Did you know that the debt of many countries, companies, and people around the world is on the rise? In particular, expenditures related to multiple wars, such as economic support for businesses and citizens due to the spread of the new coronavirus infection, the conflict between Russia and Ukraine, and the conflict between Israel and Hamas, have had a major impact, and are expected to increase rapidly worldwide. Continuing.

This article explains in detail the basic knowledge and trends of government debt and private debt, and when national debt becomes a problem, so you can learn the basic concepts and effects of debt issues.

table of contents- Global government and private debt is rapidly increasing

- Factors contributing to changes in debt ratio

- Cases where national debt becomes a problem

- Debt status of each country

- Excessive debt has a major impact on the country and its people.

1. Global government and private debt is rapidly increasing

Due in part to the response to the spread of the new coronavirus, global government and private debt is rapidly increasing to unprecedented levels. Among these, Japan's outstanding debt is at an outstanding level. Therefore, let me explain the trends in government debt and private debt around the world, comparing them with Japan.

1-1. Trends in government debt

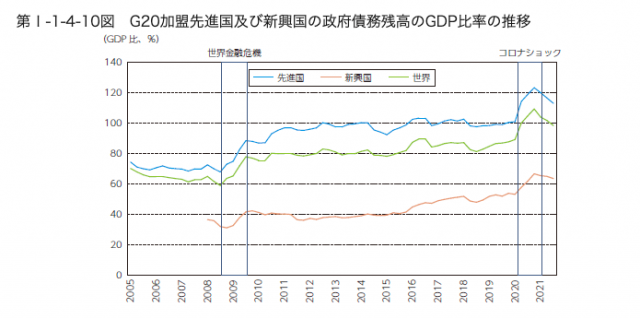

Looking at global trends since the 2000s, government debt has been rapidly increasing in many countries. In particular, debt levels are rising further due to increased fiscal spending by governments around the world in response to the spread of the new coronavirus.

Government debt:

The total amount of debt held by a country, including the outstanding balance of government bonds, short-term government bills, and national borrowings. It raises funds for the expenses necessary for people's lives and national management, such as social security, public works projects, and disaster recovery.

Generally, when looking at a government's debt situation, GDP (debt to GDP ratio) is used. The GDP ratio is the amount of government debt divided by the country's GDP (gross domestic product), and a high number indicates that the country has a large amount of debt.

Source: Overview of government debt | Ministry of Economy, Trade and Industry

Looking at the government debt of G20 member developed countries, we can see that it has been steadily increasing from 72.3% of GDP in 2008. Furthermore, the GDP ratio was 100.2% at the end of 2019, before the spread of infection, but it increased by 12.5% to 112.7% in September 2021. Even in emerging countries, it has continued to rise from 36.3% of GDP in 2008. At the end of 2019, it was 53.6%, and in 2021 it increased by 9.7% to 63.3%.

As an example, the table below summarizes the debt-to-GDP ratio by country during the period of the spread of the new coronavirus infection. We highlight the top two countries with the largest increases in developed and emerging countries.

■Debt to GDP ratio, top two countries in terms of increase

| Developed country | Canada | 80.6% | 103.7% | 23.1% |

| Developed country | Japan | 203.0% | 224.1% | 21.1% |

| emerging countries | India | 71.9% | 85.0% | 13.1% |

| emerging countries | South Africa | 57.8% | 70.4% | 12.6% |

Reference: Overview of government debt | Ministry of Economy, Trade and Industry

In addition, in many countries other than those listed above, government debt relative to GDP is increasing. Furthermore, the global debt-to-GDP ratio forecast by the IMF (National Monetary Fund) in April 2022 is expected to remain at a high level of 95.5% as of 2027, as the impact of Russia's invasion of Ukraine is unclear. It is expected that it will.

In developed countries, economic recovery through economic measures is expected to increase by 112.7% (as of 2027), and in emerging countries, the increase is expected to continue and reach 77.2%.

As described above, government debt is on the rise worldwide, and inflation is at a historically high level. In the future, depending on Russia's invasion of Ukraine and trends in the state of conflict in the Middle East, the impact on each country's economic growth and inflation, as well as the ratio of government debt to GDP, will likely change.

