Grow, a digital asset management company based in Singapore, entered the Japanese lending market in February with a high rate of “bitcoin lending, 8% annual fee”. What we are launching is a straightforward message of “Make Crypto Simple”. As the name suggests, the smartphone app for trading is extremely simple and easy to use.

From the sense of living in a long-lasting low interest rate era, the fact that “bitcoin lending is 8% annual fee” may surprise you. In fact, this is a fairly high rate among cryptocurrency lending services. How do they make this service possible? We asked CEO Sean Kim to share his secrets.

The interview was mainly conducted in English, but from time to time, very natural Japanese phrases popped out of the mouth of CEO Kim, who is from South Korea. In fact, CEO Kim has a “strong feeling” for Japan, which is also behind the launch of this service.

A “simple” service that can be used with a smartphone app

Now, before talking about CEO Kim’s connection with Japan, let’s first introduce the lending service developed by GROW.

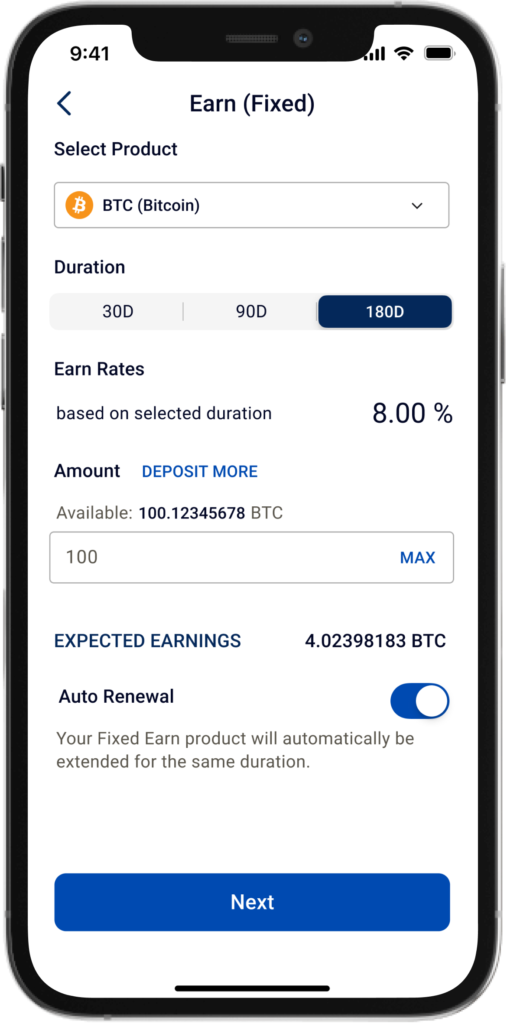

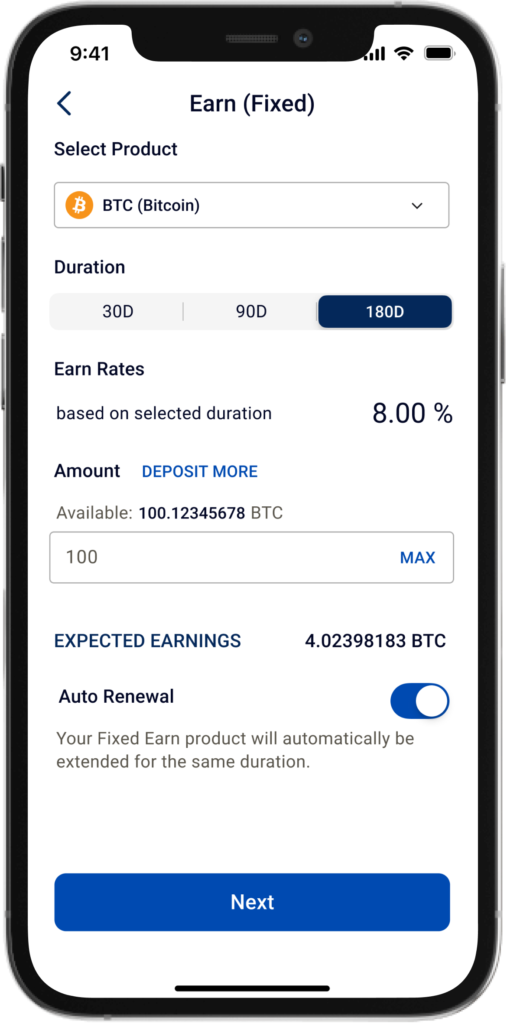

Here is a capture screen of GROW’s smartphone app. When lending Bitcoin (BTC) for 180 days, information is displayed that you can receive a reward at a rate of 8% per year. The simple service content will be conveyed from this screen.

There is also flexible lending that can be withdrawn at any time without a fixed period, and even in that case, the reward is 3% per year in Bitcoin (BTC). While other companies’ services in Japan have seen cases where the rental fee is 3% for a fixed term lending of 30 days, the rate is one step further.

Another strength is the speedy payment of remuneration. It is a design that is pleasing to the user that it is automatically “compounded” at a high frequency of “4 times a day, every 6 hours”.

