Funding Circle cofounder Samir Desai has unveiled a new U.K. fintech startup called Super Payments, a venture he founded back in February but which very little was known about up until now.

Reports emerged a few months back that Desai had raised around $30 million for this new company, and today this has been confirmed. Super has raised £22.5 million (roughly $27 million as of today) in a round of funding led by Accel, with participation from Union Square Ventures, LocalGlobe, and a slew of angel investors.

While Super isn’t opening for business until later this year, the company has now instigated a waitlist for consumers and businesses keen to be first-in-line for when things officially get off the ground — this will include an early-access program.

So what, exactly, does Super do? Well, on the consumer side, shoppers are promised cashback on purchases they make through the app, from clothes and electronics, to flights.

Super Payments in action

On the brand side, meanwhile, Super partners with businesses with the promise of increasing their sales, and these brands pay Super a commission, part of which is shared back to the customer.

So in effect, Super promises to help its customers (businesses) cut out the financial “middlemen” payments processors, who often charge up to 5% on top of every transaction.

It’s worth noting that Super offers its own payments solution as an option which apparently has no fees, and if a brand decides to support this, Super gives cashback to the customer instantly. If the brand doesn’t offer Super as a payment option, or if the customer chooses not to pay with Super, then the customer may have to wait up to two weeks.

Presumably, the cashback and commission fees vary depending on what payment method the customer uses.

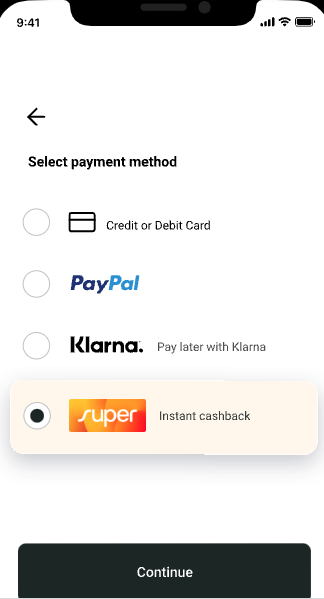

Super Payments: Payment options

On top of that, Super also promises to help brands avoid costly customer acquisition and advertising fees — they don’t pay for featuring their products in the app, they simply pay a commission for any sales that Super generates.

Desai cofounded small-business lending platform Funding Circle back in 2009, and remained CEO until he stepped down last September with the company’s shares sitting at more than half their IPO value. While he is still a non-executive director at Funding Circle, Desai said that he now wants to focus on helping businesses and shoppers avoid exorbitant ecommerce charges — this is particularly pertinent at a time when the U.K. teeters on the brink of a recession.

“Businesses and shoppers have for too long been stung by huge fees on the internet, in many cases without even knowing,” Desai said in a statement. “We believe that the simple Super app can save shoppers and businesses billions a year. At a time of high inflation and increases in the cost of living, redistributing the huge profits of payment and digital advertising companies back to customers, will significantly improve people’s lives.”

English (US) ·

English (US) ·