Adapting quickly to market trends: understanding “meta” strategies

Over the past month, a large amount of funds have been transferred from the cryptocurrency blockchain Ethereum (ETH) to Sui (SUI) and Solana (SOL).

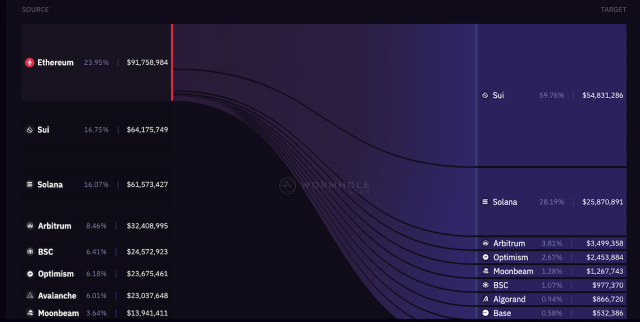

This is according to data from Wormhole (Crypto Bridge Protocol), which shows that $370 million in liquidity moved from Ethereum to other blockchains, of which almost 90% went to Sui and Solana. It is shown that.

Source: Wormhole

The incentives (rewards) of DeFi/NFT protocols deployed within the ecosystem seem to be contributing to this increase in Sui’s liquidity.

The liquidity of the crypto asset (virtual currency) Solana (SOL) has also been raised by people pursuing incentives that are being rolled out one after another in various apps after seeing recent community rewards (such as Jito and Pyth). It will be analyzed as it is delivered.

connection:The CEO of the Sui development company talks about the challenges of Web3 games and the advantages of Sui | WebX interview

connection:Virtual currency Jito (JTO) listed on Binance and Bybit, price soaring

Circulation of “meta” liquidity

Traders and investors active in the crypto asset (virtual currency) market aim to maximize profits by quickly moving funds to projects and platforms that promise rewards.

This move represents a rapid adaptation to the “meta” or most effective investment strategies and trends currently prevalent in the market.

“Meta” is a term frequently used in the international cryptocurrency community to refer to the latest and most effective investment approach at a particular time in the market.

What is a “point program”?

One of the recent metas is “points”.

The points program is a new token incentive for DeFi/NFT protocols that grants points to users who complete specific tasks such as trading tokens/NFTs, providing liquidity, and locking up.

The points will be a quantitative representation of a user’s contribution to the network and may be converted into future airdrops or other rewards.

In other cases, points programs are used as a way to beta test a product before it goes to market, before a token generation event.

Blur is an example of a project that has had great success with points programs in the past. Launched in October 2022, it has overtaken OpenSea in terms of trading volume to become the largest NFT marketplace.

connection:The reason behind the weekly trading volume of the emerging NFT market “Blur” exceeding that of OpenSea

Fund inflow to Sui and Solana is a new trend in DeFi

The recent inflow of funds from Ethereum to Sui and Solana can be attributed to the market’s “meta” trends and incentives from point-based DeFi protocols.

Last week, the Solana ecosystem began staking Pyth, which has been driving liquidity since the end of last year, and an airdrop is scheduled for Jupiter from the end of this month, so liquidity may continue to increase.

connection:Domestic exchange bitbank partners with Solana-based next-generation oracle Pyth Network

In addition, one of the current meta strategies in the SUI ecosystem is to stake SUI tokens with various protocols and accumulate points to obtain native tokens for each project.

In addition, it has been observed that liquidity is flowing into SEI, TIA (Celestia), and DA layer Eigen to earn points.

connection:What is the next trend for modular blockchains? Explaining Celestia airdrop case study and EigenLayer ecosystem

Meanwhile, points programs are designed to encourage user participation and increase usage of the platform, but they have also been criticized due to uncertainty regarding their value and timing of distribution. There are many meme coins that take advantage of hype and FOMO (fear of missing out), so you need to be aware of them.

NISA, virtual currency related stocks special feature

The post From Ethereum to Sui and Solana: Liquidity shift and the latest trends in DeFi appeared first on Our Bitcoin News.

1 year ago

81

1 year ago

81

English (US) ·

English (US) ·