Google’s venture capital arm Gradient Ventures has made another foray into Europe, investing as part of a $3.2 million seed round in two-year-old German startup Weflow.

Weflow is the latest in a line of ecosystem startups to emerge from frustrations with using the omnipresent CRM (customer relationship management) software that is Salesforce. These venture-backed upstarts focus on things like providing data backups or improving lead generation, while just last week a new company called Unaric emerged out of stealth with $35 million for the express purpose of buying and consolidating Salesforce-ecosystem startups.

Yes, Salesforce-focused tools are big business, with some estimates pegging the market value at four times that of Salesforce itself.

Weflow, for its part, is setting out to improve sales teams’ efficiency, pipeline visibility, and general “Salesforce data hygiene,” according to Weflow co-founder and CEO Janis Zech who likens his platform to something akin to “Notion for revenue teams.”

“[The main problem we solve is] helping companies to forecast their pipeline accurately — this typically requires capturing sales data, both structured and unstructured, surfacing deal insights, and pipeline analytics to run forecast predictions,” Zech explained to TechCrunch.

Show me the data

The ultimate problem that Weflow seeks to fix is that of the sheer spread of data across the B2B sales sphere, spanning the countless meetings, emails, and calls leading to a deal’s conclusion. Weflow promises to bring this data together within a coherent structure to deliver insights.

