The largest crypto exchange by volume (Binance) and the third largest crypto exchange by volume (FTX) faced off in recent days after Binance CEO Changpeng “CZ” Zhao tweeted that his exchange would slowly withdraw billions of its holdings in FTX’s native token, FTT, “due to recent revelations that have came to light.”

But first, let’s take a few steps back.

Concerns surrounding FTX’s liquidity grew following a Thursday report from CoinDesk about the balance sheet of Alameda Research, a crypto trading firm once run by FTX CEO Sam Bankman-Fried. Alameda holds $14.6 billion in assets with $8 billion in liabilities as of June 30, CoinDesk reported.

The report showed Alameda’s largest asset was about $3.66 billion of “unlocked FTT” and $2.16 billion of “FTT collateral.” (FTT is the token behind FTX.) This means the $5.82 billion in total FTT that Alameda owns is equal to 193% of the total known FTT market cap, which is about $3 billion, according to CoinMarketCap data.

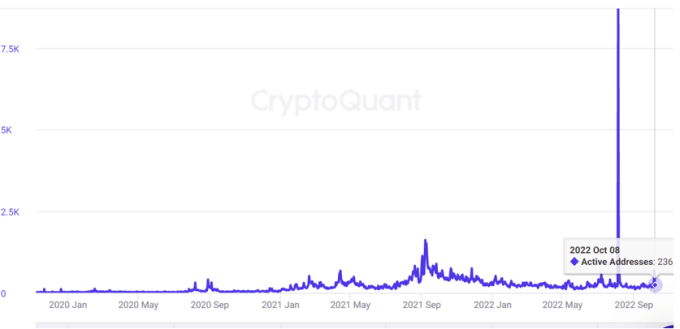

Image Credits: CryptoQuant (opens in a new window)

“The issue is that Alameda cannot sell even small amounts of their FTT holdings without heavily impacting the price,” Marcus Sotiriou, an analyst at the publicly listed digital asset broker GlobalBlock, said in a note. “Data from CryptoQuant […] tells us that there are only around 200-300 active addresses trading the FTT token, which is very small in comparison to many other large caps. Hence, large sell orders would crash the FTT price, due to being illiquid.”

Here’s the rundown on the Binance and FTX fiasco by Jacquelyn Melinek originally published on TechCrunch

English (US) ·

English (US) ·