One of the key elements of Bitcoin (BTC)’s success is the emergence of new trading infrastructure and investment products, which allow access to new investors. This trend is now further accelerated by the arrival of Bitcoin spot ETFs (exchange traded funds).

Beyond liquidity providers and trading desks, we have no idea how these breakthroughs will change the structure of Bitcoin’s market.

As the Bitcoin market structure matures, we can expect volatility to decrease. Here we explore how several important shifts surrounding the emergence of physical ETFs are likely to drive this change.

ETFs as market reference prices

It is a well-known fact that Bitcoin trading volume has clearly increased with the introduction of ETFs. Notably, a disproportionately large portion of this volume increase occurred primarily between 3:00 PM and 4:00 PM ET, close to the ETF price fix.

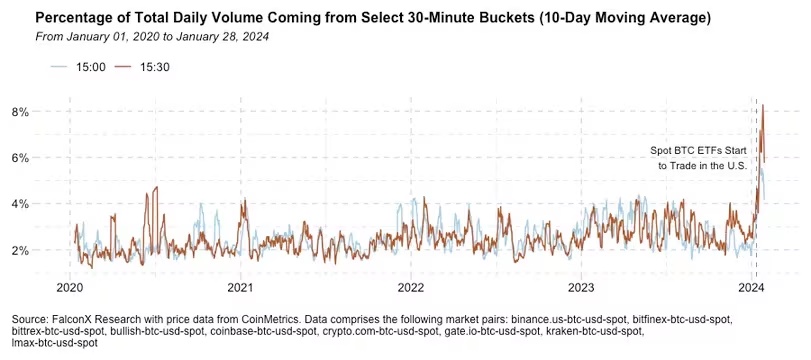

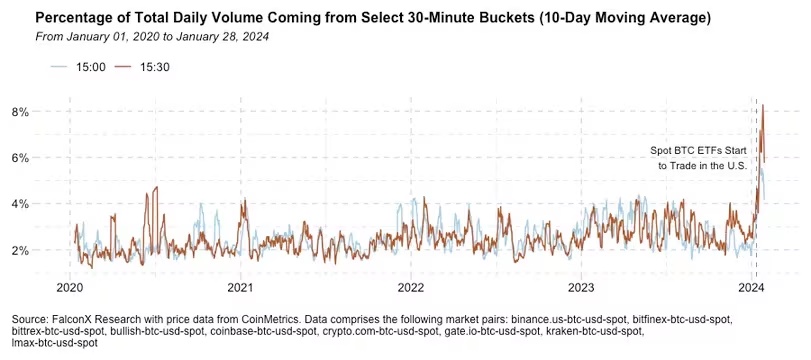

The chart below shows the percentage of Bitcoin’s daily trading volume during the 30 minutes starting at 3:00 PM and 3:30 PM ET for major trading pairs. Trading volumes during these two time periods used to account for less than 5% of daily trading volume, but now they account for 10-13%.

(Percentage of trading volume for the 30 minutes starting from 15:00/light blue and 15:30/red to the daily trading volume)

(Percentage of trading volume for the 30 minutes starting from 15:00/light blue and 15:30/red to the daily trading volume)ETF price fixes provide a transparent and consistent reference point recognized by market participants, consolidating large trades into a common time period, reducing market impact and overall market volatility. becomes possible.

New options market for ETFs

All three exchanges that currently list Bitcoin spot ETFs have already applied to the SEC to allow ETF options to be listed. The SEC review takes one to eight months, and there are problems with the clearing and settlement process.

If ETF options are approved, there is a high possibility that the Bitcoin options market will be greatly stimulated. The Bitcoin options market is currently limited to investors trading on offshore exchanges that are inaccessible to Americans and on platforms that are only accessible to large financial institutions like CME.

By allowing options on Bitcoin spot ETFs, the options market could expand significantly beyond these two markets. Bitcoin options market should continue to give importance to Bitcoin in 2024 even after massive growth in 2023.

A more developed options market would reduce volatility as investors would be able to pursue a wider range of investment strategies and liquid ETFs would become more liquid. It also expands the importance of events that drive price movements, such as expirations and dealer positioning.

20 years of ETF performance meets the Bitcoin revolution

It’s exciting to see how the ETF revolution is now benefiting the Bitcoin market. The arrival of Bitcoin spot ETFs has led to increased participation, perhaps similar to gold ETFs in the early 2000s, and will continue to do so.

More than two weeks have passed since the Bitcoin spot ETF was introduced, and its daily trading volume has already exceeded $1.5 billion (approximately 219 billion yen, equivalent to 146 yen per dollar). For comparison, this number is equivalent to about 20% of the trading volume of the Bitcoin spot market on a good day.

As innovation in crypto-asset (virtual currency) ETFs increases, trading related to them will expand, which will contribute to lower Bitcoin volatility and Bitcoin maturation.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: How the Launch of Spot ETFs Could Dampen Bitcoin’s Volatility

The post How the emergence of ETFs will reduce Bitcoin volatility | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

71

1 year ago

71

English (US) ·

English (US) ·