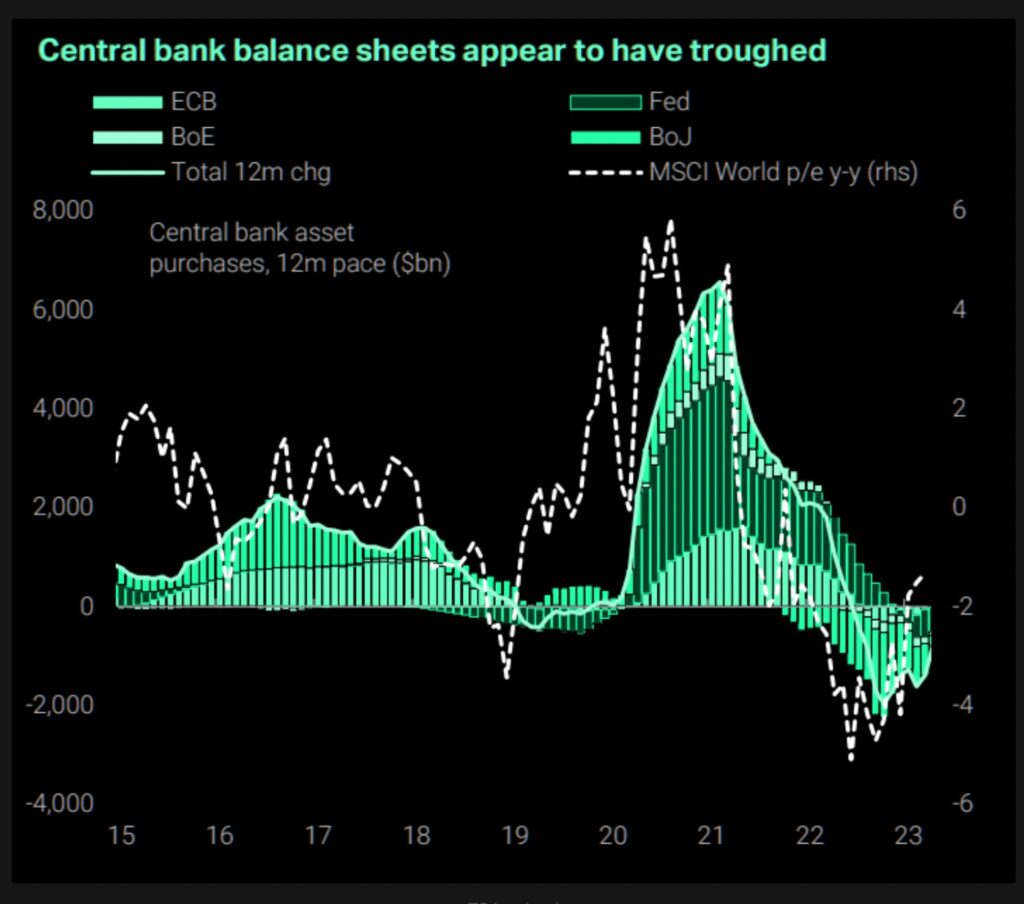

The world’s major central banks appear to have halted balance sheet reductions that began in 2022 to curb inflation.

The so-called Quantitative Tightening (QT) has recently ended and the balance sheets of major central banks – the US Federal Reserve (Fed), the European Central Bank (ECB), the Bank of England (BOE) and the Bank of Japan (BOJ) (according to data from macroeconomic research firm TS Lombard, published in the newsletter The Market Ear).

“It could be a tailwind for the market,” The Market Ear wrote in its April 13 newsletter. The expansion of central bank balance sheets is believed to be bullish for risk assets such as Bitcoin.

It remains to be seen whether the Fed’s recent expansion of lending to financial institutions in the wake of bank failures will lead to new money creation. Meanwhile, the Bank of Japan has continued to expand its balance sheet through bond purchases, compensating for the contraction of the ECB and BOE.

China’s credit impulse has picked up recently, showing signs that lending is picking up again.

Related Article: China’s ‘Credit Impulse’ Rising, Is It a Tailwind for Bitcoin?

TS Lombard, The Market Ear

TS Lombard, The Market Ear|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: TS Lombard, The Market Ear

|Original: World’s Most Influential Central Banks’ Balance Sheets Look to Have Troughed

The post Has the balance sheet of major central banks turned to expansion | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

93

2 years ago

93

English (US) ·

English (US) ·