As concerns widen around its parent company, Digital Currency Group, Grayscale’s Ethereum and Bitcoin trusts have fallen to record discounts.

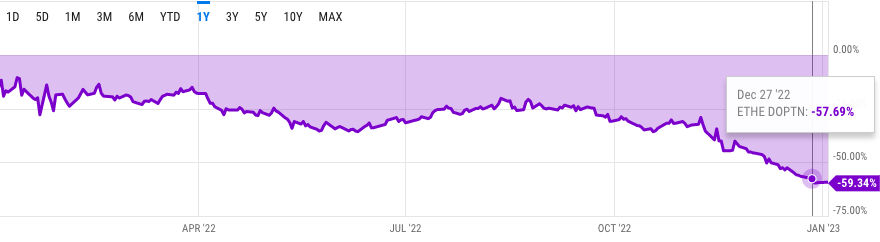

The Grayscale Ethereum Trust (ETHE) is currently trading at a significant discount of almost 60% to the value of its underlying assets. This follows a 93% decline in share value from its all-time high in June 2019. The Ethereum Trust is Grayscale’s second-largest offering, with $3.7 billion in assets under management and a holding of approximately 3 million ETH, or 2.5% of the total Ethereum market capitalization.

There are various factors contributing to this ongoing decline, but recent concerns have emerged about the potential impact on Grayscale assets from the approximately $1.675 billion debt owed by parent company Digital Currency Group to the troubled crypto lender Genesis.

Related: Gemini sends a letter to DCG

According to data from YCharts, ETHE has traded at this discount level since December 28th.

Discount or Premium to net asset value Chart

Discount or Premium to net asset value ChartDB crypto influencer tweeted an all-Grayscale trust table. Grayscale’s trust funds are experiencing a wide range of discounts, with the Ethereum Classic Trust being the most heavily impacted at a 77% discount, followed by the Litecoin Trust at 65% and the Bitcoin Cash Trust at 57%. The Ethereum Trust is trading at a 59.34% discount, while the Grayscale Bitcoin Trust (GBTC) is trading at a 45% discount. Only the Filecoin Trust and the Chainlink Trust are currently trading at premiums, at 108% and 24%, respectively.

Grayscale’s Bitcoin Trust has over $10.5 billion in assets under management and has seen a 65% decline in the past year. The Bitcoin Trust holds more than 630,000 BTC and could see renewed interest if the Securities and Exchange Commission approves its conversion to a spot exchange-traded fund. However, it is currently uncertain if this will occur due to the current state of the cryptocurrency market and regulatory environment.

2 years ago

127

2 years ago

127

English (US) ·

English (US) ·