Highbeam, a startup that provides banking features, credit and cash flow insights to e-commerce customers, today announced that it raised $10 million in debt from TriplePoint as it looks to expand the reach of its digital product portfolio.

Co-founders Samir Shergill (previously at Microsoft, McKinsey and AppNexus) and Gautam Gupta (formerly of Shopify, Venmo and Alloy) spent years working with e-commerce firms to help them scale. Together, they arrived at the conclusion that while online brands have been built to maximize revenue growth, aided by a surge in tech and marketing solutions, e-commerce is inherently capital-intensive and low-margin. The missing link to building a sustainable business, they believed, was effective cash management and responsible credit utilization.

“Having seen firsthand the frustration dealing with legacy banks, accounting firms and predatory cash advances, we decided to build a banking platform for e-commerce that allows brand operators to manage cash flow in real time, access fair and transparent credit and grow profitably,” Shergill said.

To that end, Highbeam — which typically works with “founder-led” companies with greater than $1 million in revenue — provides a range of financial services and tools centered around e-commerce brand needs. Using the platform, customers can create bank accounts, take advantage of free wire transfers and get a debit card with 2% cash back on all purchases. (Highbeam works with Blue Ridge Bank to provide the banking services and debit card and The Currency Cloud on payment services.) Via a dashboard, Highbeam also shows insights and forecasts on business expenses (e.g. inventory, hiring and sales acquisition), leveraging algorithms that automatically categorize revenue and spend transactions.

The metrics go deeper. Highbeam’s “vendor view” gives brands a real-time overview of where, exactly, their money is going. Spend tracking analytics alert customers as vendor costs fluctuate, giving them a chance to manage expenses before they become too overwhelming.

