Macroeconomics and financial markets

In the US NY stock market on the 20th after the consecutive holidays, the Dow Jones Industrial Average fell 245 dollars (0.72%) from the previous day, and the Nasdaq index closed at 22 points (0.16%).

This week, the US Federal Reserve (Fed) Chairman Jerome Powell, who is expected to make hawkish remarks in response to the former Federal Open Market Committee (FOMC), will testify before Congress. Concern about the resumption of interest rate hikes in May was conscious.

Brinken, who is visiting China for the first time in five years as US Secretary of State, mentioned on the 19th the possibility of holding a US-China summit in the United States in November this year. Amid concerns over US-China trade friction and geopolitical risks surrounding the situation in Taiwan, it is hoped that a high-level dialogue between the militaries will lead to a easing of tensions.

connection:Bitcoin returns 4 million yen, virtual currency mining stocks rebound sharply Tonight, Chairman Powell’s parliamentary remarks | 21st Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 7.06% from the previous day to 1 BTC = $ 28,770.

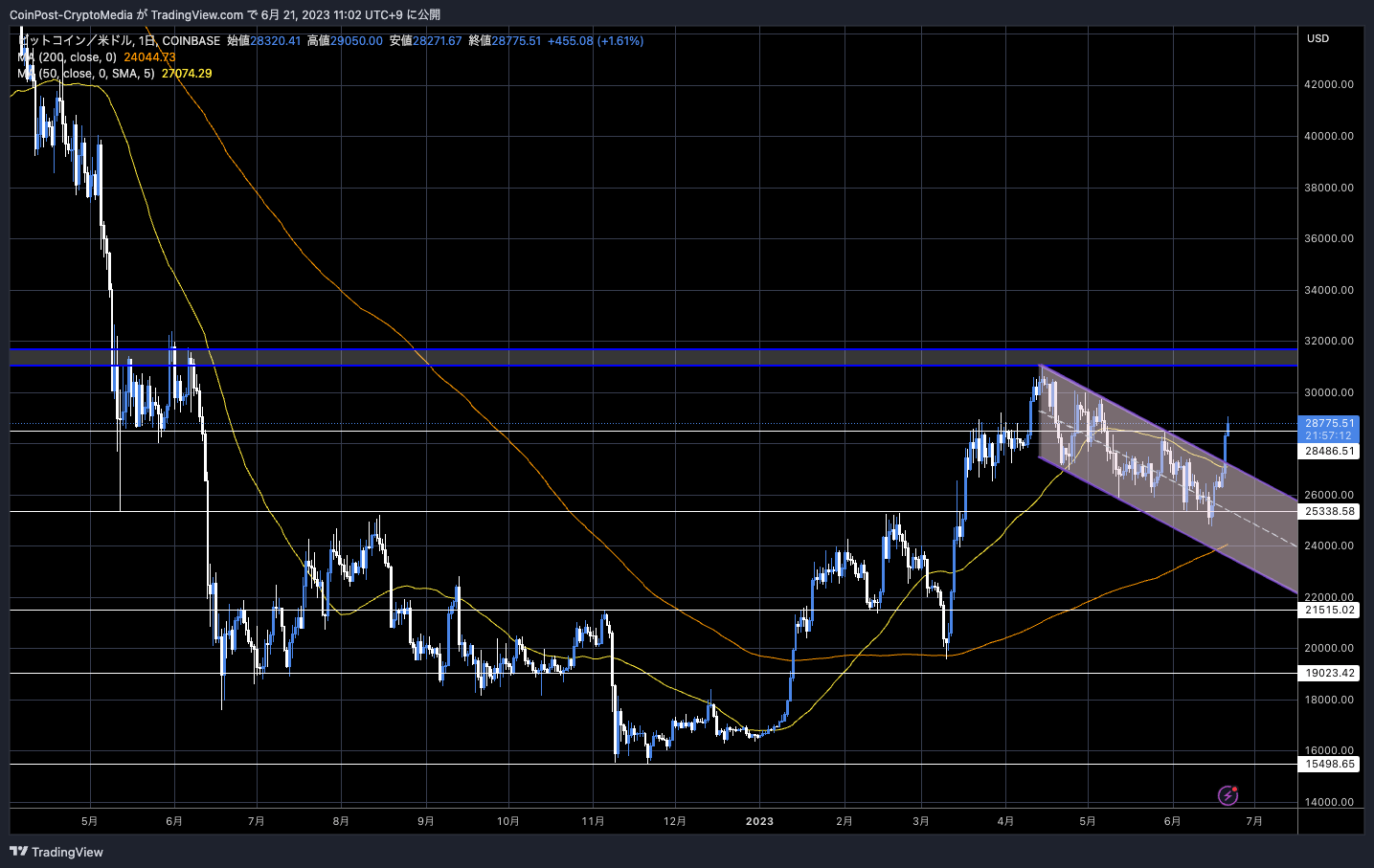

BTC/USD daily

Altcoins also rose across the board, but the rise and fall rate of Bitcoin is leading the market.

[Price Alert]

Bitcoin (BTC) continued to grow, recovering to the JPY 4 million level ($28,500).

The Yen-denominated high for the year was 4,118,000 on April 11th.

Related article https://t.co/QrXLPkmF0V pic.twitter.com/IgwJe4nNjB

— CoinPost Virtual currency media[WebX held in July](@coin_post) June 21, 2023

