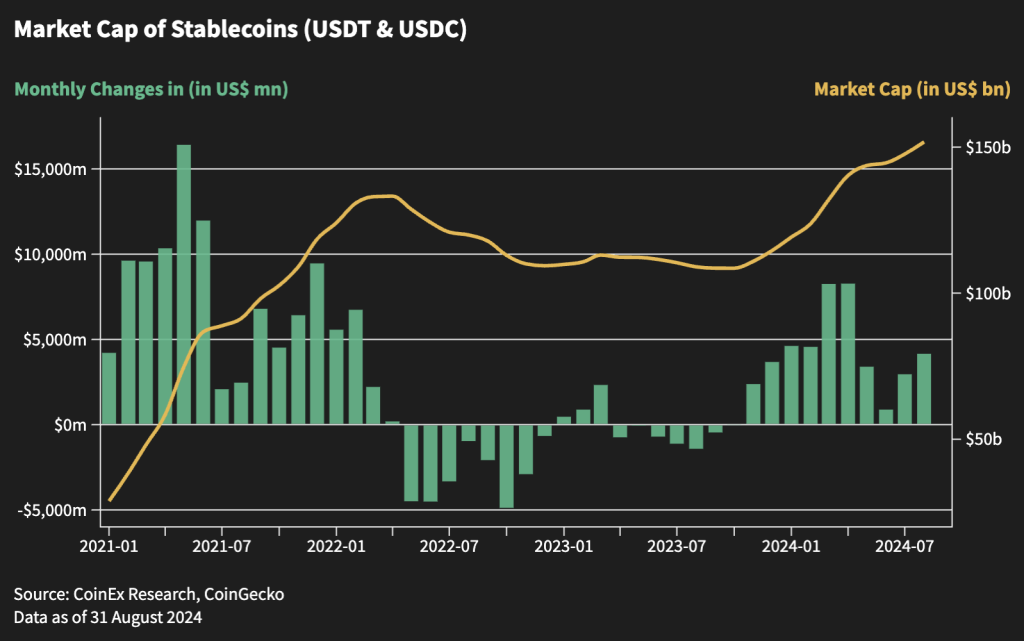

Stablecoins Issuance

In August, an additional $4 billion in USDT and USDC was issued, bringing levels back to those seen in November of last year. Currently, the market is in a period of stagnation due to a lack of liquidity and market narratives. The strong inflow of stablecoins suggests that the market has not entered an absolute bear market phase akin to early 2022 when stablecoins started flowing out.

Conclusion

The CoinEx Research report paints a picture of a cryptocurrency market at a crossroads, influenced by macroeconomic factors and internal dynamics. The findings suggest that while the market faces challenges, there are also opportunities for growth and innovation. As the industry awaits new catalysts, the focus will likely remain on regulatory developments and macroeconomic shifts. Looking ahead, the potential for interest rate cuts and other economic events could provide the necessary impetus for a market rally. As stakeholders digest these insights, the emphasis will be on strategic positioning and readiness to capitalize on emerging trends and opportunities.

About CoinEx

Established in 2017, CoinEx is a global cryptocurrency exchange committed to making crypto trading easier. The platform provides a range of services, including spot and futures trading, margin trading, swaps, automated market makers (AMM), and financial management services for over 10 million users across 200+ countries and regions. Since its establishment, CoinEx has steadfastly adhered to a “user-first” service principle. With the sincere intention of nurturing an equitable, respectful, and secure crypto trading environment, CoinEx enables individuals with varying levels of experience to effortlessly access the world of cryptocurrency by offering easy-to-use products.

CoinEx Research remains committed to providing in-depth analyses and insights into the evolving cryptocurrency market, helping investors navigate through the complexities and opportunities that lie ahead.

To learn more about CoinEx, visit: Website | Twitter | Telegram | LinkedIn | Facebook | Instagram | YouTube

11 months ago

36

11 months ago

36

English (US) ·

English (US) ·