1-2.Trends in private debt

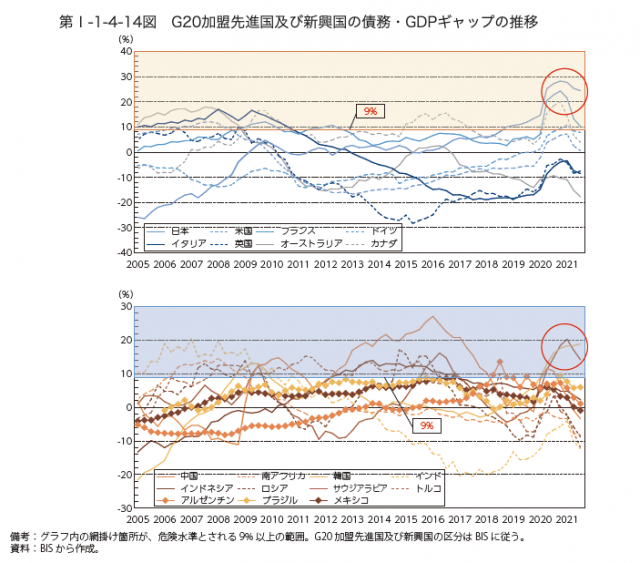

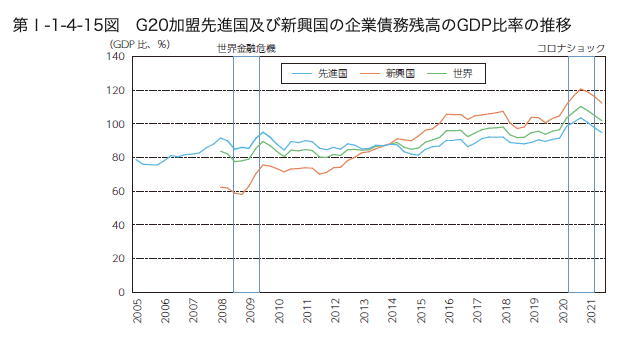

Private debt, which has improved steadily since the global financial crisis, is on the rise due to monetary policies implemented during the period of the spread of the new coronavirus infection. In order to keep the economy circulating, various interest rates have been suppressed, making it easier to borrow money, which is contributing to the increase in private debt.

Private debt:

Debt that includes corporate debt and household debt (individual). Specifically, this includes borrowings such as home loans and credit card loans, as well as corporate bonds issued by companies.

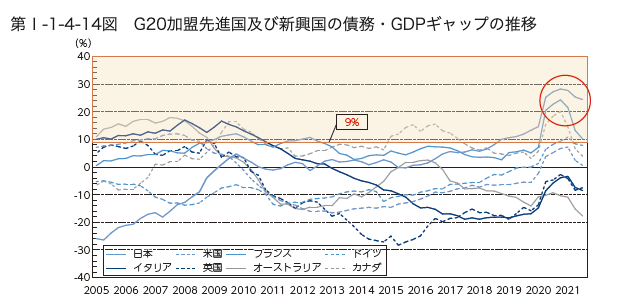

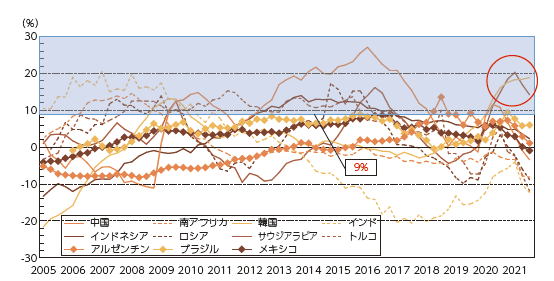

The Bank for International Settlements (BIS) says that if private debt increases faster than GDP growth, a financial crisis is likely. The figure below shows changes in the growth rate gap between debt and GDP. BIS predicts that if the gap deviates by more than 9%, there is a one-in-third chance of a financial crisis or major recession within three years.

Developed countries such as Japan, France, and Canada, and emerging countries such as South Korea and Saudi Arabia, have reached alert levels, and attention must be paid to future debt trends and economic measures to normalize.