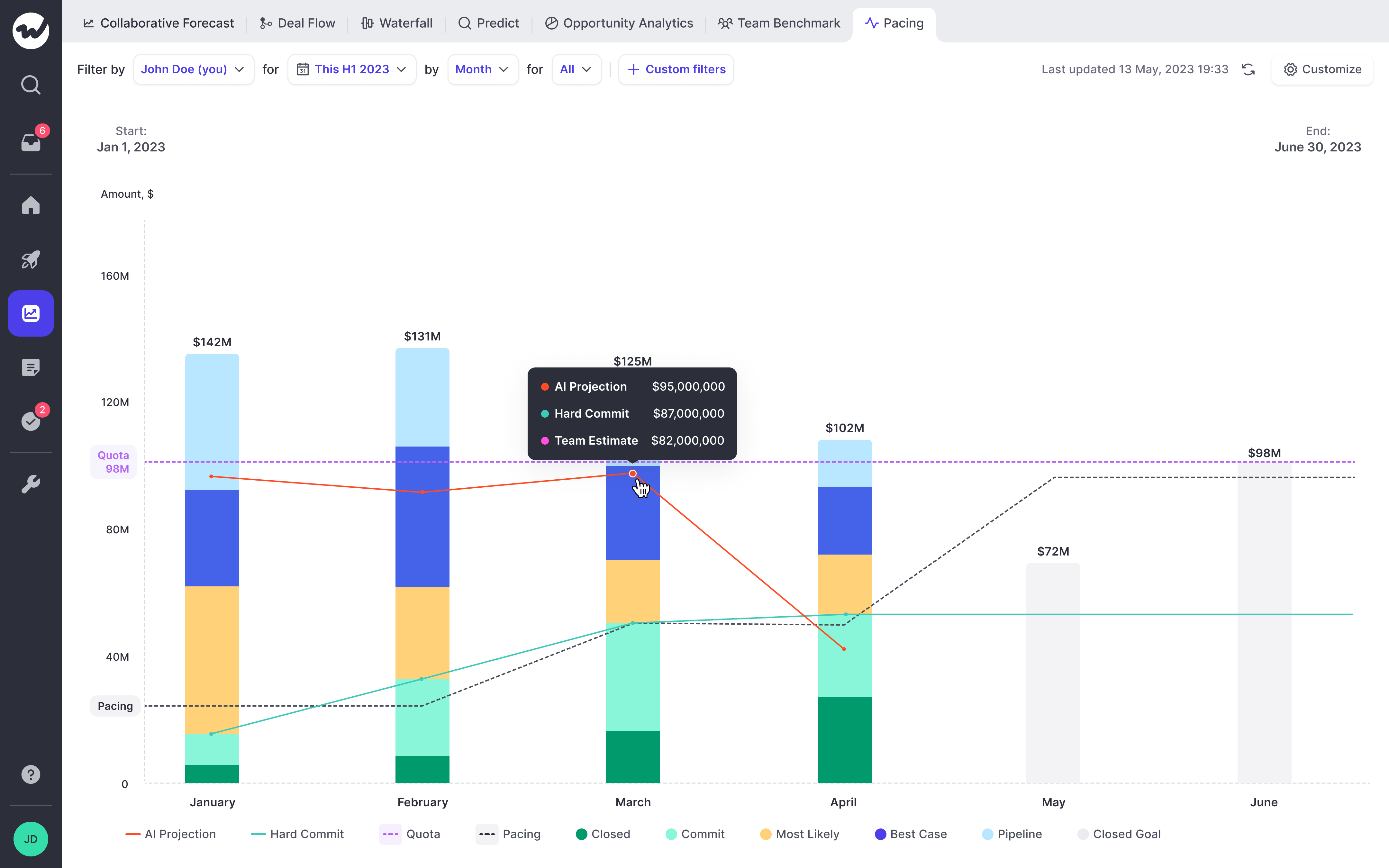

To do this, Weflow has developed what it calls a “revenue workspace,” pitched as an all-encompassing platform that allows companies to capture CRM data while serving up deal insights and tools for managing their sales pipeline. More recently, the company introduced collaborative forecasting and pipeline analytics, too.

Under the hood, Weflow uses AI to allocate what it calls a “deal score,” which is effectively a prediction that considers things like buying signals, sales activities, and historical data to forecast the likelihood of a deal closing. In the future, Zech says the platform will also lean on AI to forecast future revenues, as well as leverage unstructured email data and even video/call transcripts to uncover hidden deal insights.

Forecasting in Weflow Image Credits: Weflow

‘Salesforce fatigue’

Although Zech and his two co-founders, Henrik Basten and Philipp Stelzer, launched Weflow in 2021, the Berlin-based startup has been years in the making, built on frustrations Zech experienced at an adtech startup he founded in 2009 called Fyber (then known as SponsorPay).

“Experiencing severe ‘Salesforce fatigue’ at Fyber, we realized CRMs have become clunky infrastructure, not places to effectively work on deals and drive sales performance,” Zech said. “It’s a problem that affects most companies’ top lines.”

Zech eventually sold Fyber for €150 million in 2014, and in the intervening years he invested both as an angel and partner at Point Nine Capital. More recently, he co-founded a startup studio that birthed a company called Back, which Gradient Ventures also invested in before it was acquired by Personio last May.

As for Weflow, there are clear similarities to other tools on the market already, including venture-backed Salesforce ecosystem company Scratchpad, and revenue forecasting unicorn Clari. According to Zech, Weflow’s main selling point over incumbents in the space include per-user pricing transparency (e.g. Clari seemingly only offers a “get quote” button, while Scratchpad invites would-be customers to “schedule a demo”). Additionally, Weflow offers workflow tools such as a task manager, notepad, and a Chrome extension to easily integrate with Gmail and Google Calendar.

The Google factor

Securing Google’s VC off-shoot as a lead backer is a major coup for any young startup, opening doors to potential new partners, customers, among other commercial benefits.

While the lion’s share of Gradient’s investments do hail from the U.S., it’s no stranger to the European startup scene. Last month, we learned it had invested in Versed, a Dutch startup developing tools to help anyone create video games using generative AI. And last year it backed U.K. insurance tech startup Penny, as well as Germany’s Gigs which wants to make it easier to launch a mobile network.

Prior to all this, Gradient has also invested in Denmark’s Contractbook; Kaizo from the Netherlands; Finland’s Oura; and, as noted, Germany’s Back Technologies.

Prior to now, Weflow had raised $2.7 million in pre-seed funding back in 2021, and with its fresh cash injection it said that it’s looking to further invest in its AI efforts, bringing it to other areas of its platform.

Aside from lead investor Gradient Ventures, Weflow’s seed round included contributions from existing investor Cherry Ventures, Hello World, and several angel investors.

Google’s Gradient Ventures backs Weflow to bring greater hygiene to Salesforce data by Paul Sawers originally published on TechCrunch

English (US) ·

English (US) ·