The era of Bitcoin (BTC) $40,000 is back. Ethereum (ETH) has also surpassed $2,000, and other tokens with smaller market caps are also trying to catch up with the major tokens. Looks like it’s just in time for the holiday season.

Cryptocurrency market cycle

The crypto asset (virtual currency) market is like a roller coaster. A wild ride that captivates our eyes and makes us nervous. Protocols and projects are forged and refined in the fires of market cycles. As markets dramatically rise and fall, inferior ideas drop out and exit the market.

These cycles are rooted in specific factors driven by a combination of demand dynamics driven by investor sentiment, regulatory developments, technological advancements, and supply-side factors such as halving schedules, protocol forks, and ICOs. ing.

When these factors work in your favor, demand surges and prices skyrocket, further fueled by excitement and the familiar catalyst known as FOMO (fear of missing out). There are many. These are the happy days of the bull market, when the euphoria is high and the fear is the focus of unexpected further price increases.

However, every cycle has dual sides, and for every yang there is a yin. The infamous “crypto asset winter” is here. This icy season occurs when sentiment becomes overly bullish and investors overleverage. As a result, the market self-corrected and prices plummeted. Investors panic and the mood is more icy than a winter bomb cyclone in New York.

Signs of this cold season are prolonged price declines, increased market volatility, lower trading volumes, and a general desperation among investors who buy during the boom and try to ignore the stress of unrealized losses.

end of winter

So where are we in this cycle now and why are we bidding farewell to the “crypto winter” and stepping into warmer weather?

Bitcoin (left) and Ethereum (center) trend indicators and CoinDesk Market Index

Bitcoin (left) and Ethereum (center) trend indicators and CoinDesk Market Index(CoinDesk Indices)

Bitcoin is trending steadily up 18% from the previous month, and the CoinDesk Markets Index (CMI), which tracks the broader market, is up 21% (as of this writing).

The fact that CMI is outperforming Bitcoin indicates that altcoins with small market capitalization are preferred, and the trend indicator values for Bitcoin and Ethereum are positive, and the Bitcoin ETF This, along with the continued heating up of the topic, is a sign of a positive cycle.

Cryptocurrency investment funds are seeing a surge in capital flows and even meme coins are making a comeback. Additionally, the conclusion of Sam Bankman-Fried’s trial has given crypto assets a fresh start.

Why did we emerge from the freezing winter? The reason for this is the change in story. Wall Street is getting in on the action in a big way, talking about billions of dollars of investment through ETFs. The story is that big financial institutions will come along and save crypto assets from disaster by making them safer and more transparent for investors.

Where is the current focus? A more well-regulated crypto exchange that builds broader, more sustainable products like ETFs, security tokens, and stablecoins. It’s not a speculative product, like the rise in meme coins and NFTs we’ve seen during the pandemic, an inside joke.

This shift may anger some as a departure from the original idea of crypto assets as an alternative to mainstream finance. However, it is certain that it is gaining momentum again.

And it’s not just Wall Street that’s driving this. Macro factors such as a possible end to the US rate hike cycle, tensions in the Middle East, and long-term inflation concerns, as BlackRock CEO Larry Fink’s “flight to quality” comments suggest, factors are driving investors towards safer haven assets (safe assets), including crypto assets.

It’s strange that someone like Fink, who was once a crypto skeptic, is now praising Bitcoin on national television.

current location

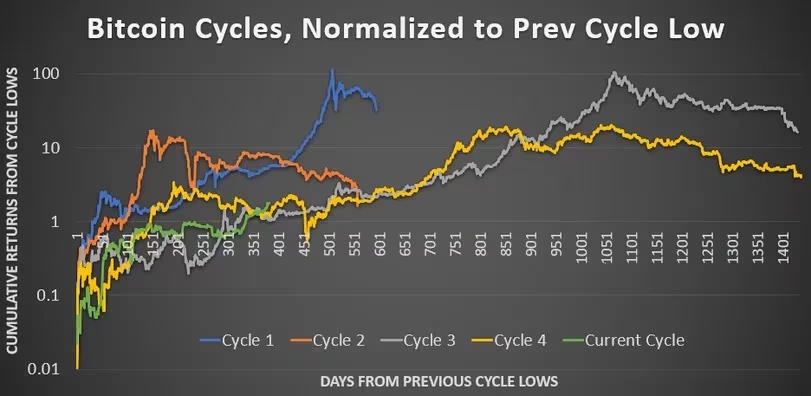

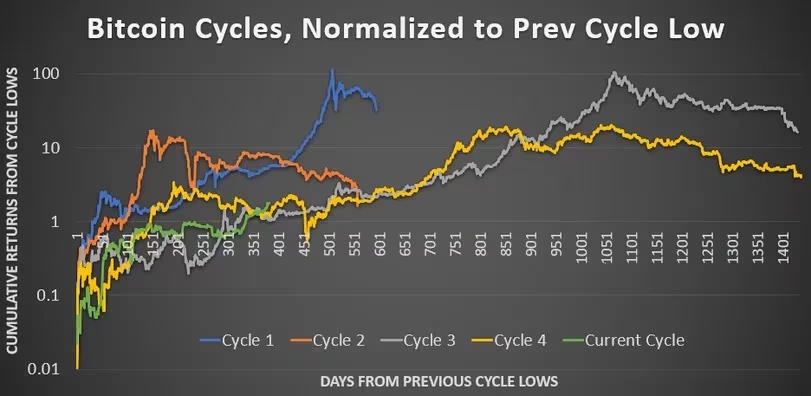

Assuming we are now out of the deep “crypto winter”, where are we in this new cycle? An analysis of past Bitcoin cycles using the CoinDesk Bitcoin Price Index (XBX) shows that we may be heading towards the next cycle high.

Based on historical cycle averages, there are about 700 days between the previous cycle’s low and the new cycle’s high, and the drawdown averages about -80% over the cycle.

Assuming November 21, 2022 was the previous cycle low, that means a new cycle high will come in Q3 2024, and the new high will be the same as the previous cycle high (November 9, 2021). Bitcoin is 2-7 times higher than its all-time high of $67,000. However, this assumes that the average of a small sample of Bitcoin cycles holds true and history repeats itself.

Bitcoin price cycle (CoinDesk Indices)

Bitcoin price cycle (CoinDesk Indices)Not forgetting the big caveat to cycle analysis, we appear to have emerged from the “crypto winter” once again, supported by a story of broader institutional adoption and a favorable macroeconomic backdrop.

This holiday season is shaping up to be something I’m truly grateful for.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Bitcoin Has Gifts This Holiday Season

The post Holiday gifts from Bitcoin | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

99

1 year ago

99

English (US) ·

English (US) ·