Source: Overview of private debt | Ministry of Economy, Trade and Industry

– Corporate debt

The recent increase in corporate debt is against the background of worsening cash flow caused by the coronavirus shock and an environment of low interest rates. This is also related to the use of corporate bonds to raise funds in order to improve cash flow.

Source: Trends in corporate debt | Ministry of Economy, Trade and Industry

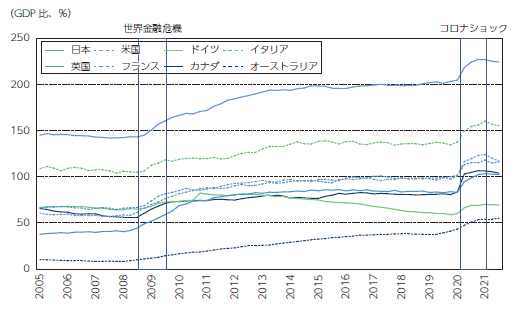

The growth rate of corporate debt as a percentage of GDP from the end of 2019, before the spread of infection, to September 2021 is shown in the table below. We have summarized the figures for the three major countries with the highest rate of increase.

■Three major countries with high growth rate of corporate debt as a percentage of GDP

| Developed country | Japan | 101.2% | 115.7% | 14.5% |

| Developed country | France | 149.7% | 164.0% | 14.3% |

| emerging countries | South Korea | 101.3% | 113.7% | 12.4% |

Reference: Trends in corporate debt | Ministry of Economy, Trade and Industry

2. Factors contributing to changes in debt ratio

Factors that cause the debt ratio to fluctuate include “changes in economic growth rates,” “high and unstable inflation,” and “impact on government, corporate, and household budgets.”

2-1. Fluctuations in economic growth rate

As the economic growth rate increases, the debt balance relative to GDP tends to decrease, and as the economic growth rate decreases, the debt balance tends to rise.

For example, increased economic activity and increased per capita income will lead to an increase in tax revenue. As a result, the government's financial situation will improve, its debt repayment capacity will be strengthened, and the debt ratio will fall. If the nation's economic growth continues, the need for new debt will be reduced.

However, when the economy is stagnant or shrinking, as it is in Japan, people's incomes decrease, and as a result, tax revenues also decrease. As a result, we will likely lack the financial resources needed to service existing debt or implement new policies, and will likely incur new debt. In this way, it can be said that stagnation in economic growth is closely related to a rise in the debt ratio.

2-2. High and unstable inflation

In addition, high and unstable inflation is a factor that causes fluctuations in the debt ratio.

Inflation is a decline in the value of fiat currency and a relative rise in the prices of goods and services. As inflation increases, more money is required to purchase the same goods.

Higher inflation rates cause raw material costs to rise, forcing companies to raise product prices. Consumers are forced to spend more to buy the same products as before. If companies are unable to pass on rising raw material costs to product prices, their profits will decline and they will incur new debt.

Furthermore, when inflation is volatile, it is difficult to accurately predict the rate of increase in prices. This situation may cause confusion throughout the economy, causing companies and individuals to refrain from economic activities. This reduces profitability and increases the risk of increasing debt. As a result, volatile inflation also contributes to pushing up debt ratios.

2-3. Impact on government, business, and household budgets

Furthermore, when a situation like the new coronavirus occurs that causes a stagnation of economic activity, the government is forced to spend large sums of money to provide support to businesses and individuals. Under these circumstances, it is necessary to provide support while the government's tax revenue is declining, and it is essential to raise funds using government debt.

However, increasing government debt inevitably places a burden on businesses and households in the form of increased taxes. This increased tax burden will lead to a decline in investment and consumption, leading to a slowdown in overall economic growth and stagnation in the long term.

In this way, stagnation in economic activity causes an increase in government debt, and increased debt puts constraints on overall economic activity, which can lead to a vicious cycle that causes the debt ratio to rise even further.

3. Cases where “national debt” becomes a problem

When a country's debt grows faster than its debt service capacity (GDP), it has a major impact on the economy as a whole. For example, if a country's debt continues to increase and its fiscal situation worsens, that country's creditworthiness will decline, potentially leading to excessive yen depreciation and rapid inflation. If the creditworthiness of government bonds declines, it may become difficult to secure investors and new borrowing may become difficult. If this situation continues to worsen, there is a risk that the country will eventually default on its debts.