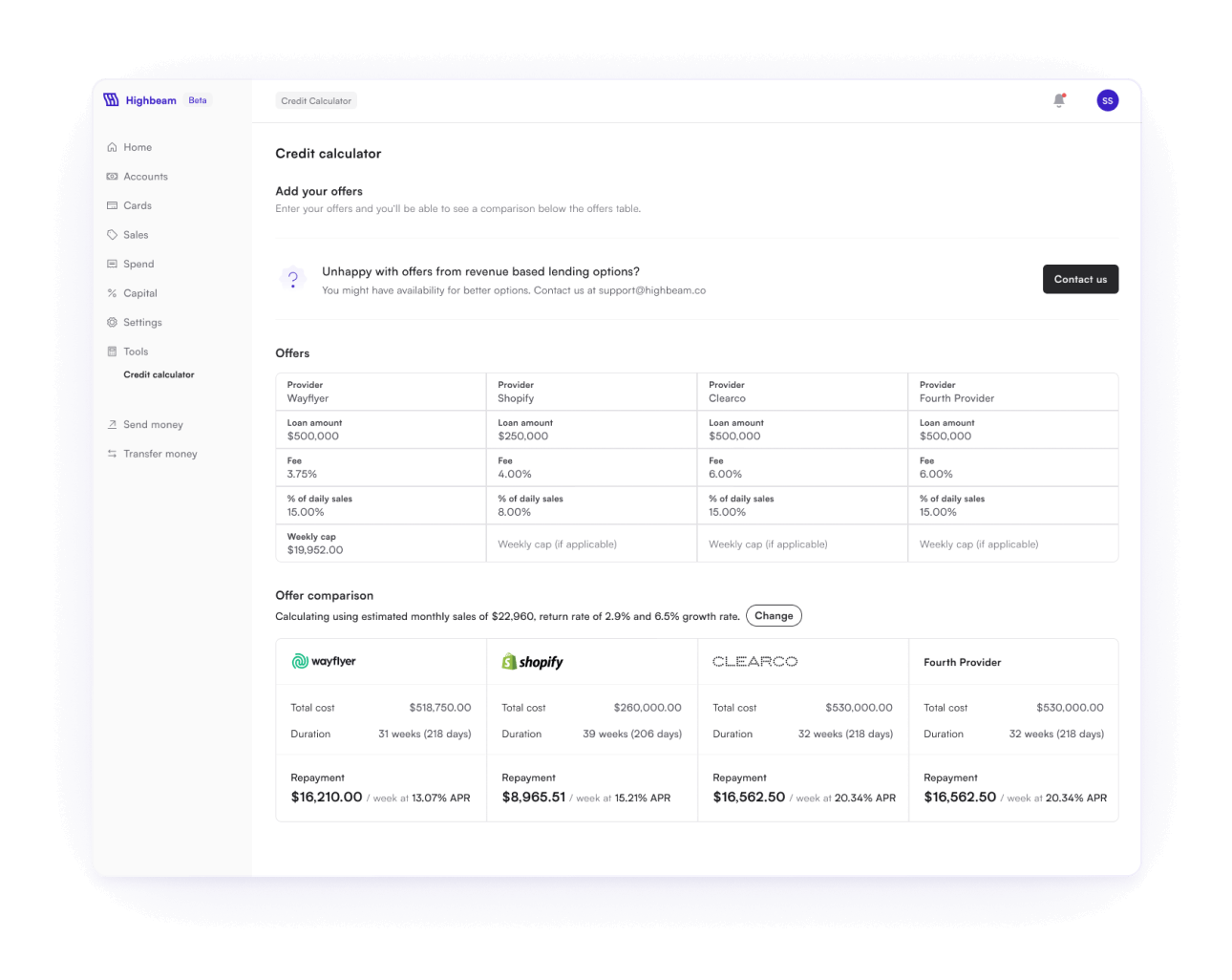

Highbeam’s analytics dashboard for e-commerce.

Highbeam’s credit product is a flat-rate, revenue-based line of credit that lets customers draw down and pay back loans on-demand. Shergill argues that it’s a major differentiator in that it’s “fair and flexible” versus a fee-based merchant cash advance, which tend to be more expensive and rigid in their terms.

For context, Highbeam rival Wayflyer adopts a similar approach to e-commerce loans — using analytics and sending merchants cash to make inventory purchases or investments in their business. Merchants repay the loans using a percentage of their revenue until the money is paid back; merchants are using their revenue to get financing, hence the term revenue-based financing.

The advantage, companies like Highbeam and Wayfler claim, is that retailers make repayments as a percentage of their sales. If they have a slow month, they’ll pay back less.

“For many brands, today’s economic headwinds have led to significant uncertainty around sales and inventory planning,” Shergill said. “Highbeam’s e-commerce focus helps brands establish strong financial fundamentals by making effective cash planning and spend management easier.”

Highbeam sees itself competing with a wide range of fintech vendors including merchant cash advance providers like Shopify Capital (and also the aforementioned Wayflyer, Clearco and Onramp Funds); spend management and accounting services like Quickbooks; and corporate card firms such as Ramp and Brex. Ambitious? Perhaps — particularly for a firm with only $7 million in capital under its belt. (Highbeam raised $7 million last spring from Mayfield and FirstMark.) But Shergill insists that Highbeam’s expanding at a rapid clip, notching 30% growth year-over-year and annual cash flow in the hundreds of millions.

Certainly, Highbeam’s market — e-commerce — shows no sign of slowing down. Statista estimates that revenue from U.S.-based e-commerce hit $905 billion in 2022 and predicts that it’ll reach $1.78 trillion by 2027. Online shopping remains one of the strongest and fastest-growing digital sectors, spawning multimillion-worth new businesses every year; a separate Statista report found that unicorn e-commerce startup companies made up an industry of almost $114 billion in 2021.

“We’ve grown mainly through customer referrals but will now ramp up hiring in our sales and customer success functions,” Shergill said. “Highbeam’s core value proposition is to help brands make smarter decisions around profitability and cash flow, which is a key focus for everyone in this environment. Highbeam is well-positioned and funded to provide the tools brands need to grow sustainably and profitably.”

I must note, however, that Shergill didn’t elaborate when asked why Highbeam chose to raise debt versus equity nor did he reveal the size of Highbeam’s customer base. He also declined to give even a ballpark estimate of the company’s annual recurring revenue, citing competitive reasons. Make of that what you will.

Highbeam secures $10M loan to provide credit, spend monitoring and more to e-commerce retailers by Kyle Wiggers originally published on TechCrunch

English (US) ·

English (US) ·