In addition to Bitcoin (BTC), Ethereum (ETH), USDT, USDC, etc., are compatible with a total of 9 or more crypto assets. The reward rate also varies depending on the lending period and the type of crypto assets.

Where is the “secret” to achieve a high rate?

Well, when it comes to high-rate services, what comes to mind is “safety”. Earning a consistent 8% annual return on investments is not that easy. How does GROW achieve its 8% annual fee rate?

According to the CEO, GROW’s lending service has been used for 2 years since its launch, and has been used by people in 150 countries around the world. It has a track record of over 10,000 staking transactions. On the other hand, he said, “there was never a single time,” such as not being paid, or being unable to withdraw cash.

A major feature of GROW is the policy of not using DeFi.

CEO Kim said, “As a company that handles crypto assets, we are very careful about risk management. I think the risk is too high,” he said.

At GROW, most of the crypto assets entrusted to us by our customers are managed through arbitrage. Cryptocurrency arbitrage is a method of making profit by taking advantage of price differences between various exchanges. It requires a high degree of expertise to operate successfully. GROW is responsible for that.

In general, arbitrage trading, which earns a profit margin from interest rate and price differences, has an image of “low risk, but low profit”. However, CEO Kim said, “In the case of crypto assets, there are still big opportunities sleeping.”

“GROW is a company of about 20 people, but we have gathered the best members with more than 10 years of experience in the industry, such as Goldman Sachs and PwC. It’s a service,” said CEO Kim proudly. He himself studied financial engineering at a graduate school in the UK and has industry experience at PwC and Credit Suisse.

In Singapore, the “Payment Services Act 2021 Amendment (PSA2021)”, which requires crypto trading companies to obtain licenses, has been enacted and is currently awaiting enforcement. In response to this, CEO Kim said, “Since last year, we have spent time and effort on internal preparations to meet the new standards. We are waiting for

Why “Japan” Now?

By the way, why would such GROW dare to be “Japan” at this timing?

“The Japanese market is very attractive,” said CEO Kim. The biggest reason is that “Japanese cryptocurrency users have a deep understanding of the transparency and liquidity of Bitcoin and the mechanism of PoW, and have strong expectations for its future potential.” In other words, there are many users in Japan who have high hopes for the future potential of Bitcoin and are determined to “hold” it even if there are some price fluctuations.

If “HODL’s resolution” is decided, the price fluctuation risk during the loan period is within the assumption. Considering the use of lending is a natural flow. But with lending providers such as BlockFi, Celusius and FTX going bankrupt, users may be confused.

CEO Kim said:

“In a nutshell, the cause of their bankruptcy was ‘excessive risk-taking.’ We have created a mechanism.We want to deliver to everyone in Japan ‘an easy way to earn money with global-level crypto assets.'”

CEO Kim also pointed out the “affinity” between crypto assets and Japanese users.

“I think one of the reasons why Japanese users have such ambitious knowledge is that the cryptocurrency itself has a strong link with Japan in the first place. Nakamoto”.There are many names that originated in Japan, such as SushiSwap and Shiba Inu Coin.This is a manifestation of the fact that cryptocurrency users around the world have some form of respect for Japanese culture.On the contrary, it is Japan. For people, it has the secondary effect of being friendly and making names easier to remember.”

We expect that these various points will continue to have a positive psychological effect on the use of “crypto assets” in Japan. The fact that Japan owns various world-class content IP such as manga, anime, and games, and the development of GemiFi and NFT, etc., is a unique strength that is different from other areas. It seems that there is

By the way, there are personal circumstances behind CEO Kim’s great interest in the potential of the Japanese market. CEO Kim is from South Korea, but he married a Japanese woman. Over the course of her ten years of marriage, she has learned about Japanese culture from many angles.

“Family conversations are basically in Japanese, and we eat a lot of Japanese food. My children also go to Japanese school. I often go to Japan to meet my parents-in-law. A special place,” emphasizes Kim. The fact that Japanese phrases come out naturally even during interviews in English means that he uses Japanese on a regular basis.

CEO Kim recalls, “I myself grew up reading ‘Slam Dunk’, and I was exposed to Japanese culture and ways of thinking through various contents such as Japanese anime, manga, and games.” I often go to Yokohama because of my family, and my favorite ramen is a “family lineage” that originated in Yokohama.

Against this background, GROW sees the service development in Japan as something special, not just “the 151st country”. CEO Kim said, “For this time, we have created a team of native Japanese speakers. We will focus on user support, tutorials, and information dissemination in Japanese, such as blogs and SNS.” He expressed his desire to open up the market.

GROW Japanese version Twitter is here

|Text and editing: Coindesk JAPAN Editorial Department Advertising Production Team

|Image: coindesk JAPAN, UFI PTE.LTD. (GROW)

The post GROW enters Japan with bitcoin lending “8% annual fee” ── CEO talks about the secret of high rate and thoughts on Japan | coindesk JAPAN appeared first on Our Bitcoin News.

2 years ago

113

2 years ago

113

English (US) ·

English (US) ·