Additionally, a situation where the increase in debt exceeds the growth in GDP can be expressed as the debt repayment burden being postponed. Postponing debt repayments may lead to problems such as reduced future spending on citizens and increased tax burdens. In addition, budgetary freedom is restricted, which may make it difficult to respond quickly to unexpected expenses such as large-scale disasters.

4. Debt status of the top two countries in the world's GDP rankings, the United States and China

As an example, I would like to introduce the debt situation of the United States and China, which are ranked first and second in the world's GDP rankings.

4-1. US debt situation

U.S. government and private debt are trending upward. For example, the U.S. government debt as a percentage of GDP increased by 16.8% from the end of 2019 to September 2021, during the period of the spread of the new coronavirus. The main reason for the increase is likely to be the payment of benefits to businesses and households affected by the spread of infection.

Source: Overview of government debt | Ministry of Economy, Trade and Industry

Debt continues to increase in the United States, and in 2023 the debt ceiling problem will occur, reaching the maximum amount of government debt that the United States can issue. The bill to freeze the debt ceiling was passed in June 2023, so there was no major impact. However, if the debt ceiling is actually reached, it will have a major impact on government agencies, such as the inability to pay the salaries of government employees and the closure of government-managed facilities.

Ultimately, there is a risk of a “default” in which interest payments and redemptions on government bonds cannot be made. It has been pointed out that the United States' fiscal and debt problems have been worsening over the past 20 years, and the US bond rating has been lowered by one rank from the highest rating, “AAA'', to “AA+''.

Source: Overview of private debt | Ministry of Economy, Trade and Industry

Also, like government debt, private debt has increased during the coronavirus pandemic. Companies used corporate bonds to raise funds due to worsening cash flow, and the amount of corporate bonds issued increased 1.3 times from $120 million to $150 million.

Additionally, in the United States, with the establishment of a telework environment, more people are moving from urban areas to regional cities to prevent coronavirus infection, and mortgages are increasing. Additionally, U.S. household debt has increased as soaring car prices have made it necessary to borrow more.

4-2.China's debt situation

China's debt situation has increased rapidly in recent years.

Many local governments in China rely on income obtained from the transfer of land use rights, but real estate income has plummeted due to the slump in the real estate market. However, local governments' finances deteriorated rapidly due to excessive investment in infrastructure and increased spending related to coronavirus countermeasures.

Furthermore, local governments have a large amount of debt due to mature by 2027, and the burden is likely to increase in the future.

Source: Overview of government debt | Ministry of Economy, Trade and Industry

China's private debt increased by 10.2% from the end of 2019 to September 2021, from 57.4% to 67.6%. Specifically, corporate debt increased by 5.4% from 150.1% to 155.5%, and household debt increased by 6.1% from 55.5% to 61.6%.

Source: Overview of private debt | Ministry of Economy, Trade and Industry

Chinese companies are also facing worsening cash flow due to the spread of infection, with corporate debt increasing 1.4 times from $1.2 trillion to $1.6 trillion.

As of September 2022, China's total debt has reached 295% of GDP, exceeding the US's 257%. Household debt as a percentage of disposable income is now 110%, a level close to that around the 2008 global financial crisis. It must be discontinued as it may lead to financial instability and economic deterioration in the future.

5. Excessive debt has a major impact on the country and its people

In this article, we explained global debt trends, factors that change the debt ratio, when national debt becomes a problem, and the debt situation of the United States and China.

Adequate debt is essential to protect the economy and people's lives. However, debt that exceeds the growth of GDP (debt repayment capacity) has a significant impact on the entire economy. As an investor, we recommend that you always keep a close eye on trends in national debt, as there is a risk that this will affect a nation's creditworthiness and ultimately lead to default.

NISA, virtual currency related stocks special feature

The post Global Debt Issues What is “national debt”? | Explaining the factors that change the debt ratio and the situation in each country appeared first on Our Bitcoin News.

1 year ago

89

1 year ago

89

English (US) ·

English (US) ·