When BTC broke out of the 200-day moving average (200MA) of $27,000 and the resistance of the parallel channel that had been lowering since April, it strengthened its rising momentum and surged in the form of loss cuts (forced liquidation) of short positions. connected.

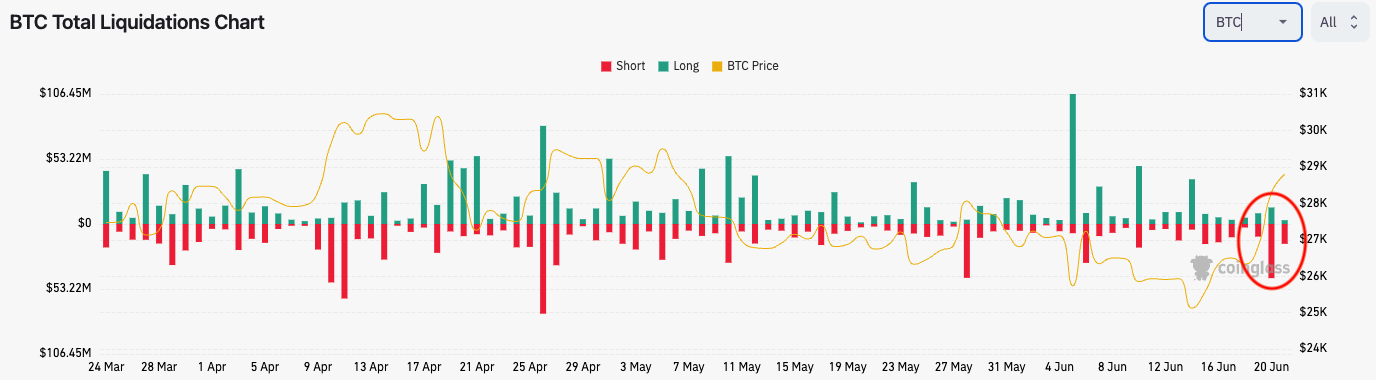

Looking at futures data in the derivatives (financial derivatives) market, positions equivalent to 6 billion yen have been burned due to the occurrence of a short squeeze (short selling), and as with the price movements at the beginning of the year, investors are becoming more down-looking. , It is pointed out that the possibility of doing the opposite of mass psychology.

coin glass

As of yesterday, “Bitcoin dominance,” which indicates the market share, exceeded 50%, the first level in two years, and an alt-drain phenomenon similar to the bottoming signal of past market cycles was also confirmed.

connection:Bitcoin Reversal Offensive, Dominance Exceeds 50% Level for First Time in 2 Years

The U.S. SEC (Securities and Exchange Commission) has sued Coinbase and Binance for selling unregistered securities, and designated many altcoins as securities. It is easy for funds to concentrate on bitcoin, which is recognized as a commodity, based on past statements by the SEC chief.

In Hong Kong, which China positions as a special administrative region, under the new licensing system, the momentum for crypto assets and the web3 area is rapidly increasing, including acceptance of bitcoin transactions by individual investors since June.

