Silicon Valley dreams of unicorns. Thinking big fuels the entire startup ecosystem, and overall, it’s a very good thing.

But product-market fit is hard to get right. When it’s not quite there, we all know what to do: pivot. Still, not every startup is destined to go all the way, especially right now.

So what if “going long” isn’t on the cards, no matter how much you pivot? Promising young companies that need financing but can’t command good market value are caught between the devil and the deep blue sea: On one hand, you can take a down round, which hurts everyone; on the other, you can protect your valuation, but you risk sinking with the ship.

Living through four major downturns has taught me that “winning” and “losing” are not the only possible outcomes. When you can’t quite make it to product-market fit, there’s a third choice that too many entrepreneurs, and their investors, overlook: selling out.

You can think of it as playing “the short game,” and it should always be an option.

How can founders decide whether to go long or short?

Founders often feel they have to become a unicorn to do right by their constituents. In reality, sometimes playing the short game delivers more value to founders, investors, employees and the acquiring company than the long game ever could.

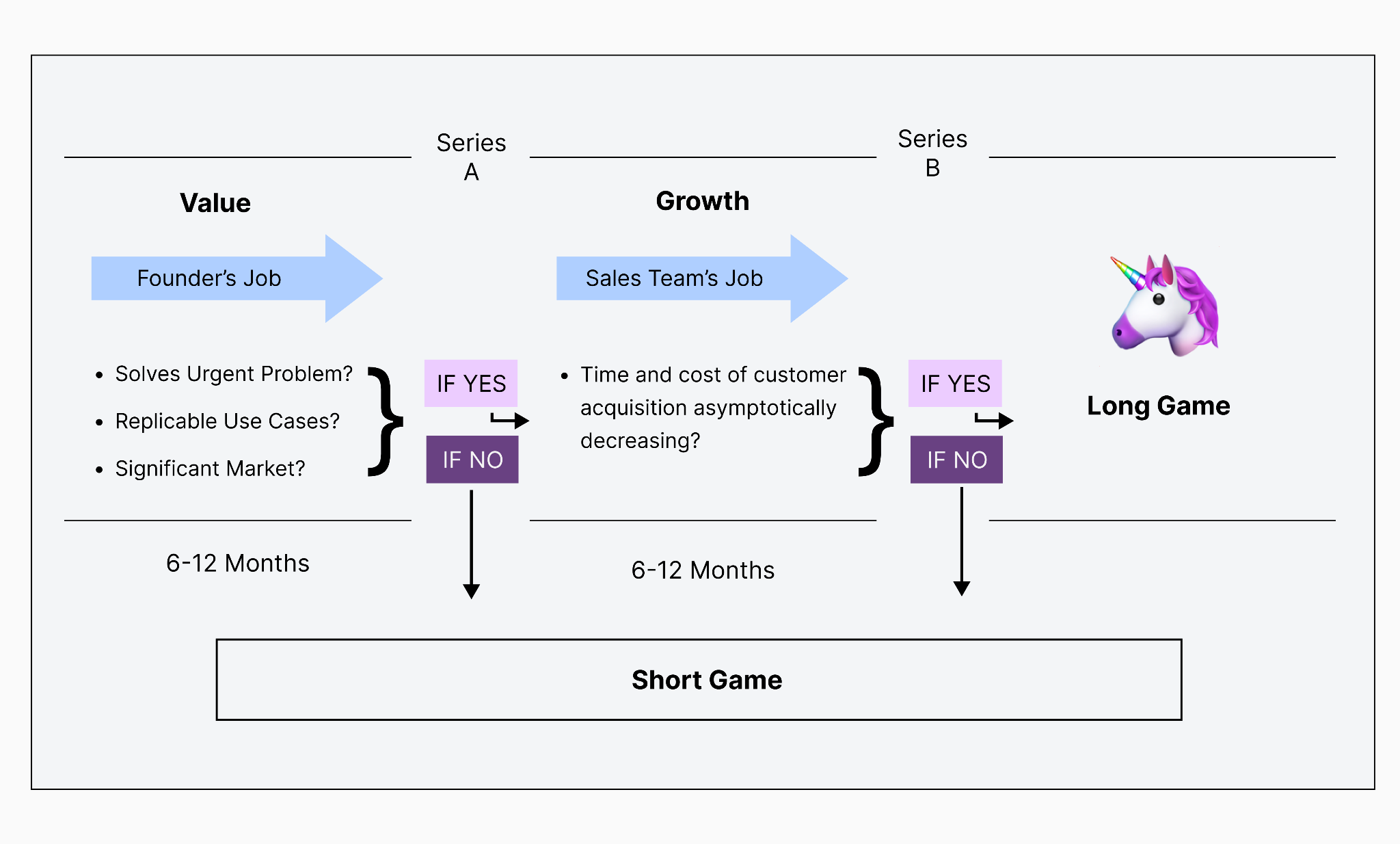

How can you choose? While it isn’t a trivial decision, it’s also not as hard as you might think. The answer has been hiding in plain sight ever since Steve Blank and Eric Ries first defined in “The Lean Startup” the concept that Andy Rachliff later canonized as “product-market fit.” There are only two gates: value and growth.

Value

First, you need to validate your “proof of value.” Does your solution solve a “hair on fire” problem that customers can’t live without? Are there replicable use cases a significant number of customers have? To establish proof of value, founders need to be out there, confirming that their solution is something customers really need and will pay for.

If you don’t have clear, positive market feedback by the time you reach Series A, take it as a sign. Pivot big or start looking for the exit.

Growth

Next, address your growth hypothesis, the “proof of market”: Do you have a sales model that allows you to economically acquire customers at a pace and volume high enough to expand your business?

While proof of value is a job for the founders, sales teams should be trained to build proof of market effectively so that you can scale. If both the time and cost of acquiring your next customer is asymptotically decreasing by the time you are approaching your Series B round, it’s strong evidence that you have established proof of market.

If not, it could be time to go short.

Image Credits: Neotribe Ventures

If the chart above helped you determine that going short makes sense, you’re probably asking yourself: Where do I start? How do I decide which buyers to go after? What can I do to attract their attention without scaring off customers and potential investors? How can I negotiate from a position of strength and get good value? What should I do if none of that works?

Here are my thoughts:

Make yourself attractive to buyers

Go long or go short? A VC reveals when it’s time to sell and how to maximize buyer interest by Ram Iyer originally published on TechCrunch

English (US) ·

English (US) ·