On this point, Arthur Hayes, former CEO of BitMEX, said, “Investors in Greater China are buying bitcoin ETFs listed on the Hong Kong Stock Exchange.” As war breaks out, the mass printing of banknotes will lead to a depreciation of the renminbi, forcing China’s wealthy to move their capital.” In May 2021, the Chinese government’s full regulation of crypto assets (virtual currencies) stopped the inflow of capital and flowed out to overseas countries such as the United States. If the attractiveness of long-term government bonds declines in the future, they should hold tail hedges such as stocks, gold, and cryptocurrencies.

China’s central bank has effectively cut interest rates (money easing policy) for the first time in about 10 months and has shown its intention to support the economy. It is also possible that demand for flight to assets will increase further.

connection:Huobi joins new local organization to make Hong Kong the world’s largest cryptocurrency market

The launch of “EDX Markets,” a non-custodial cryptocurrency exchange for institutional investors funded by a major Wall Street financial institution, was also well received. The actions of BlackRock and EDX Markets suggest that US regulators are not necessarily pessimistic.

connection:EDX Markets, a virtual currency exchange funded by Wall Street Financial, opens in the United States

GBTC price divergence sharply reduced

Meanwhile, it turned out that the discount (negative divergence) of the grayscale investment trust “Bitcoin Trust (GBTC)” is rapidly shrinking.

According to Wu Blockchain, GBTC price surged 11.44% on June 20, with trading volume surpassing $10 million, the highest level since November last year.

GBTC surged 11.44% on June 20, with a trading volume of $10.24 million, the highest trading volume since November 22 last year. GBTC has rallied more than 25% since BlackRock filed for a Bitcoin ETF like GBTC application. CryptoQuant shows that the current GBTC premium is…

— Wu Blockchain (@WuBlockchain) June 21, 2023

As a result, the GBTC discount to the spot market price is -34.19%. As of the 13th, it was -44.03%. In February this year, it had expanded to a record low of -46.9%, but since the announcement of the application for Bitcoin ETF (exchange traded trust) by BlackRock, the largest asset management company, buying has begun to stand out.

This comes as unconfirmed reports suggest that Fidelity, a major U.S. asset manager, is interested in bidding for Grayscale, a GBTC issuer owned by the Digital Currency Group (DCG), which is amid debt concerns. Arch Public co-founder Andrew Parish and others mentioned.

connection:Digital Currency Group and Genesis could break up on debt repayment plans

Fidelity has previously applied for a “Bitcoin ETF” in the U.S., and offers services to institutional investors in Canada through Fidelity Clearing Canada. In January 2010, it announced that it would incorporate its own bitcoin ETF into two funds it manages.

Fidelity’s total assets under management (AUM) reached $4.283 billion, making it the third largest asset manager in the world. In 2018, he founded Fidelity Digital Assets, a small company specializing in crypto assets.

GBTC aims to achieve investment results in which the BTC holding ratio per beneficiary certificate is linked to the Bitcoin market price. In the 2021 bull market, combined with demand for arbitrage trading, demand will surge, especially from institutional investors, and the premium will expand. It exceeded +40% at the peak in December 2009.

What is GBTC

A Bitcoin investment trust provided by Grayscale. GBTC is an investment trust linked to the price of Bitcoin and can be traded like ordinary stocks. It is offered to institutional investors and accredited investors recognized by the U.S. Securities and Exchange Commission (SEC), and has the advantage that investors do not need to buy, sell or hold actual Bitcoins.

CoinPost: Virtual Currency Glossary

CoinPost: Virtual Currency Glossary

However, after that, the exposure of institutional investors decreased sharply due to the significant deterioration of the overall financial market sentiment and the rise of other companies’ products such as the approval of Bitcoin futures ETFs. There are also specifications that cannot be redeemed directly from GBTC to BTC, and in turn, a large discount continued.

GBTC is a closed-end product that cannot be redeemed before maturity and cannot be canceled before maturity, so it may deviate from its intrinsic value. Refunds based on the net asset value are allowed for open-ended products, which makes it easier to contribute to more efficient price formation. However, it has not been recognized by the US SEC (Securities and Exchange Commission), and has developed into a lawsuit.

connection:Bitcoin investment trust GBTC litigation issue, proposal to eliminate negative divergence

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post GBTC’s “negative divergence”, which exceeds the 4 million yen level due to the soaring Bitcoin price, has decreased significantly appeared first on Our Bitcoin News.

2 years ago

231

2 years ago

231

English (US) ·

English (US) ·